EBK CONTEMPORARY FINANCIAL MANAGEMENT

14th Edition

ISBN: 9781337514835

Author: MOYER

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Question

Please solve this question financial accounting

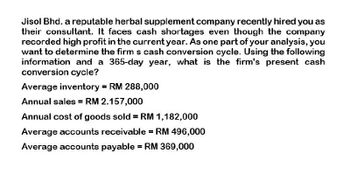

Transcribed Image Text:Jisol Bhd. a reputable herbal supplement company recently hired you as

their consultant. It faces cash shortages even though the company

recorded high profit in the current year. As one part of your analysis, you

want to determine the firm s cash conversion cycle. Using the following

information and a 365-day year, what is the firm's present cash

conversion cycle?

Average inventory = RM 288,000

Annual sales = RM 2.157,000

Annual cost of goods sold = RM 1,182,000

Average accounts receivable = RM 496,000

Average accounts payable = RM 369,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- You have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following Information and a 365-day year, your estimate of the firm's current cash conversion cycle would be __________days Current Inventory = P120,000. Accounts receivable = P157,808. Accounts payable = P25,000. Annual sales P600,000. Total annual purchases = P365,000. Purchases credit terms: net 30 days. Receivables credit terms: net 50 days. O 100 O 49 O 144 O 168arrow_forwardYou have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? Current inventory = $241,000.00 • Annual sales = $1,200,000.00 • Accounts receivable = $300,000.00 • Accounts payable = $245,000.00 • Total annual purchases = $600,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forwardYour consulting firm was recently hired to improve the performance of Realyou Inc, which is highly profitable but has been experiencing cash shortages due to its high growth rate. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year, what is the firm’s present cash conversion cycle? Average inventory P75,000 Annual sales 500,000 Annual cost of goods sold 360,000 Average accounts receivable 160,000 Average accounts payable 25,000arrow_forward

- You have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(a) what is your estimate of the firm’s current cash conversion cycle? • Current inventory = $ 180,000.00 • Annual sales = $ 700,000.00 • Accounts receivable = $ 165,000.00 • Accounts payable = $ 85,000.00 • Total annual purchases = $ 567,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forwardYou have recently been hired to improve the performance of Multiplex Corporation, which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm’s cash conversion cycle. Using the following information and a 365-day year,(b) what is your Net Working Capital • Current inventory = $ 180,000.00 • Annual sales = $ 700,000.00 • Accounts receivable = $ 165,000.00 • Accounts payable = $ 85,000.00 • Total annual purchases = $ 567,000.00 • Purchases credit terms: net 30 days. • Receivables credit terms: net 50 days.arrow_forward"You have recently been hired to improve the performance of Multiplex Corporation which has been experiencing a severe cash shortage. As one part of your analysis, you want to determine the firm's cash conversion cycle. Using the following information and a 360-day year, what is your estimate of the firm's current cash conversion cycle? Current inventory = $120,000. Annual sales = $600,000. Accounts receivable = $160,000. Accounts payable = $35,000. Total annual purchases = $360,000. Purchases credit terms: net 30 days. Receivables credit terms: net 50 days. " Group of answer choices 195 days 177 days 171 days 201 days 181 daysarrow_forward

- Need help with this question solution general accountingarrow_forwardPlease provide this question solution general accountingarrow_forwardSuppose that LilyMac Photography has annual sales of $233,000, cost of goods sold of $168,000, average inventories of $4,800, average accounts receivable of $25,600, and an average accounts payable balance of $7,300. Assuming that all of LilyMac's sales are on credit, what will be the firm's cash cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.) What will be the firm's operating cycle? (Use 365 days a year. Do not round intermediate calculations. Round your final answer to 2 decimal places.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning