FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

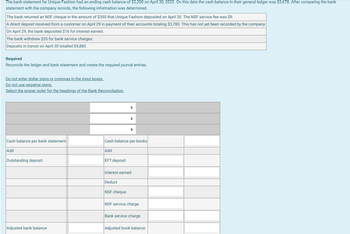

Transcribed Image Text:The bank statement for Unique Fashion had an ending cash balance of $2,200 on April 30, 2022. On this date the cash balance in their general ledger was $3,678. After comparing the bank

statement with the company records, the following information was determined.

The bank returned an NSF cheque in the amount of $350 that Unique Fashion deposited on April 20. The NSF service fee was $9.

A direct deposit received from a customer on April 29 in payment of their accounts totaling $3,780. This has not yet been recorded by the company.

On April 29, the bank deposited $16 for interest earned.

The bank withdrew $35 for bank service charges.

Deposits in transit on April 30 totalled $4,880.

Required

Reconcile the ledger and bank statement and create the required journal entries.

Do not enter dollar signs or commas in the input boxes.

Do not use negative signs.

Select the proper order for the headings of the Bank Reconciliation.

Cash balance per bank statement

Add

Outstanding deposit

Adjusted bank balance

EFT deposit

Cash balance per books

Add

◆

Deduct

+

Interest earned

NSF cheque

NSF service charge

Bank service charge

Adjusted book balance

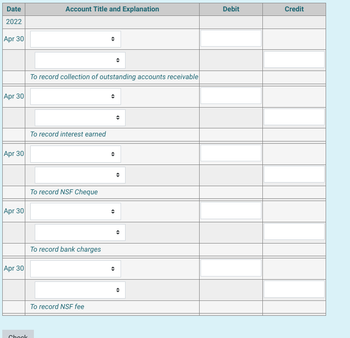

Transcribed Image Text:Date

2022

Apr 30

Apr 30

Apr 30

Apr 30

Apr 30

Chook

Account Title and Explanation

To record collection of outstanding accounts receivable

To record interest earned

To record NSF Cheque

To record bank charges

To record NSF fee

Debit

Credit

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- give answer of this question pleasearrow_forwardWestern Flyers received its bank statement for the month of July 2019 with an ending balance of $11,065.00 whereas the cash book balance for Western Flyers is $12875. Western Flyers determined that check #598 for $125.00 and check #601 for $375.00 were both outstanding. Also, a $7,500.00 deposit for July 30th was in transit as of the end of the month. Big Bucks Bank also collected an amount of $5,300 from a client of Western Flyer as payment of a note ($5,000) and interest ($300) earned on a note. Big Bucks Bank charged Flyers a $15.00 fee for the collection service and $20 for issuance of 10 check books. 5. A check for $75.00 from Colin Abraham, a client, was returned with the bank statement marked “NSF”.arrow_forwardThe Cash account of Ranger Security Systems reported a balance of $2,550 at December 31, 2025. There were outstanding checks totaling $800 and a December 31 deposit in transit of $100. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,910. Included in the bank balance was a collection of $670 on account from Sally Jones, a Ranger Security Systems customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Ranger Security System earned on its bank balance. Prepare Ranger Security System's bank reconciliation at December 31. Ranger Security Systems Bank Reconciliation Bank: Balance, December 31, 2025 ADD: Deposit in transit December 31, 2025 LESS: Outstanding checks Adjusted bank balance, December 31, 2025 Book: Balance, December 31, 2025 ADD: LESS: Service charge Adjusted book balance, December 31, 2025arrow_forward

- Infinity Emporium Company received the monthly statement for its bank account, showing a balance of $67,300 on August 31. The balance in the Cash account in the company's accounting system at that date was $72,628. The company's accountant reviewed the statement and the company's accounting records and noted the following. 1. 2. 3. After comparing the cheques written by the company with those deducted from the bank account in August, the accountant determined that all six cheques (totalling $6,180) that had been outstanding at the end of July were processed by the bank in August. However, five cheques written in August, totalling $4,500, were outstanding on August 31. A review of the deposits showed that a deposit made by the company on July 31 for $11,532 was recorded by the bank on August 1, and an August 31 deposit of $13,300 was recorded in the company's accounting system but had not yet been recorded by the bank. The August bank statement also showed: a service fee of $24 a…arrow_forwardHathaway Company’s general ledger shows a cash account balance of $23,290 on July 31, 2024. Cash sales of $1,839 for the last three days of the month have not yet been deposited. The bank statement dated July 31 shows bank service fees of $51 and an NSF check from a customer of $310. The bank processes all checks written by the company by July 31 and lists them on the bank statement, except for one check totaling $1,470. The bank statement shows a balance of $22,560 on July 31. Required: 1. Prepare a bank reconciliation to calculate the correct balance of cash on July 31, 2024. 2. Record the necessary entry(ies) to adjust the balance for cash.arrow_forwardOscar Myer receives the March bank statement for Jam Enterprises on April 11, 2018. The March 31 bank statement shows an ending cash balance of $67,566. A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following. O. Myer notices that the bank erroneously cleared a $500 check against his account in March that he did not issue. The check documentation included with the bank statement shows that this check was actually issued by a company named Jam Systems. On March 25, the bank lists a $50 charge for the safety deposit box expense that Jam Enterprises agreed to rent from the bank beginning March 25. On March 26, the bank lists a $102 charge for printed checks that Jam Enterprises ordered from the bank. On March 31, the bank lists $33 interest earned on Jam Enterprises' checking account for the month of March. O. Myer notices that the check he issued for $128 on March 31, 2018, has not yet cleared the bank. O. Myer verifies that all deposits…arrow_forward

- The beginning checkbook balance of Shamma Co. was $5,559.10. The bank statement showed a bank balance of $7,888.44. The bookkeeper of Shamma Co. noticed a $111.10 deposit in transit along with check numbers 90 and 97 for $499.88 and $1,256.45, respectively, as outstanding. The bank statement credited Shamma's account for $750.99 for a note collected. The bank statement revealed a check printing charge of $66.88. The reconciled balance is:arrow_forwardOn June 30, 2019, Wally Company's bank statement showed a $7,500.10 bank balance. Wally has a beginning checkbook balance of $9,800.00. The bank statement also showed that it collected a $1,200.50 note for the company. A $4,500.10 June 30 deposit was in transit. Check No. 119 for $650.20 and check No. 130 for $381.50 are outstanding. Wally's bank charges $.40 cents per check. This month, 80 checks were processed. Prepare a reconciled statement. (Round your answers to the nearest cent.) Checkbook balance Wally's checkbook balance Add: Deduct: Reconciled balance WALLY COMPANY Bank Reconciliation as of June 30, 2019 Bank balance Add: Deduct: Reconciled balance Bank balancearrow_forwardAccounting please answer asap? John Corporation's bank statement for April 30 showed an ending cash balance of $1,350. The company's Cash account in its general ledger showed a $995 debit balance. The following information was also available as of April 30: • The bank deducted $125 for an NSF check from a customer deposited on April 15. • The April 30 cash receipts, $1,250, were placed in the bank's night depository after banking hours on that date and this amount did not appear on the April 30 bank statement. • A$15 debit memorandum (service charges) for checks printed by the bank was included with the canceled checks. • Outstanding checks amounted to $1,145. • Included with the bank statement was a credit memo in the amount of $875 for an EFT in payment of a customer's account. • Included with the canceled checks was a check for $275, drawn on the account of another company by error. Required: 1. Prepare a bank reconciliation as of April 30. 2. Prepare the journal entries for the…arrow_forward

- The Cash account of Gate City Security Systems reported a balance of $2,490 at December 31, 2024. There were outstanding checks totaling $1,000 and a December 31 deposit in transit of $300. The bank statement, which came from Tri Cities Bank, listed the December 31 balance of $3,810. Included in the bank balance was a collection of $630 on account from Nicole Lee, a Gate City customer who pays the bank directly. The bank statement also shows a $20 service charge and $10 of interest revenue that Gate City earned on its bank balance. Prepare Gate City's bank reconciliation at December 31. Gate City Security Systems Bank Reconciliation December 31, 2024 Bank: Balance, December 31, 2024 ADD: LESS Adjusted bank balance, December 31, 2024 Book: Balance, December 31, 2024 ADD: LESS Adjusted book balance, December 31, 2024arrow_forwardOn April 3, Erin Gardner received her bank statement showing a balance of $2,086.93. Her checkbook showed a balance of $1,912.47. Outstanding checks were $234.15, $317.80, $78.10, $132.42, and $212.67. The account earned $20.43. Deposits in transit amount to $814.11, and there is a service charge of $7.00. Use the form below to calculate the reconciled balance. CHECKBOOK BALANCE Add: Interest Earned & Other Credits SUBTOTAL Deduct: Service Charges & Other Debits ADJUSTED CHECKBOOK BALANCE tA ta ta ta tA STATEMENT BALANCE Add: Deposits in Transit SUBTOTAL Deduct: Outstanding Checks LA tA ·SA $ LA ADJUSTED STATEMENT BALANCE $ LA Earrow_forwardThe Cash account of ReeseCorporation had a balance of $3,540 at October 31, 2018. Included were outstanding checkstotaling $1,800 and an October 31 deposit of $300 that did not appear on the bank statement.The bank statement, which came from Turnstone State Bank, listed an October 31 balance of$5,570. Included in the bank balance was an October 30 collection of $600 on account froma customer who pays the bank directly. The bank statement also showed a $30 service charge,$10 of interest revenue that Reese earned on its bank balance, and an NSF check for $50.Prepare a bank reconciliation to determine how much cash Reese actually had at October 31.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education