FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:<

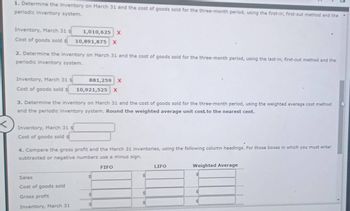

1. Determine the Inventory on March 31 and the cost of goods sold for the three-month period, using the first-in, first-out method and the

periodic inventory system.

Inventory, March 31 s

1,010,625 X

Cost of goods sold s

10,891,875 X

2. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the last-in, first-out method and the

periodic inventory system.

Inventory, March 31 s

Cost of goods sold

881,259 X

10,921,525 X

3. Determine the inventory on March 31 and the cost of goods sold for the three-month period, using the weighted average cost method

and the periodic inventory system. Round the weighted average unit cost to the nearest cent.

Inventory, March 31 s

Cost of goods sold s

4. Compare the gross profit and the March 31 inventories, using the following column headings. For those boxes in which you must enter

subtracted or negative numbers use a minus sign.

Sales

Cost of goods sold

Gross profit

Inventory, March 31

FIFO

LIFO

Weighted Average

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Subject: acountingarrow_forward< Inventory by Three Methods; Cost of Goods Sold The units of an item available for sale during the year were as follows: Jan. 1 May 15 Aug. 7 Inventory Nov. 20 Purchase 12 units at $2,040 17 units at $2,100 There are 20 units of the item in the physical inventory at December 31. Determine the cost of ending inventory and the cost of goods sold by three methods, presenting your answers in the following form: Round your final answers to the nearest dollar. Purchase Purchase 21 units at $1,800 30 units at $1,950 Inventory Method a. First-in, first-out method b. Last-in, first-out method c. Weighted average cost method Feedback Ending Inventory Cost of Goods Sold 0 X 0 X 0 Cost X $ 114,660 ✓ 0 X 0 Xarrow_forward1. Compute the cost of the ending inventory under the FIFO method. Round the cost-to-retail ratio to three decimal places and the final answers to the nearest dollar.arrow_forward

- Beginning inventory, purchases, and sales for Item MMM8 are as follows: November 1 Inventory 109 16 9 Sale 91 16 Purchase 129 14 25 Sale 77 Assuming a perpetual inventory system and using the Last-in, first-out (FIFO) method, determine the inventory value on November 30.arrow_forwardwer the following independent questions and show computations supporting your answers. 1. Assume that the company uses the FIFO method. The value of the ending inventory at December 31 is 2. Assume that the company uses the average cost method. The value of the ending inventory on Decemb $. 3. Assume that the company uses the LIFO method. The value of the ending inventory on December 31 isarrow_forwardBased on the following data for the current year, what is the inventory turnover (rounded to one decimal place)? Sales on account during year $469,274 Cost of merchandise sold during year 179,305 Accounts receivable, beginning of year 42,159 Accounts receivable, end of year 52,598 Merchandise inventory, beginning of year 32,886 Merchandise inventory, end of year 40,548 Oa. 17.7 Ob. 12.8 Oc. 3.9 Od. 4.9arrow_forward

- Beginning inventory, purchases, and sales for an inventory item are as follows: Sep. 1 Beginning Inventory 23 units @ $11 5 Sale 11 units 17 Purchase 24 units @ $12 30 Sale 18 units Assuming a perpetual inventory system and the last-in, first-out method: a. Determine the cost of the goods sold for the September 30 sale. b. Determine the inventory on September 30.arrow_forward1. How much is the ending inventory FIFO method? Show your solution.a. 33,680 c. 33,677 b. 33,050 d. 33,530 2. Assuming there are goods in transit purchased FOB destination as of end of January 31, 300 units of iinventory at 43/unit. How much is the ending inventory as of end of January using weighted average method? Show your solutiona. 46,675 c. 49,727 b. 46,670 d. 33,530arrow_forwardBeginning inventory, purchases, and sales for Item MMM8 are as follows: November 1 Inventory 102 16 9 Sale 89 16 Purchase 128 0 25 Sale 83 Assuming a perpetual inventory system and using the Last-in, first-out (FIFO) method, determine the inventory value on November 30.arrow_forward

- Required information [The following information applies to the questions displayed below.] The following are the transactions for the month of July. Unit Selling July 1 July 13 July 25 July 31 Beginning Inventory Purchase Units 43 Unit Cost $ 10 Price 215 11 Sold Ending Inventory (100) 158 $ 14 Required: a. Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. b. Calculate sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. Complete this question by entering your answers in the tabs below. Required A Required B Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. FIFO (Periodic) Beginning Inventory Units Cost per Unit Total 43 $ 10 $ 430 Purchases July 13 Goods Available for Sale 215 $ 11 $ 2,365 $ 258 Cost of Goods Sold Units from Beginning Inventory 43 $ 10 Units from July 13 Purchase $ 11 Total Cost of…arrow_forwardPlease help solve and explain processarrow_forward! Required information [The following information applies to the questions displayed below.] The following are the transactions for the month of July. July 1 July 13 July 25 July 31 Beginning Inventory Purchase Units 46 Unit Cost $ 10 Unit Selling Price 230 11 Sold Ending Inventory (100) 176 $ 14 Required: a. Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. b. Calculate sales, cost of goods sold, and gross profit, under FIFO. Assume a periodic inventory system is used. Complete this question by entering your answers in the tabs below. Required A Required B Calculate cost of goods available for sale and ending inventory under FIFO. Assume a periodic inventory system is used. FIFO (Periodic) Units Cost per Unit Total Beginning Inventory Purchases July 13 S Prev 1 2 3 of 11 Nextarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education