FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

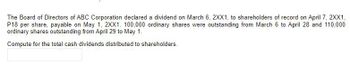

Transcribed Image Text:The Board of Directors of ABC Corporation declared a dividend on March 6, 2XX1, to shareholders of record on April 7, 2XX1,

P18 per share, payable on May 1, 2XX1. 100,000 ordinary shares were outstanding from March 6 to April 28 and 110,000

ordinary shares outstanding from April 29 to May 1.

Compute for the total cash dividends distributed to shareholders.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- A company has the following transactions during the year related to stockholders’ equity. February 1 Issues 4,700 shares of no-par common stock for $16 per share. May 15 Issues 300 shares of $10 par value, 6% preferred stock for $13 per share. October 1 Declares a cash dividend of $0.60 per share to all stockholders of record (both common and preferred) on October 15. October 15 Date of record. October 31 Pays the cash dividend declared on October 1. Record each of these transactions. (If no entry is required for a particular transaction/event, select "No Journal Entry Required" in the first account field.)arrow_forwardA company's board of directors declared a $0.50 per share cash dividend on its $3 par common stock. On the date of declaration, there were 44,000 shares authorized, 18,000 shares issued, and 5,000 shares held as treasury stock.What is the entry when the dividends are declared? A. Dividends 6,500 Dividends Payable 6,500 B. Dividends 6,500 Cash 6,500 C. Dividends 22,000 Dividends Payable 22,000 D. Dividends 9,000 Cash 9,000arrow_forward1.A company's board of directors votes to declare a cash dividend of $1.00 per share on its 12,000 common shares outstanding. The journal entry to record the declaration of the cash dividend is: The journal entry to record the declaration of the cash dividend is: 2.A company's board of directors votes to declare a cash dividend of $1.00 per share on its 12,000 common shares outstanding. The journal entry to record the declaration of the cash dividend is: Multiple Choice Debit Dividend Expense $12,000; credit Common Dividend Payable $12,000. Debit Retained Earnings $12,000; credit Common Dividend Payable $12,000. Debit Common Dividend Payable $12,000; credit Retained Earnings $12,000. Debit Common Dividend Payable $12,000; credit Cash $12,000. Debit Dividend Expense $12,000; credit Cash $12,000.arrow_forward

- The charter of a corporation provides for the issuance of 104,020 shares of common stock. Assume that 35,959 shares were originally issued and 3,317 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2 per share dividend is declared?arrow_forwardA corporation reacquires 60,000 shares of its own $10 par common stock for $3,000,000, recording it at cost. a) what effect does this transaction have on revenue or expense of the period? b) what effect does it have on stockholders' equity?arrow_forwardHao Corporation had the following transactions during the current period. Mar. 2 Issued 37,000 common shares to its legal counsel in payment of a bill for $41,000 for services performed in helping the company incorporate. June 12 Issued 50,000 common shares for $440,000 cash. July 11 Issued 1,600, $3 noncumulative preferred shares at $125 per share cash. Nov. 28 Issued 3,200, $3 noncumulative preferred shares at $93 per share cash. Journalize the transactions. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit choose a transaction date enter an account title to record issuance of shares enter a debit amount enter a credit amount…arrow_forward

- The charter of a corporation provides for the issuance of 106,635 shares of common stock. Assume that 42,957 shares were originally issued and 4,364 were subsequently reacquired. What is the amount of cash dividends to be paid if a $2-per-share dividend is declared?arrow_forwardLucky Corporation began the year with a simple capital structure consisting of 200,000 shares of outstanding common stock. On April 1, 90,000 additional common shares were issued, and another 30,000 common shares were issued on August 1. The company had net income for the year of $690,000. Calculate the earnings per share of common stock. Round to two decimal points. Earnings per Share $arrow_forwardAstro Corporation was started with the issue of 5,500 shares of $11 par stock for cash on January 1, Year 1. The stock was issued at a market price of $20 per share. During Year 1, the company earned $68,450 in cash revenues and paid $45,862 for cash expenses. Also, a $4,800 cash dividend was paid to the stockholders. Required Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Astro Corporation's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Income Statement Stmt of Changes Prepare a statement of changes in stockholders' equity. ASTRO CORPORATION Statement of Changes in Stockholders' Equity For the Year Ended December 31, Year 1 $ 10 Beginning common stock Plus: Issuance of common stock Ending common stock Beginning retained earnings Plus: Net income Less: Dividend Ending retained earnings Total stockholders' equity Answer is complete but not entirely correct. Balance Sheet…arrow_forward

- Astro Corporation was started with the issue of 4,500 shares of $10 par stock for cash on January 1, Year 1. The stock was issued at a market price of $17 per share. During Year 1, the company earned $71,100 in cash revenues and paid $47,637 for cash expenses. Also, a $4,100 cash dividend was paid to the stockholders. Required Prepare an income statement, statement of changes in stockholders' equity, balance sheet, and statement of cash flows for Astro Corporation's Year 1 fiscal year. Complete this question by entering your answers in the tabs below. Balance Sheet Stmt of Cash Flows Income Stmt of Statement Changes Prepare the income statement. ASTRO CORPORATION Income Statement For the Year Ended December 31, Year 1arrow_forwardAt the end of the prior annual reporting period, Barnard Corporation's balance sheet showed the following: BARNARD CORPORATION Balance Sheet At December 31, Prior Year Stockholders' equity Contributed capital Common stock (par $10; 5,100 shares) Paid-in capital Total contributed capital Retained earnings Total stockholders' equity $ 51,000 13,000 64,000 49,000 $ 113,000 During the current year, the following selected transactions (summarized) were completed: a. Sold and issued 2,000 shares of common stock at $27 cash per share (at year-end). b. Determined net income, $53,000. c. Declared and paid a cash dividend of $2 per share on the beginning shares outstanding. Required: Prepare a statement of stockholders' equity for the year ended December 31, current year. BARNARD CORPORATION Statement of Stockholders' Equity Common Stock Shares Amount Paid-in Capital Retained Earnings Total Stockholders' Equity Balances as of December 31, prior year Balances as of December 31, current yeararrow_forwardHorton Company began business on January 1, 20x1 by issuing all of its 1,000,000 authorized shares of its $1 par value common stock for $20 per share. On June 30, the Company declared a cash dividend of $1 per share to stockholders of record on July 31. The Company paid the cash dividend on August 30. On November 1, Horton reacquired 200,000 of its own shares of stock for $25 per share. On December 22, the Company resold half of these shares for $30 per share. a. Prepare all of the necessary journal entries to record the events described above.b. Prepare the Stockholders' Equity section of the Balance sheet as of 12/31/20x1 assuming that the Net Income for the year was $3,000,000.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education