FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

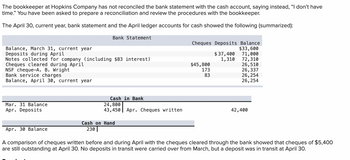

Transcribed Image Text:The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead, "I don't have

time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper.

The April 30, current year, bank statement and the April ledger accounts for cash showed the following (summarized):

Balance, March 31, current year

Deposits during April

Notes collected for company (including $83 interest)

Cheques cleared during April

NSF cheque-A. B. Wright

Bank service charges

Balance, April 30, current year

Mar. 31 Balance

Apr. Deposits

Bank Statement

Apr. 30 Balance

Cash in Bank

24,800

43,450 Apr. Cheques written

Cash on Hand

230

Cheques Deposits Balance

$33,600

71,000

72,310

26,510

26,337

26, 254

26,254

$45,800

173

83

$ 37,400

1,310

42,400

A comparison of cheques written before and during April with the cheques cleared through the bank showed that cheques of $5,400

are still outstanding at April 30. No deposits in transit were carried over from March, but a deposit was in transit at April 30.

Transcribed Image Text:3. What were the balances in the cash accounts in the ledger on April 30, current year?

Balance in cash in bank account

Balance in cash on hand account

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 1 steps

Knowledge Booster

Similar questions

- Sal's Surf Shop deposits all receipts in the bank and makes all payments by check. On July 31 the cash account had a balance of $6,105.42. The bank statement on July 31 reported a balance of $4,146.46. Upon comparing the bank statement to the books, the following items were found.arrow_forwardOn March 31, Sigment Company had a $44,547.60 checkbook balance. The bank statement showed a balance on that date of $46,574.10, and the following information on the bank statement had not been entered in the checkbook: $24.75 Service charge $68.85 NSF charge A review of the company’s bank statement and checkbook showed a deposit in transit of $3,919.44 and outstanding checks as follows: Number 234 for $281.34 Number 236 for $445.12 Number 237 for $2,901.60 Number 238 for $2,411.48 Prepare a bank reconciliation in proper format. List and total the outstanding checks at the bottom of the bank reconciliation.arrow_forwardDhapaarrow_forward

- Note:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forwardAccompanying a bank statement for Borden Company is a credit memo for $15,225 representing the principal ($15,000) and interest ($225) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Journalize the entry that should be made by the company to bring the accounting records up to date. If an amount box does not require an entry, leave it blank. UDarrow_forwardPlease prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon Co. 1) Balance per bank statement $ 9,915 2) Balance per cash general ledger account (books) $ 8,954 3) April 30th deposit of $ 2,600 is not on the bank statement (Deposit in Transit) 4) Check numbers #219 for $ 1000 and # 222 for $ 1,100 written in April do not appear on the April bank statement (Outstanding Checks) 5) Debit memo for a $ 20 service charge appeared on the bank statement 6) The bank incorrectly deducted $ 400 from Bannon's checking account 7) The bank collected a note on behalf of the company in April, a credit memo for net proceeds of $ 2,000 included the principal of $1,900, interest of $ 150, less a collection fee of $ 50 accompanied the bank statement 8) A check from Apple Co. for $ 150 was returned by the bank marked NSF 9) The bank added $40 of interest earned directly to the checking account balance 10) A Cash Sale in the amount of $ 297 was erroneously journalvized…arrow_forward

- TSLA Co. found that the receipt of a check from a customer was properly recorded in th accounting records for $7,426 but improperly credited by the bank in the amount of $4,726. When preparing that month's bank reconciliation, the company should: Add $2,700 to the bank statement balance of cash. Add $2,700 to the book balance of cash. educt $2,700 from the book balance of cash O Deduct $2,700 from the bank statement balance of cash.arrow_forwardAccompanying a bank statement for Borden Company is a credit memo for $24,360 representing the principal ($24,000) and interest ($360) on a note that had been collected by the bank. The company had been notified by the bank at the time of the collection but had made no entries. Journalize the entry that should be made by the company to bring the accounting records up to date. If an amount box does not require an entry, leave it blank. blank Account Debit Credit blankarrow_forwardCoasters Co. issued a note receivable to a customer. The customer made payment directly to the Coaster’s bank. The payment appeared on the month-end bank statement. How would this payment be adjusted in the bank reconciliation? Add to company records (book side) Subtract from company records (book side) Subtract from bank statement (bank side) Add to bank statement (bank side)arrow_forward

- The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead, "I don't have time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper. The April 30, current year, bank statement and the April ledger accounts for cash showed the following (summarized): Balance, March 31, current year Deposits during April Notes collected for company (including $83 interest) Cheques cleared during April NSF cheque-A. B. Wright Bank service charges Balance, April 30, current year Mar. 31 Balance Apr. Deposits Bank Statement Apr. 30 Balance Cash in Bank 24,800 43,450 Apr. Cheques written Cash on Hand 230 Cheques Deposits Balance $33,600 71,000 72,310 26,510 26,337 26, 254 26,254 $45,800 173 83 $ 37,400 1,310 42,400 A comparison of cheques written before and during April with the cheques cleared through the bank showed that cheques of $5,400 are still outstanding at April 30. No deposits in transit were carried over…arrow_forwardOscar Myer receives the March bank statement for Jam Enterprises on April 11, 2018. The March 31 bank statement shows an ending cash balance of $67,566. A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following. O. Myer notices that the bank erroneously cleared a $500 check against his account in March that he did not issue. The check documentation included with the bank statement shows that this check was actually issued by a company named Jam Systems. On March 25, the bank lists a $50 charge for the safety deposit box expense that Jam Enterprises agreed to rent from the bank beginning March 25. On March 26, the bank lists a $102 charge for printed checks that Jam Enterprises ordered from the bank. On March 31, the bank lists $33 interest earned on Jam Enterprises' checking account for the month of March. O. Myer notices that the check he issued for $128 on March 31, 2018, has not yet cleared the bank. O. Myer verifies that all deposits…arrow_forwardMarin Company’s general ledger indicates a cash balance of $22,340 as of September 30, 2018. Early in OctoberMarin received a bank statement indicating that during September Marin had an NSF check of $1,500 returnedto a customer and incurred service charges of $45. Marin also learned it had incorrectly recorded a checkreceived from a customer on September 15 as $500 when in fact the check was for $550. Calculate Marin’s correct September 30, 2018, cash balance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education