SWFT Comprehensive Vol 2020

43rd Edition

ISBN: 9780357391723

Author: Maloney

Publisher: Cengage

expand_more

expand_more

format_list_bulleted

Question

General accounting

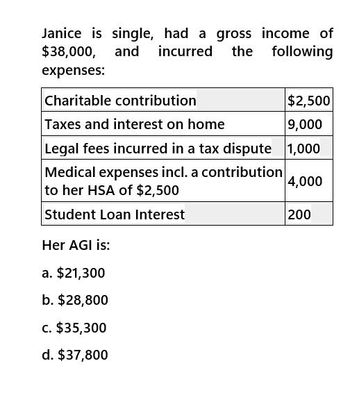

Transcribed Image Text:Janice is single, had a gross income of

$38,000, and incurred the

expenses:

Charitable contribution

Taxes and interest on home

following

$2,500

9,000

Legal fees incurred in a tax dispute 1,000

Medical expenses incl. a contribution

to her HSA of $2,500

Student Loan Interest

Her AGI is:

a. $21,300

b. $28,800

c. $35,300

d. $37,800

4,000

200

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The estate of Nancy Hanks reports the following information: What is the taxable estate value? $7,070,000. $7,100,000. $7,180,000. $7,420,000.arrow_forwardElton Weiss and Reyna Herrera-Weiss are married and report the following income items: Elton's salary Reyna's Schedule C net profit The income tax deduction for Reyna's SE tax was $3,532. Elton contributed the maximum to a Section 401(k) plan, and Reyna contributed the maximum to a SEP plan. Both spouses contributed $2,750 to their IRAS. $ 254,000 50,000 Required: Compute their AGI. Note: Round your intermediate calculations to the nearest whole dollar amount. AGI Answer is complete but not entirely correct. $ 304,000arrow_forwardBoyd Salzer, an unmarried individual, has $226,400 AGI consisting of the following items: Salary Interest income $189,500 7,150 12,400 17,350 Dividend income Rental income from real property Required: a. Compute Mr. Salzer's Medicare contribution tax. b. Compute the Medicare contribution tax if Boyd Salzer files a joint income tax return with his wife Harriet.arrow_forward

- Linda is an employee of JRH Corporation. Which of the following would be included in Lindas gross income? a. Premiums paid by JRH Corporation for a group term life insurance policy for 50,000 of coverage for Linda. b. 1,000 of tuition paid by JRH Corporation to State University for Lindas masters degree program. c. A 2,000 trip given to Linda by JRH Corporation for meeting sales goals. d. 1,200 paid by JRH Corporation for an annual parking pass for Linda.arrow_forwardA married couple received $11,000 of social security benefits. a. Calculate the taxable amount of those benefits if the couple's provisional income is $24,500. b. Calculate the taxable amount of those benefits if the couple's provisional income is $42,500. c. Calculate the taxable amount of those benefits if the couple's provisional income is $65,000. a. b. " Taxable amount of benefits $ 0arrow_forwardam.101.arrow_forward

- From the following information determine Steve's gross income for tax purposes. salary: 32,000 interest checking account:25 Cash received as birthday gift 1,000 dividends (mutual funds) 5,500 Child support payments received from ex wife-$24,000 Life insurance benefits received after aunt's death:50,000arrow_forwardTaxpayer:Gregory and Brenda Morris, filing 1040Filing Status:married, filing jointlyExemptions:2 childrenTaxes withheld:$5,300Income:Mr. Morris: $32,000Mrs. Morris: $20,000Interest income: $500Bonus for Mr. Morris: $4,000Deductions:● Medical expenses:Drugs: $400Hospitalization insurance: $1,000Doctor bills: $2,000Dentist bills: $1,600Eyeglasses: $200Medical supplies: $800● Interest expenses:Home mortgage: $6,000● Contributions:Calvary Church: $5,000Oakdale Children's Home: $1,000 How much is the taxable income? Do they owe additional taxes, or do they get a refund? How much?arrow_forwardTyrone and Akira, who are married, incurred and paid the following amounts of interest during 2021 Home acquisition debt interest Credit card interest Home equity loan interest (used for home improvement) Investment interest expense Mortgage insurance premiums (PMI) Required: $ 11,250 3,500 5,525 9,000 1,000 With 2021 net investment income of $1,125, calculate the amount of their allowable deduction for investment interest expense and their total deduction for allowable interest. Home acquisition principal and the home equity loan principal combined are less than $750,000. Deduction for investment interest expense Total deduction for allowable interest Amountsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT