Concept explainers

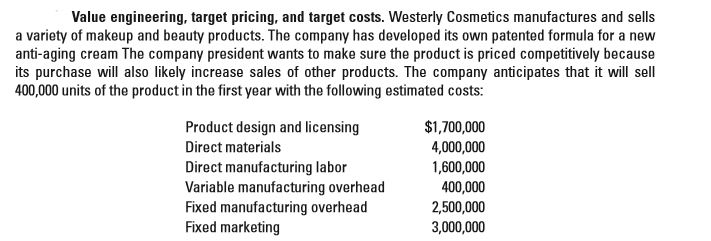

The company believes that it can successfully sell the product for $45 a bottle. The company’s target operating income is 30% of revenue. Calculate the target full cost of producing the 400,000 units. Does the cost estimate meet the company’s requirements? Is value engineering needed?

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 5 images

A componenet of the direct materials cost requires the nectar of a specific plant in South America. If the company could eliminate this special ingredient, the materials cost would decrease by 25%. However, this would require design changes of 300000 to engineer a chemical equivalent of the ingredient. Will this design change allow the product to meet its target cost?

A componenet of the direct materials cost requires the nectar of a specific plant in South America. If the company could eliminate this special ingredient, the materials cost would decrease by 25%. However, this would require design changes of 300000 to engineer a chemical equivalent of the ingredient. Will this design change allow the product to meet its target cost?

- Grace Co. can further process Product B to produce Product C. Product B is currently selling for $22 per pound and costs $14 per pound to produce. Product C would sell for $37 per pound and would require an additional cost of $11 per pound to produce. The differential revenue of producing and selling Product C is Oa. $37 per pound Ob. $26 per pound Oc. $23 per pound Od. $15 per poundarrow_forwardDiversity Ltd. produces and sells a product called Star. The company is currently selling 9,560 units of the product which represent £143,400. Total fixed costs equal £66,920 and total contribution equals £66,920. Required: Considering this information, is Diversity Ltd. selling a profitable amount of its product Star and which would be your advice for the company? Which is the price per unit at which Diversity Ltd. is selling its product? Explain your answer in detail. Consider that, after an increase in the market demand of product Star, Diversity Ltd. sells 25% more units of product Star. In this new situation, is Diversity Ltd. selling a profitable amount of its product Star? Explain your answer in detail. Draw a graph related to your previous answers in a) and b). Consider the information from the graph, which would be the financial situation of Diversity Ltd. if sales decrease in more than 25%?arrow_forwardNeed Helparrow_forward

- A product is priced to sell for $12 with average variable costs of $8. The company expects to ear a profit of $400,000 with its total fixed costs of $120,000. Calculate the minimum number of units that must be sold in order to reach this target return.arrow_forwardHelp me pleasearrow_forwardNEED ANSWERarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education