FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

What are the earings per share on these financial accounting question?

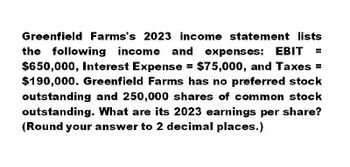

Transcribed Image Text:Greenfield Farms's 2023 income statement lists

the following income and expenses: EBIT =

$650,000, Interest Expense = $75,000, and Taxes =

$190,000. Greenfield Farms has no preferred stock

outstanding and 250,000 shares of common stock

outstanding. What are its 2023 earnings per share?

(Round your answer to 2 decimal places.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The Esposito Import Company had 1 million shares of common stock outstanding during 2024. Its income statement reported the following items: income from continuing operations, $7 million; loss from discontinued operations, $1.4 million. All of these amounts are net of tax. Required: Prepare the 2024 EPS presentation for the Esposito Import Company. Note: Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places.arrow_forwardThe Esposito Import Company had 1 million shares of common stock outstanding during 2024. Its income statement reported the following items: income from continuing operations, $15 million; loss from discontinued operations, $2.8 million. All of these amounts are net of tax. Required: Prepare the 2024 EPS presentation for the Esposito Import Company. Note: Amounts to be deducted should be indicated with a minus sign. Round your answers to 2 decimal places. Answer is complete but not entirely correct. Earnings per share: Income from continuing operations Loss from discontinued operations Net income $ $ 15.00✔ 2.80 x 12.20arrow_forwardAnswer the questions based on the Data Table.arrow_forward

- The 2025 income statement of Sheridan Corporation showed net income of $518,000 and a loss from discontinued operations of $130,000. Sheridan had 100,000 shares of common stock outstanding all year. Prepare Sheridan's income statement presentation of earnings per share. (Round answers to 2 decimal places, e.g. 3.55.) SHERIDAN CORPORATION Income Statement LAarrow_forwardIn 2022, Cullumber Corporation had net sales of $600,000 and cost of goods sold of S 353,000. Operating expenses were $149, 000, and interest expense was $5,500. The corporation's tax rate is 20%. The corporation declared preferred dividends of $11,500 in 2022, and its average common stockholders' equity during the year was $182, 000. Prepare an income statement for Cullumber Corporation.arrow_forwardCoronado Ltd. had sales revenue of £ 550,800 in 2022. Other items recorded during the year were: Cost of goods sold £ 336,600 Selling expenses 122,400 Income tax 25,500 Increase in value of employees 15,300 Administrative expenses 10,200 Prepare an income statement for Coronado for 2022. Coronado has 100,000 shares outstanding. (Round earnings per share to 2 decimal places, e.g. 1.48.) CORONADO LTDIncome Statementchoose the accounting period enter an income statement item £ enter a pound amount enter an income statement item enter a pound amount select a summarizing line for the first part enter a total amount for the first part enter an income statement item £ enter a pound amount enter an income statement item enter a pound amount enter a subtotal of the two previous amounts select a summarizing line for the second part enter a total amount for two parts enter an…arrow_forward

- In 2022, Oriole Corporation had net sales of $595,000 and cost of goods sold of $356, 000. Operating expenses were $149,000, and interest expense was $6,500. The corporation's tax rate is 20%. The corporation declared preferred dividends of $13,000 in 2022, and its average common stockholders' equity during the year was $178,000. (a) Prepare an income statement for Oriole Corporation. ORIOLE CORPORATION Income Statement Prepare an income statement for Oriole Corporation. ORIOLE CORPORATION Income Statementarrow_forwardThe financial statements of Friendly Fashions include the following selected data (in millions): ($ in millions) 2024 2023 Sales $8,343 $9,434 Net income $170 $648 Stockholders' equity $1,780 $2,220 Average Shares outstanding (in millions) 710 0 Dividends per share $0.28 0 Stock price $8.00 0 Required:Calculate the following ratios for Friendly Fashions in 2024. (Enter your dividend yield and price-earnings ratio values to 2 decimal places. Enter your answers in millions (i.e. 5,500,000 should be entered as 5.5).)arrow_forwardSheffield Corporation had 2025 net income of $1,175,000. During 2025, Sheffield paid a dividend of $2 per share on 201,900 shares of preferred stock. During 2025, Sheffield had outstanding 241,000 shares of common stock. Compute Sheffield's 2025 earnings per share. (Round answer to 2 decimal places, e.g. 3.56.) Earnings per share per sharearrow_forward

- Casello Mowing & Landscaping's year-end 2021 balance sheet lists current assets of $437,100, fixed assets of $552,900, current liabilities of $418,500, and long-term debt of $318,300. Calculate Casello's total stockholders' equity. (Enter your answer in dollars. Round your answer to the nearest dollar amount.) Total stockholders' equityarrow_forwardThe 2020 income statement of Blossom Corporation showed net income of $1,271,000, which included a loss from discontinued operations of $114,800. Blossom had 41,000 common shares outstanding all year. (a) Calculate earnings per share (EPS) for 2020 as it should be reported to shareholders. (Round answers to 2 decimal places, e.g. 15.25. Enter negative amounts using either a negative sign preceding the number e.g. -45 or parentheses e.g. (45).) Income from continuing operations Loss from discontinued operations, net of tax Net income $ $ $ Earnings per sharearrow_forwardSuppose McDonald's 2025 financial statements contain the following selected data (in millions). Current assets $3,461.5 Interest expense $480.0 Total assets 30,250.0 Income taxes 1,942.0 Current liabilities 3,010.0 Net income 4,538.0 Total liabilities 16,637.5 (a1) Compute the following values. a. Working capital. (Round to 1 decimal place in millions, e.g. 5,275.5.) $ 451.5 millions b. Current ratio. (Round to 2 decimal places, e.g. 6.25:1.) 1.15 :1 C. Debt to assets ratio. (Round to O decimal places, e.g. 62%.) 55 % d. Times interest earned. (Round to 2 decimal places, e.g. 6.25.) 14.50 timesarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education