FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:Whispering Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2020. Annual

rental payments of $54,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in

setting the payment schedule is 6%; Whispering's incremental borrowing rate is 8%. Whispering is unaware of the rate being used by

the lessor. At the end of the lease, Whispering has the option to buy the equipment for $5,000, considerably below its estimated fair

value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Whispering uses the straight-line

method of depreciation on similar owned equipment.

Click here to view factor tables.

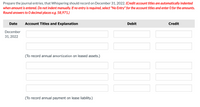

Transcribed Image Text:Prepare the journal entries, that Whispering should record on December 31, 2022. (Credit account titles are automatically indented

when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.

Round answers to O decimal places e.g. 58,971.)

Date

Account Titles and Explanation

Debit

Credit

December

31, 2022

(To record annual amortization on leased assets.)

(To record annual payment on lease liability.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Sandhill Company, a machinery dealer, leased a machine to Wildhorse Corporation on January 1, 2025. The lease is for an 8-year period and requires equal annual payments of $30,232 at the beginning of each year. The first payment is received on January 1, 2025. Sandhill had purchased the machine during 2024 for $105,000. Collectibility of lease payments by Sandhill is probable. Sandhill set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Sandhill at the termination of the lease. Click here to view factor tables. (a) Compute the amount of the lease receivable. (for calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to O decimal places e.g. 5,275.) Amount of the lease receivable eTextbook and Media List of Accountsarrow_forwardSheridan Company, a machinery dealer, leased a machine to Sunland Corporation on January 1, 2025. The lease is for an 8-year period and requires equal annual payments of $31,448 at the beginning of each year. The first payment is received on January 1, 2025. Sheridan had purchased the machine during 2024 for $116,000. Collectibility of lease payments by Sheridan is probable. Sheridan set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Sheridan at the termination of the lease. Click here to view factor tables. (a) Compute the amount of the lease receivable. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to 0 decimal places e.g. 5,275.) Amount of the lease receivable $arrow_forwardWildhorse Company, a machinery dealer, leased a machine to Blossom Corporation on January 1, 2025. The lease is for an 8-year period and requires equal annual payments of $32,055 at the beginning of each year. The first payment is received on January 1, 2025. Wildhorse had purchased the machine during 2024 for $129,000. Collectibility of lease payments by Wildhorse is probable. Wildhorse set the annual rental to ensure a 6% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Wildhorse at the termination of the lease. Click here to view factor tables. (a) * Your answer is incorrect. Compute the amount of the lease receivable. (For calculation purposes, use 5 decimal places as displayed in the factor table provided and round final answer to O decimal places e.g. 5,275.) Amount of the lease receivable 256440arrow_forward

- Sunland Steel Company, as lessee, signed a lease agreement for equipment for 5 years, beginning December 31, 2025. Annual rental payments of $47,000 are to be made at the beginning of each lease year (December 31). The interest rate used by the lessor in setting the payment schedule is 6%; Sunland's incremental borrowing rate is 8%. Sunland is unaware of the rate being used by the lessor. At the end of the lease, Sunland has the option to buy the equipment for $5,000, considerably below its estimated fair value at that time. The equipment has an estimated useful life of 7 years, with no salvage value. Sunland uses the straight-line method of depreciation on similar owned equipment. Click here to view factor tables. (a) Your answer is partially correct. Prepare the journal entries, that Sunland should record on December 31, 2025. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardRich Company uses lease as a means of selling its equipment. On July 1,2019, the company leased an equipment to Poor Company. The cost of the equipment to Rich Company was P 684,000. The fair market value ( which was the sales price) was P 792,236.54 at the time of the inception of the lease. Annual lease payments are P 135,000 and are payable in advance for 8 years. The equipment has an expected economic life of 10 years. At the end of the lease term , title to the equipment will pass to Poor Company. Implicit interest rate is 10%. What is the rich Company's total financial revenue pertaining to the lease?arrow_forwardBerne Company (lessor) enters into a lease with Fox Company to lease equipment to Fox beginning January 1, 2019. The lease terms, provisions, and related events are as follows: 1. The lease term is 4 years. The lease is noncancelable and requires annual rental payments of $50,000 to be made at the end of each year. The equipment costs $130,000. The equipment has an estimated life of 4 years and an estimated residual value at the end of the lease term of zero. Fox agrees to pay all executory costs directly to a third party. 4. The interest rate implicit in the lease is 12%. 5. The initial direct costs are insignificant and assumed to be zero. 6. The collectability of the rentals is reasonably assured. Required: 2. 3. 1. Next Level Assuming that the lease is a sales-type lease from Berne's point of view, calculate the selling price and assume that this is also the fair value. 2. Prepare a table summarizing the lease receipts and interest income earned by Berne. 3. Prepare journal entries…arrow_forward

- Integrity Company uses leases as a means of selling equipment. On July 1, 2021, the company leased a machine to a lessee. The cost of the machine to Integrity was P784,500. Annual lease payments are P135,000 and are payable in advance for 12 years. The residual value of the machine at the end of the lease term is P100,000 which is not guaranteed by the lessee. The lessor’s implicit interest rate is 10%. (Round off the PV factor to four decimal places, then do not round off during the computation)How much is the Cost of Sales to be reported by Integrity in 2021?arrow_forwardCharlotte Corp., a machinery dealer, leased a machine to Eleanor Corp. on January 1, 2022. The lease is for an 8-year period, is noncancelable and requires equal annual payments of $35,013 at the beginning of each year. The first payment is received on January 1, 2022. Charlotte had purchased the machine during 2021 for $160,000. The FMV of the machine is 200,000. The present value of the minimum lease payments is also $200,000. Collectibility of lease payments is reasonably predictable, and no important uncertainties surround the amount of costs yet to be incurred by Charlotte. Charlotte set the annual rental to ensure an 11% rate of return. The machine has an economic life of 10 years with no residual value and reverts to Charlotte at the termination of the lease. Required: What type of lease is this for Charlotte (lessor) and why Prepare all of Charlotte’s journal entries for 2022.arrow_forwardOriole Ltd., a public company following IFRS, recently signed a lease for equipment from Costner Ltd. The lease term is 7 years and requires equal rental payments of $19,049 at the beginning of each year. The equipment has a fair value at the lease's inception of $104,500, an estimated useful life of 7 years, and no residual value. Oriole pays all executory costs directly to third parties. The appropriate interest rate is 9%. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY DUE. Using tables, a financial calculator, or Excel functions, calculate the amount of the right-of-use asset and lease liability. Prepare the initial entry to reflect the signing of the lease agreement and the first payment under the lease. (List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forward

- Alpesharrow_forwardOn January 1, 2024, Rick's Pawn Shop leased a truck from Corey Motors for a seven-year period with an option to extend the lease for three years. Rick's had no significant economic incentive as of the beginning of the lease to exercise the three-year extension option. Annual lease payments are $19,500 due on December 31 of each year, calculated by the lessor using a 6% interest rate. The agreement is considered an operating lease. Note: Use tables, Excel, or a financial calculator. (FV of $1, PV of $1, FVA of $1, PVA of $1, FVAD of $1 and PVAD of $1) Required: 1.Prepare Rick's journal entry to record for the right-of-use asset and lease liability on January 1, 2024. 2.Prepare the journal entries to record interest and amortization on December 31, 2024.arrow_forwardOn January 1, 2019, Ballieu Company leases specialty equipment with an economic life of 8 years to Anderson Company. The lease contains the following terms and provisions: • The lease is noncancelable and has a term of 8 years. • The annual rentals are $28,900, payable at the beginning of each year. • The interest rate implicit in the lease is 12%. • Anderson agrees to pay all executory costs directly to a third party and is given an option to buy the equipment for $1 at the end of the lease term, December 31, 2026. • The cost of the equipment to the lessor is $144,000, and the fair value is approximately $160,800. • Ballieu incurs no material initial direct costs. • It is probable that Ballieu will collect the lease payments. • Ballieu estimates that the fair value is expected to be significantly greater than $1 at the end of the lease term. Ballieu calculates that the present value on January 1, 2019, of 8 annual payments in advance of $28,900 discounted at…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education