Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Provide answer

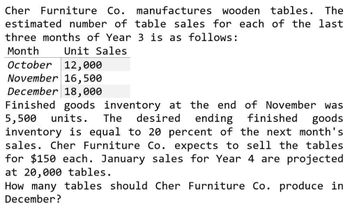

Transcribed Image Text:Cher Furniture Co. manufactures wooden tables. The

estimated number of table sales for each of the last

three months of Year 3 is as follows:

Month

Unit Sales

October 12,000

November 16,500

December 18,000

Finished goods inventory at the end of November was

5,500 units. The desired ending finished goods

inventory is equal to 20 percent of the next month's

sales. Cher Furniture Co. expects to sell the tables

for $150 each. January sales for Year 4 are projected

at 20,000 tables.

How many tables should Cher Furniture Co. produce in

December?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Rehydrator makes a nutrition additive and expects to sell 3,000 units in January, 2,000 in February, 2,500 in March, 2,700 in April. and 2,900 in May. The required ending inventory is 20% of the next months sales, and the beginning inventory on January 1 was 600 units. Prepare a production budget for the first four months of the year.arrow_forwardOne Device makes universal remote controls and expects to sell 500 units in January, 800 in February, 450 in March, 550 in April, and 600 in May. The required ending inventory is 20% of the next months sales. Prepare a production budget for the first four months of the year.arrow_forwardAll Temps has a policy of always paying within the discount period, and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 80% of its payments are made in the month of purchase and 20% are made the following month. The direct materials budget provides for purchases of $23,812 in February, $23,127 in March, $21,836 in April, and $28,173 in May.What is the balance in accounts payable for April 30, and May 31?arrow_forward

- Halifax Shoes has 30% of its sales in cash and the remainder on credit. Of the credit sales, 65% is collected in the month of sale, 25% is collected the month after the sale, and 5% is collected the second month after the sale. How much cash will be collected in August if sales are estimated as $75,000 in June, $65,000 in July, and $90,000 in August?arrow_forwardEarthies Shoes has 55% of its sales in cash and the remainder on credit. Of the credit sales, 70% is collected in the month of sale, 15% is collected the month after the sale, and 10% is collected the second month after the sale. How much cash will be collected in June if sales are estimated as $75,000 in April, $65,000 in May, and $90,000 in June?arrow_forwardLens Junction sells lenses for $45 each and is estimating sales of 15,000 units in January and 18,000 in February. Each lens consists of 2 pounds of silicon costing $2.50 per pound, 3 oz of solution costing $3 per ounce, and 30 minutes of direct labor at a labor rate of $18 per hour. Desired inventory levels are: Â Prepare a sales budget, production budget. direct materials budget for silicon and solution, and a direct labor budget.arrow_forward

- If the sales forecast estimates that 50,000 units of product will be sold during the following year, should the factory plan on manufacturing 50,000 units in the coming year? Explain.arrow_forwardSports Socks has a policy of always paying within the discount period and each of its suppliers provides a discount of 2% if paid within 10 days of purchase. Because of the purchase policy, 85% of its payments are made in the month of purchase and 15% are made the following month. The direct materials budget provides for purchases of $129,582 in November, $294,872 in December, $239,582 in January, and $234,837 in February. What is the balance in accounts payable for January 31, and February 28?arrow_forwardRanger Industries has provided the following information at June 30: Other information: Average selling price, 196 Average purchase price per unit, 110 Desired ending inventory, 40% of next months unit sales Collections from customers: In month of sale20% In month after sale50% Two months after sale30% Projected cash payments: Inventory purchases are paid for in the month following acquisition. Variable cash expenses, other than inventory, are equal to 25% of each months sales and are paid in the month of sale. Fixed cash expenses are 40,000 per month and are paid in the month incurred. Depreciation on equipment is 2,000 per month. REQUIREMENT You have been asked to prepare a master budget for the upcoming quarter (July, August, and September). The components of this budget are a monthly sales budget, a monthly purchases budget, a monthly cash budget, a forecasted income statement for the quarter, and a forecasted September 30 balance sheet. The worksheet MASTER has been provided to assist you. Ranger Industries desires to maintain a minimum cash balance of 8,000 at the end of each month. If this goal cannot be met, the company borrows the exact amount needed to reach its goal. If the company has a cash balance greater than 8,000 and also has loans payable outstanding, the amount in excess of 8,000 is paid to the bank. Annual interest of 18% is paid on a monthly basis on the outstanding balance.arrow_forward

- Shadee Corporation expects to sell 650 sun shades in May and 410 in June. Each shades sells for $13. Shadee's beginning and ending finished goods inventories for May are 60 and 60 shades, respectively. Ending finished goods inventory for June will be 65 shades. It expects the following unit sales for the third quarter: July August September 515 470 430 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale, 38 percent is collected during the following month, and 10 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September. Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. Total Cash Receipts August Septemberarrow_forwardShadee Corporation expects to sell 600 sun shades in May and 450 in June. Each shades sells for $11. Shadee's beginning and ending finished goods inventories for May are 70 and 40 shades, respectively. Ending finished goods inventory for June will be 60 shades. It expects the following unit sales for the third quarter: July August 545 480 September460 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale, 36 percent is collected during the following month, and 12 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September. Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. Total Cash Receipts August Septemberarrow_forwardShadee Corporation expects to sell 590 sun shades in May and 360 in June. Each shades sells for $15. Shadee's beginning and ending finished goods inventories for May are 60 and 45 shades, respectively. Ending finished goods inventory for June will be 55 shades. It expects the following unit sales for the third quarter: July August September 545 500 470 Sixty percent of Shadee's sales are cash. Of the credit sales, 52 percent is collected in the month of the sale, 38 percent is collected during the following month, and 10 percent is never collected. Required: Calculate Shadee's total cash receipts for August and September. Note: Do not round your intermediate calculations. Round your answers to the nearest whole dollar. August September Total Cash Receiptsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning