FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:### Bank Reconciliation Explanation

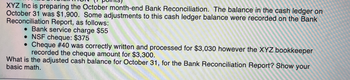

XYZ Inc is preparing the October month-end Bank Reconciliation. The balance in the cash ledger on October 31 was $1,900. Some adjustments to this cash ledger balance were recorded on the Bank Reconciliation Report, as follows:

- **Bank service charge**: $55

- **NSF cheque**: $375

- **Cheque #40 correction**: This cheque was correctly written and processed for $3,030; however, the XYZ bookkeeper recorded the cheque amount as $3,300.

**Task:**

What is the adjusted cash balance for October 31, for the Bank Reconciliation Report? Show your basic math.

#### Solution:

1. **Initial Cash Ledger Balance**: $1,900

2. **Adjust for Bank Service Charge**:

- Subtract $55 (service charge)

- New balance: $1,900 - $55 = $1,845

3. **Adjust for NSF Cheque**:

- Subtract $375 (NSF cheque)

- New balance: $1,845 - $375 = $1,470

4. **Adjust for Cheque #40 Error**:

- Difference: $3,300 (recorded) - $3,030 (actual) = $270

- Add $270 (since $270 was recorded as an extra deduction)

- New balance: $1,470 + $270 = $1,740

**Adjusted Cash Balance**: $1,740

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The cash account shows a balance of P45,000 before reconciliation. The bank statement does not include a deposit of P2,300 made on the last day of the month. The bank statement shows a collection by the bank of P940 and a customer's check for P320 was returned because it was NSF. A customer's check for P450 was recorded on the books as P540, and a check written for P79 was recorded as P97. The correct balance in the cash account wasarrow_forwardI'm a little confused how to prep the bank reconciliation and the journal entrys.arrow_forwardThe bank reconciliation shows the following adjustments: Outstanding checks: $987 Error by bank recorded customer check twice: $436 Notes receivable collected by bank: $2,500; interest: $145 Deposits in transit: $1,698 Bank charges: $70 PLEASE NOTE: For similar accounting treatment (DR or CR), you are to record accounts in the order in which they are mentioned in the adjustments. Using the following accounts: Bank Errors Bank Service Charges Cash Deposits in Transit Interest Expense Interest Income Notes Receivable Outstanding Checks prepare the two correcting journal entries: DR CR and DR CR CR PLEASE NOTE: You must enter the account names exactly as written above and all dollar amounts will be with "$" and commas as needed (i.e. $12,345).arrow_forward

- Given the following information to reconcile GCompany’s cash book balance with its bank statement balance as of July 31, 2021: a. Cheques #296 for $1,334 and #307 for $12,754 were outstanding on the September 30 bank reconciliation. Cheque #307 was returned with the October cancelled cheques, but cheque #296 was not. It was also found that cheque #315 for $893 and cheque #321 for $2,000, both written in July, were not among the cancelled cheques returned with the statement. b. In comparing the cancelled cheques returned by the bank with the entries in the accounting records, it was found that cheque #320 for the July rent was correctly written for $4,090 but was erroneously entered in the accounting records as $4,900. c. Also enclosed with the statement was a $74 debit memo for bank services. It had not been recorded because no previous notification had been received. d. A credit memo enclosed with the bank statement indicated that there was an electronic fund transfer related to a…arrow_forwardCoasters Co. issued a note receivable to a customer. The customer made payment directly to the Coaster’s bank. The payment appeared on the month-end bank statement. How would this payment be adjusted in the bank reconciliation? Add to company records (book side) Subtract from company records (book side) Subtract from bank statement (bank side) Add to bank statement (bank side)arrow_forwardthe December bank statement has a balance of $5,300 before reconciliation. after reconciliation the adjust balance is 4100. if one deposit in transit amounted to 800 what was the total of the outstanding checks, assuming no other adjustments would be made to the bank statementarrow_forward

- Bb2.arrow_forwardWhile performing its monthly bank reconciliation, XYZ Inc. discovered that it recorded a cash receipt from a customer for an incorrect amount. The company debited “Cash” and credited “Sales Revenue” for $920 instead of $290. On its bank reconciliation, how should the company adjust for this error? Add $630 to the company (book) side. Subtract $630 from the company (book) side. Add $630 to the bank side. Subtract $630 from the bank side.arrow_forwardYardworx reconciled its book balance of Cash with its bank statement balance on April 30 and showed two cheques outstanding at the time, #1771 for $15463 and # 1780 for $955.65. The following information is available for May 31, 2020 reconciliation: From May 31, 2020 bank statement: Cheque #1788 was correctly written for $985.65 to pay for May utilities however, the bookkeeper misread the amount and entered it in the accounting records with a debt to Utilities expenses and credit to Cash as though it were for $895.65. the bank paid ad deducted the correct amount. The NSF cheque was originally received from a customer, Gertie Mayer, in payment of her account. Its return was unrecorded. The credit memo resulted from $5300 electronic fund transfer for the collection of a customer payment. The bank had deducted a $100 bank service charge fee. The collection has not been recorded in the company books. Required: Prepare reconciliation for yardworxs Prepare the general journal entries…arrow_forward

- Please solve thisarrow_forwardPart ii. Prepare the journal entries resulting from the bank reconciliationarrow_forwardA table for a monthly bank reconciliation dated September 30 is given below. For each item 1 through 12, indicate whether the item should be added to or subtracted from the book or bank balance, and whether it should or should not appear on the reconciliation.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education