FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

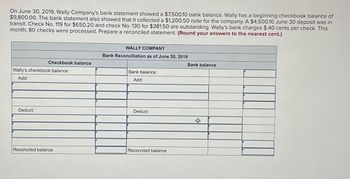

Transcribed Image Text:On June 30, 2019, Wally Company's bank statement showed a $7,500.10 bank balance. Wally has a beginning checkbook balance of

$9,800.00. The bank statement also showed that it collected a $1,200.50 note for the company. A $4,500.10 June 30 deposit was in

transit. Check No. 119 for $650.20 and check No. 130 for $381.50 are outstanding. Wally's bank charges $.40 cents per check. This

month, 80 checks were processed. Prepare a reconciled statement. (Round your answers to the nearest cent.)

Checkbook balance

Wally's checkbook balance

Add:

Deduct:

Reconciled balance

WALLY COMPANY

Bank Reconciliation as of June 30, 2019

Bank balance

Add:

Deduct:

Reconciled balance

Bank balance

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Oscar Myer receives the March bank statement for Jam Enterprises on April 11, 2018. The March 31 bank statement shows an ending cash balance of $67,566. A comparison of the bank statement with the general ledger Cash account, No. 101, reveals the following. O. Myer notices that the bank erroneously cleared a $500 check against his account in March that he did not issue. The check documentation included with the bank statement shows that this check was actually issued by a company named Jam Systems. On March 25, the bank lists a $50 charge for the safety deposit box expense that Jam Enterprises agreed to rent from the bank beginning March 25. On March 26, the bank lists a $102 charge for printed checks that Jam Enterprises ordered from the bank. On March 31, the bank lists $33 interest earned on Jam Enterprises' checking account for the month of March. O. Myer notices that the check he issued for $128 on March 31, 2018, has not yet cleared the bank. O. Myer verifies that all deposits…arrow_forwardOn December 15, you recieved your bank statement showing a balance of $2270.32. Your checkbook shows a balance of $2433.33. Outstanding checks are $225.50 and $356.20. The account earned $77.52. Deposits in transit amount to $805.23, and there is a service charge of $17.00. Calculate the reconciled balance. options are: a. 163.01 b. 2046.79 c. 2372.81 d. 2493.85arrow_forwardThe beginning checkbook balance of Shamma Co. was $5,559.10. The bank statement showed a bank balance of $7,888.44. The bookkeeper of Shamma Co. noticed a $111.10 deposit in transit along with check numbers 90 and 97 for $499.88 and $1,256.45, respectively, as outstanding. The bank statement credited Shamma's account for $750.99 for a note collected. The bank statement revealed a check printing charge of $66.88. The reconciled balance is:arrow_forward

- The following information for the month of March is available from Butters Cookies, Inc.'s accounting records: Balance per bank statement, March 31, 2020 $12,100 Cash balance per books, March 31, 2020 15,295 Deposit made on February 28; recorded by bank on March 3 3,600 March 31, 2016, outstanding checks: #2346 438 #2348 231 #2355 107 Bank service charge for March (not recorded yet by Butters) 54 NSF check of customer returned by bank with March statement 832 A check drawn on Moore Company was erroneously charged to Butters 275 A $347 check to a supplier in payment of account was erroneously recorded on Batters' books as $437 ? Deposit made on March 31, recorded by bank on April 3 2,900 Required: a. Prepare a March 31, 2020, bank reconciliation. b. Prepare any related adjusting entries that are necessary on March 31, 2020.arrow_forwardThe following information is available for the FRAN Company for the month of December 2019 1. On December 31, 2019 the balance in the company's Cash account has a balance of $ 15,862 . 2. The company's bank statement shows a balance December 31, 2019 of $ 19,454 . 3. Outstanding checks at December 31, 2019 total $ 2,967 . 4. A deposit placed in the bank's night depository on December 31, 2019 totaling $ 1,351 did not appear on the bank statement. 5. Included with the bank statement was a debit memorandum in the amount of $ 26 for bank service charges. It has not been recorded on the company's books. 6. Included with the bank statement was a credit memorandum for collection of a notes receivable for $ 1,243 . It has not been recorded on the company’s books. 7. A cash sales on December 15, 2019 that totaled $ 916 was incorrectly journaled and posted as $ 961 . 8. A cash sales on December 27, 2019 that totaled $ 461 was incorrectly journaled and posted as $ 416 . 9. Check #145 was written…arrow_forwardYour friend Steve comes to you for help in preparing his bank reconciliation for his company Steve’s Electronic Shop inc. (“SES”) at the end of the first month of operation in June 2019: He provides you with the following information: Opening Book balance of: $12,423.21 Balance on the June 30th bank statement: $17,743.96 SES pays utilities and Insurance through Electronic Funds Transfers (EFT). For the month of June, the payments were respectively $328 and $145. Steve prepared the June 30th deposit of $1,872 but didn’t make it in time for the bank to record it in June Bank service charge for June was $12.50 Interest earned on checking account for June was $25 and automatically deposited The bank statement shows a deposit of $423 that SES didn’t make. After a call to the Bank Manager, she apologized and told John the error would be corrected in July The following cheques are outstanding as at June 30th: Cheque # Payee Amount 745 Landlord $ 2,100.00 751…arrow_forward

- Using the following, prepare a bank reconciliation for Samtani Co. for August 31, 2020, including a proper three-line heading (please use Figure 8.6 in the text as your guide): a) The bank statement balance is $4,010 b) The cash account balance is $4,207 c) Outstanding checks amounted to $507 d) Deposits in transit are $633 e) The bank service charge is $35 f) A check for $84 for supplies was recorded as $48 in the ledger (an error in recording)arrow_forwardNew Store has the following information at August 31: attached in ss below thanks for help hwrphwtphtowh warrow_forwardThe following data represents information necessary to assist in preparing the July 31, 2019 bank reconciliation for Domore Company. On July 31, the bank balance was $5,353. The bank statement indicated a deduction of $20 for all bank service charges. A customer deposited $1,210 directly into the bank account to settle an outstanding accounts receivable bill. Cheque #566 for $800 and cheque #573 for $560 have been recorded in the company ledger but did not appear on the bank statement. A customer paid an amount of $4,570 to Domore Company on July 31 but the deposit did not appear on the bank statement. The accounting clerk made an error and recorded a $150 cheque as $1,500. The cheque was written to pay an outstanding accounts payable account. Cheque #8603 for $170 was deducted from Domore Company's account by the bank. This cheque was not written by Domore Company and needs to be reversed by the bank. The bank included an NSF cheque in the amount of $490 relating to a…arrow_forward

- please make it book balance of cash and bank balance of cash clearlyarrow_forwardYou are the bookkeeper of Mel Traders. You undertake a bank reconciliation at the end of every month. Mel Traders received its bank statement for the month ending 31 May 2021. The bank reconciliation at the end of April showed a deposit in transit of $11,700 and two outstanding cheques (no. 663 for $3,060 and no. 671 for $6,300). The adjusted cash balance in the entity’s records was $106,305 debit at the end of April. Below are the entity’s May bank statement and the entity’s book records that indicate the deposits made and cheques written during the month of May: AU Bank - Bank Statement For the period 01/05/2021 – 31/05/2021 Mel Traders Dr Cr Balance $ Balance brought forward 103,965 CR 1 May Deposit 11,700 115,665 CR 3 May Deposit 10,620 126,285 CR May Cheque # 682 4,680 121,605 CR 6 May Deposit 6,120 127,725 CR 8 May # 671 6,300 121,425 CR 9 May Deposit…arrow_forwardPlease help.me to do part a and b. Thank you for your helparrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education