FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

please and thank you

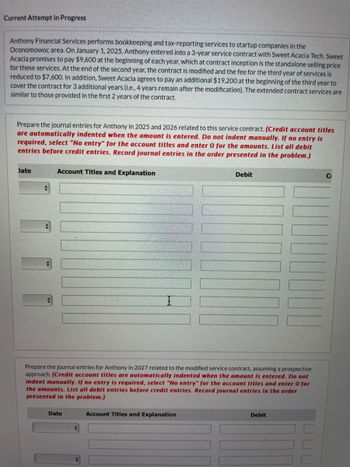

Transcribed Image Text:Current Attempt in Progress

Anthony Financial Services performs bookkeeping and tax-reporting services to startup companies in the

Oconomowoc area. On January 1, 2025, Anthony entered into a 3-year service contract with Sweet Acacia Tech. Sweet

Acacia promises to pay $9,600 at the beginning of each year, which at contract inception is the standalone selling price

for these services. At the end of the second year, the contract is modified and the fee for the third year of services is

reduced to $7,600. In addition, Sweet Acacia agrees to pay an additional $19,200 at the beginning of the third year to

cover the contract for 3 additional years (i.e., 4 years remain after the modification). The extended contract services are

similar to those provided in the first 2 years of the contract.

Prepare the journal entries for Anthony in 2025 and 2026 related to this service contract. (Credit account titles

are automatically indented when the amount is entered. Do not indent manually. If no entry is

required, select "No entry" for the account titles and enter 0 for the amounts. List all debit

entries before credit entries. Record journal entries in the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Ci

I

Prepare the journal entries for Anthony in 2027 related to the modified service contract, assuming a prospective

approach. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for

the amounts. List all debit entries before credit entries. Record journal entries in the order

presented in the problem.)

Date

Account Titles and Explanation

Debit

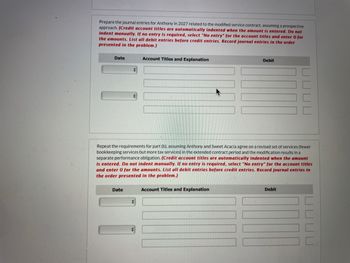

Transcribed Image Text:Prepare the journal entries for Anthony in 2027 related to the modified service contract, assuming a prospective

approach. (Credit account titles are automatically indented when the amount is entered. Do not

indent manually. If no entry is required, select "No entry" for the account titles and enter O for

the amounts. List all debit entries before credit entries. Record journal entries in the order

presented in the problem.)

Date

Account Titles and Explanation

Debit

Repeat the requirements for part (b), assuming Anthony and Sweet Acacia agree on a revised set of services (fewer

bookkeeping services but more tax services) in the extended contract period and the modification results in a

separate performance obligation. (Credit account titles are automatically indented when the amount

is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles

and enter 0 for the amounts. List all debit entries before credit entries. Record journal entries in

the order presented in the problem.)

Date

Account Titles and Explanation

Debit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education