FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

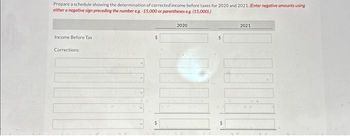

Transcribed Image Text:Prepare a schedule showing the determination of corrected income before taxes for 2020 and 2021. (Enter negative amounts using

either a negative sign preceding the number eg. -15,000 or parentheses e.g. (15,000))

Income Before Tax

Corrections:

$

2020

2021

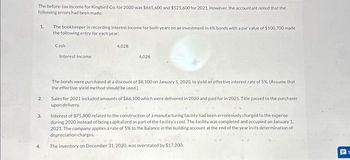

Transcribed Image Text:The before-tax income for Kingbird Co. for 2020 was $665,600 and $525,600 for 2021. However, the accountant noted that the

following errors had been made:

1.

2.

3.

4.

The bookkeeper in recording interest income for both years on an investment in 4% bonds with a par value of $100,700 made

the following entry for each year:

Cash

Interest Income

4,028

4,028

The bonds were purchased at a discount of $8,100 on January 1, 2020, to yield an effective interest rate of 5%. (Assume that

the effective-yield method should be used.)

Sales for 2021 included amounts of $66,100 which were delivered in 2020 and paid for in 2021. Title passed to the purchaser

upon delivery.

Interest of $75,800 related to the construction of a manufacturing facility had been erroneously charged to the expense

during 2020 instead of being capitalized as part of the facility's cost. The facility was completed and occupied on January 1,

2021. The company applies a rate of 5% to the balance in the building account at the end of the year in its determination of

depreciation charges.

The inventory on December 31, 2020, was overstated by $17,200.

s

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- On August 1, 2022, Bramble Corp. issued $482,400, 8%, 10-year bonds at face value. Interest is payable annually on August 1. Bramble’s year-end is December 31. Prepare the journal entry to record the issuance of the bonds. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Aug. 1 enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount enter an account title to record the issuance of the bonds on August 1 enter a debit amount enter a credit amount eTextbook and Media List of Accounts Prepare the journal entry to record the accrual of interest on December 31, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an…arrow_forwardCost and fair value data for the trading debt securities of Wildhorse Company at December 31, 2022, are $60,500 and $57,450 respectively.Prepare the adjusting entry to record the securities at fair value. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter 0 for the amounts.) Date Account Titles and Explanation Debit Credit Dec. 31 enter an account title for the adjusting entry on December 31 enter a debit amount enter a credit amount enter an account title for the adjusting entry on December 31 enter a debit amount enter a credit amountarrow_forwardOn January 1, 2018, Methodical Manufacturing issued 100 bonds, each with a face value of $1,000, a stated interest rate of 8 percent paid annually on December 31, and a maturity date of December 31, 2020. On the issue date, the market interest rate was 7.25 percent, so the total proceeds from the bond issue were $101,959. Methodical uses the effective-interest bond amortization method and adjusts for any rounding errors when recording interest in the final year. Prepare the journal entry to record the bond issue, interest payments on December 31, 2018 and 2019, interest and face value payment on December 31, 2020 and the bond retirement. Assume the bonds are retired on January 1, 2020, at a price of 102.arrow_forward

- Please Explain Proper Step by Step and do not give solution in image format ??arrow_forwardIn the past year, Blossom Corporation reported assets of $230229000. Liabilities reported on the balance sheet on the same date were reported at $69091655. Blossom issued a new note payable for cash during the year. The 8%, 5-year note was issued at a face value of $5008000. What is the company's debt to asset ratio after the refinance? O 29.37% 31.50% 32.18% O 30.01%arrow_forwardOn January 1, Year 1, Maverick Company sold bonds that pay interest semiannually on June 30 and December 31. Maverick has a fiscal year - end of February 28. The amortization schedule for these bonds shows a cash payment of interest of $7, 200 and effective interest of $9, 009 relating to the interest payment that will be made on June 30, Year 1. What is the amount of interest expense that should be accrued by Maverick in an adjusting entry dated February 28, Year 1?arrow_forward

- On the day Federer Ltd redeemed its $1,000,000 face value bonds at 98, their carrying value was $1,200,000. Prepare a residual analysis for the bond redemption. Prepare the journal entry for the bond redemption. If you recognise a gain or loss, state where in the Statement of Comprehensive Income the gain or loss should appeararrow_forwardOn January 1, Year 1, Hanover Corporation issued bonds with a $39,000 face value, a stated rate of interest of 8%, and a 5-year term to maturity. The bonds were issued at 97. Hanover uses the straight-line method to amortize bond discounts and premiums. Interest is payable in cash on December 31 each year. How much interest expense will Hanover report on its income statement on December 31, Year 1? Multiple Choice O O O O $234 $1,170 $3.354 $3,120arrow_forwardTHIS QUESTION WILL ALSO BE CHECKED MANUALLY (to make adjustments for typos). QUESTION 9 On the first day of the fiscal year, a company issues a $828,000, 12%, 10-year bond that pays semiannual interest of $49,680, receiving cash of $869,400. Journalize the entry for the first interest payment and amortiation of premium using the straight-line method and the chart of accounts below. Bonds Payable Cash Discount on Bonds Payable Interest Revenue Gain on Redemption of Bonds Interest Expense Interest Payable Loss on Redemption of Bonds Premiun on Bonds Payable Enter your answers into the table below. Key the account names carefully (exactly as shown above) and follow formatting instructions below. DO NOT USE A DECIMAL WITH ZEROES FOR WHOLE DOLLAR AMOUNTS AND USE COMMAS APPROPRIATELY. WHEN THE DEBIT/CREDIT DOES NOT REQUIRE AN ENTRY, LEAVE IT BLANK. Account Debit Credit THIS QUESTION WILL ALSO BE CHECKED MANUALLY (to make adjustments for typos). Click Save and Submit to save and submit. Click…arrow_forward

- On May 1, 2025, Blossom Company issued 2,500 $1,000 bonds at 102. Each bond was issued with one detachable stock warrant. Shortly after issuance, the bonds were selling at 99, but the fair value of the warrants cannot be determined. a. Prepare the entry to record the issuance of the bonds and warrants. (List debit entry before credit entry. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Account Titles and Explanation Debit Credit b. Assume the same facts as part (a), except that the warrants had a fair value of $24. Prepare the entry to record the issuance of the bonds and warrants. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts. Do not round intermediate…arrow_forwardOn January 1, 2021, the company issued $1,800,000, 6% bonds with a 10-year maturity. The bonds were issued to investors that require an effective interest rate of 9%. The accountant did NOT record the issuance of these bonds. Interest is paid annually and the accountant did NOT record the interest payment transaction. The effective interest method is used to amortize any premium or discount. NOTE – round calculations to nearest dollar. In the Excel spreadsheet, see the tab labelled “Bonds Payable – Series 2” to make any calculations, including an amortization schedule, to support journal entries.arrow_forwardThe Melon Company issues $519,000 of 8%, 10-year bonds at 103 on March 31, Year 1. The bonds pay interest on March 31 and September 30. Assume that the company uses the straight- line method for amortization. Calculate the net balance that will be reported for the bonds on the September 30, Year 1 balance sheet. (Round your intermediate answers to the nearest dollar.) Group of answer choices $533, 791 $535, 349 $519,000 $534, 570arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education