FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

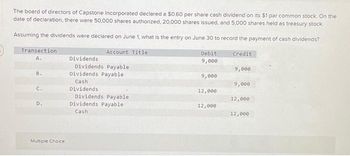

Transcribed Image Text:The board of directors of Capstone Incorporated declared a $0.60 per share cash dividend on its $1 par common stock. On the

date of declaration, there were 50,000 shares authorized, 20,000 shares issued, and 5,000 shares held as treasury stock.

Assuming the dividends were declared on June 1, what is the entry on June 30 to record the payment of cash dividends?

Account Title

Transection

A.

B.

D.

Multiple Choice

Dividends

Dividends Payable.

Dividends Payable

Cash

Dividends

Dividends Payable

Dividends Payable

Cash

Debit

9,000

9,000

12,000

12,000

Credit

9,000

9,000

12,000

12,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps with 1 images

Knowledge Booster

Similar questions

- Journalize the following selected transactions completed during the current fiscal year: Date Transaction February 1 The board of directors declared a stock split that reduced the par of common shares from $100 to $20. This action increased the number of outstanding shares to 500,000. February 11 Purchased 25,000 shares of the company's own stock at $44, recording the treasury stock at cost. May 1 Declared a dividend of $2.50 per share on the outstanding shares of common stock. May 15 Paid the dividend declared on May 1. October 19 Declared a 2% stock dividend on the common stock outstanding (the fair market value of the stock to be issued is $55). November 12 Issued the certificates for the common stock dividend declared on October 19. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank.arrow_forward5. Magenta Corporation declared $0.70 per share cash dividends on September 18. The dividends were recorded and paid on September 23 and September 29, respectively. Magenta Corporation had 50,000 shares outstanding with par value of $1. The journal entry to record the transaction on September 29 is … a. Cash Dividends $35,000 Dividends Payable $35,000 b. No journal entry required on this date c. Retained Earnings $50,000 Cash Dividends $50,000 d. Dividends Payable $35,000 Cash $35,000arrow_forwardA company declared a cash dividend of $.35 per common share to the shareholders of record on July 15. The cash dividend will be paid on July 31. This company has 500,000 shares authorized and 100,000 shares outstanding. What is the entry to record the payment on the payment date? O debit Common Dividend Payable 35,000 and credit Cash 35,000 O debit Common Dividend Payable 175,000 and credit Cash 175,000 O no entry on payment date O debit Retained Earnings 175,000; credit Common Dividend Payable 175,000 79°F Rain tarrow_forward

- Please help me jn this sir accounting questionarrow_forwardNewly formed S&J Iron Corporation has 143,000 shares of $7 par common stock authorized. On March 1, Year 1, S&J Iron issued 12,000 shares of the stock for $10 per share. On May 2, the company issued an additional 23,500 shares for $22 per share. S&J Iron was not affected by other events during Year 1. Required a. Record the transactions in a horizontal statements model. In the Cash Flow column, indicate whether the item is an operating activity (OA), investing activity (IA), or financing activity (FA). If an element was not affected by the event, leave the cell blank. b. Determine the amount S&J Iron would report for common stock on the December 31, Year 1, balance sheet. c. Determine the amount S&J Iron would report for paid-in capital in excess of par. d. What is the total amount of capital contributed by the owners? e. What amount of total assets would S&J Iron report on the December 31, Year 1, balance sheet? Complete this question by entering your answers in the tabs below. Req A…arrow_forwardSubject: accountingarrow_forward

- Godaarrow_forwardLooking for the Less: Cash dividends declared to find the Retained earnings.. Attached the journal entries as well.arrow_forwardEntries for Stock Dividends Advanced Life Co. is an HMO for businesses in the Albuquerque area. The following account balances appear on the balance sheet of Advanced Life Co.: Common stock (600,000 shares authorized; 400,000 shares issued), $8 par, $3,200,000; Paid-in capital in excess of par-common stock, $800.000; and Retained earnings, $25,600,000. The board of directors declared a 2% stock dividend when the market price of the stock was $19 a share. Advanced Life Co. reported no income or loss for the current year. a1. Journalize the entry to record the declaration of the dividend, capitalizing an amount equal to market value. If an amount box does not require an entry, leave it blank. Retained Earnings Stock Dividends Distributable Paid-In Capital in Excess of Par-Common Stock a2. Journalize the entry to record the issuance of the stock certificates. If an amount box does not require an entry, leave it blank. Stock Dividends Distributable Common Stock b. Determine the following…arrow_forward

- Treasury Shares On October 10, the capital of the shareholders (stockholders' equity) of Sherman Systems, Inc. it consisted of the following: Common stock–$10 par value, 72,000 shares authorized, issued, and outstanding $ 720,000 Paid-in capital in excess of par value, common stock 216,000 Retained earnings 864,000 Total stockholders’ equity $ 1,800,000 Prepare the daily entries to record the following transactions: October 11 – Sherman Systems purchased 5,000 of its own common stock at a price of $25 per share. November 1 – Sherman Systems sold 1,000 of its shares in treasury stock at a price of $31 per share. November 25 – Sherman Systems sold the remaining shares in treasury at a price of $20 per share.arrow_forwardH1.arrow_forwardEntries for Cash Dividends The declaration, record, and payment dates in connection with a cash dividend of $57,700 on a corporation's common stock are July 9, August 31, and October 1. Journalize the entries required on each date. If no entry is required, select "No Entry Required" and leave the amount boxes blank. If an amount box does not require an entry, leave it blank. July 9 Aug. 31 Oct. 1arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education