FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

The beginning inventory at ABC Supplies and data on purchases and sales for a three-month period ending March 31, are as follows: (See attached dates/transactions/units/totals list attached)

1. Record the inventory, purchases, and cost of merchandise sold data in a perpetual inventory record, using the first-in, first-out method. (I have attached an example of how the table should look as I had a hard time formatting the blank table I provided below)

| Date | Purchases | Cost of Merchandise sold | Inventory | ||||||

| Quantity | Unit Cost | Total Cost | Quantity | Unit Cost | Total Cost | Quantity | Unit Cost | Total Cost | |

| Jan. 1 |

|

|

|

||||||

| 10 |

|

|

|

|

|

|

|||

| 10 |

|

|

|

||||||

| 28 |

|

|

|

||||||

| 28 |

|

|

|

|

|

|

|||

| 30 |

|

|

|

|

|

|

|||

| Feb. 5 |

|

|

|

|

|

|

|||

| 10 |

|

|

|

|

|

|

|||

| 10 |

|

|

|

||||||

| 16 |

|

|

|

||||||

| 16 |

|

|

|

|

|

|

|||

| 28 |

|

|

|

|

|

|

|||

| Mar. 5 |

|

|

|

|

|

|

|||

| 5 |

|

|

|

||||||

| 14 |

|

|

|

||||||

| 14 |

|

|

|

|

|

|

|||

| 25 |

|

|

|

|

|

|

|||

| 25 |

|

|

|

||||||

| 30 |

|

|

|

|

|

|

|||

| 30 |

|

|

|

||||||

| 31 | Balances |

|

|

2. |

Determine the total sales and the total cost of merchandise sold for the period. Journalize the entries in the sales and cost of merchandise sold accounts. Assume that all sales were on the account and date your |

| 3. | Determine the gross profit from sales for the period. |

| 4. | Determine the ending inventory cost as of March 31. |

Transcribed Image Text:The beginning inventory at Midnight Supplies and data on purchases and sales for a three-month period ending March 31, are as follows:

Date

Transaction

Number of Units

Per Unit

Total

Jan.

1

Inventory

2,700

$50.00

$135,000

10

Purchase

7,300

58.00

423,400

28

Sale

4,050

100.00

405,000

30

Sale

1,200

100.00

120,000

Feb.

Sale

500

100.00

50,000

10

Purchase

17,000

60.00

1,020,000

16

Sale

9,200

105.00

966,000

28

Sale

8,000

105.00

840,000

Mar.

5

Purchase

14,300

61.60

880,880

14

Sale

10,300

105.00

1,081,500

25

Purchase

3,200

62.00

198,400

30

Sale

8,000

105.00

840,000

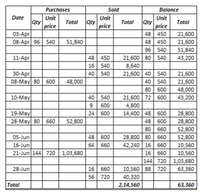

Transcribed Image Text:Purchases

Sold

Balance

Unit

Qty

price

Unit

Qty

price

Date

Unit

Qty

price

Total

Total

Total

03-Apr

08-Аpr| 96

48 | 450

48 450

96| 540

21,600

21,600

51,840

540

51,840

11-Apr

48 | 450

16| 540

40 | 540

21,600 80 540

8,640

21,600 40 540

40 | 540

80 600

21,600 72 600

4,800

43,200

30-Аpr

08-May 80

21,600

21,600

48,000

600

48,000

10-May

40 | 540

43,200

8

600

19-May

28-May 80

24| 600

14,400 48 600

48 | 600

28,800

660

52,800

28,800

80

660

52,800

48 600

64| 660

28,800 80 660

42,240 16

05-Jun

52,800

16-Jun

660

10,560

21-Jun 144 720 | 1,03,680

16

660

10,560

144 720 1,03,680

16| 660

56 720

28-Jun

10,560 88 720

63,360

40,320

Total

2,14,560

63,360

Expert Solution

arrow_forward

Step 1

First-in, first-out method is the method that is used to record the purchase sales and inventory of goods into business in which is assumed that the first purchased inventory is sold first. This means at the time of sales, the oldest inventory purchased is sold first.

Step by stepSolved in 5 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- need help with all working , explanation , computation , formula, with stepsarrow_forwardThe following data regarding purchases and sales of a commodity were taken from the related inventory account (perpetual inventory system is used): May 1 Balance 25 units at $41 6 Sale 20 units 8 Purchase 20 units at $42 16 Sale 10 units 20 Purchase 20 units at $43 23 Sale 25 units 30 Purchase 15 units at $45 (a) Determine the total cost of the inventory balance at May 31, using the first-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (b) Determine the total cost of the inventory balance at May 31, using the last-in, first-out method. Also, identify the quantity, unit price, and total cost of each lot/layer in the ending inventory. (a) FIFO (b) LIFOarrow_forwardB66's transactions involving inventory for the month are shown below. Calculate the dollar amount of Sales, Cost of Goods Sold, Gross Margin and Ending Inventory using the three cost allocation methods (FIFO, LIFO, and Weighted Average) with perpetual inventory updating. Number of Units Unit Cost Sales Beginning Inventory 100 $66 Sold 50 $120 Purchased 80 $75 Sold 25 $125 Ending Inventory 105 Show your calculations and clearly label your solution. Submit your work as an attachment to this assignment.arrow_forward

- sarrow_forwardRapid Resources, which uses the FIFO inventory costing method, has the following account balances at July 31, 2025, prior to releasing the financial statements for the year: Merchandise Inventory, ending $ Cost of Goods Sold Net Sales Revenue Date 16,500 71,000 122,000 Jul. 31 Requirement 1. Prepare any adjusting journal entry required from the given information. (Record debits first, then credits. Select the explanation on the last line of the journal entry. For situations that do not require an entry, make sure to select "No entry required" in the first cell in the "Accounts" column and leave all other cells blank.) Accounts and Explanation Credit Rapid has determined that the current replacement cost (current market value) of the July 31, 2025, ending merchandise inventory is $13,500. Read the requirements. Debit 4arrow_forwardI need help.arrow_forward

- PLEASE HELP MEarrow_forward[The following information applies to the questions displayed below.] Laker Company reported the following January purchases and sales data for its only product. For specific identification, ending inventory consists of 270 units from the January 30 purchase, 5 units from the January 20 purchase, and 10 units from beginning inventory. Date January 1 January 10 January 20 January 25 January 30 Assume the perpetual inventory system is used. Required: Activities Beginning inventory Sales Purchase Sales Purchase Totals Req 1 Req 2 to 4 Sales Cost of goods sold Gross profit Complete this question by entering your answers in the tabs below. Specific Identification $ LAKER COMPANY For Month Ended January 31 Weighted Average $ Units Acquired at Cost 185 units @ $11.00 = 5,600 100 units @ 1. Compute gross profit for the month of January for Laker Company for the four inventory methods. 2. Which method yields the highest gross profit? 3. Does gross profit using weighted average fall between that…arrow_forwardRequired information [The following information applies to the questions displayed below.] Total Date March 1 March 5 March 9 March 18 March 25 March 29 Warnerwoods Company uses a perpetual inventory system. It entered into the following purchases and sales transactions for March. Beginning inventory Purchases: March 5 March 18 March 25 Activities Beginning inventory Purchase Sales Purchase Purchase Sales Totals Saved Required: 1. Compute cost of goods available for sale and the number of units available for sale. # of units Cost per Unit Units Acquired at Cost 100 units @ $51.00 per unit 225 units @ $56.00 per unit 130 units @ $96.00 per unit 390 units Subnarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education