FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Domestic

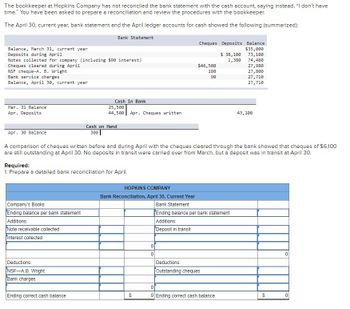

Transcribed Image Text:The bookkeeper at Hopkins Company has not reconciled the bank statement with the cash account, saying instead, "I don't have

time." You have been asked to prepare a reconciliation and review the procedures with the bookkeeper.

The April 30, current year, bank statement and the April ledger accounts for cash showed the following (summarized):

Bank Statement

Balance, March 31, current year

Deposits during April

Notes collected for company (including $90 interest)

Cheques cleared during April

NSF cheque-A. B. Wright

Bank service charges

Balance, April 30, current year

Mar. 31 Balance

Apr. Deposits

Apr 30 Balance

Company's Books

Ending balance per bank statement

Additions:

Note receivable collected

Interest collected

Cash in Bank

Required:

1. Prepare a detailed bank reconciliation for April.

Deductions:

NSF-A.B. Wright

Bank charges

25,500

44,500 Apr. Cheques written

Ending correct cash balance

Cash on Hand

300

A comparison of cheques written before and during April with the cheques cleared through the bank showed that cheques of $6,100

are still outstanding at April 30. No deposits in transit were carried over from March, but a deposit was in transit at April 30.

Cheques Deposits Balance

$35,000

73,100

74,480

$

$46,500

180

90

0

0

HOPKINS COMPANY

Bank Reconciliation, April 30, Current Year

Bank Statement

Ending balance per bank statement

Additions:

Deposit in transit

$ 38,100

1,380

Deductions:

Outstanding cheques

0

0 Ending correct cash balance

27,980

27,800

27,710

27,710

43,100

$

0

0

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education