Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

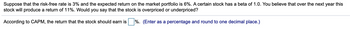

Transcribed Image Text:Suppose that the risk-free rate is 3% and the expected return on the market portfolio is 6%. A certain stock has a beta of 1.0. You believe that over the next year this

stock will produce a return of 11%. Would you say that the stock is overpriced or underpriced?

According to CAPM, the return that the stock should earn is

%. (Enter as a percentage and round to one decimal place.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Which of the following is TRUE? O An American call option on a stock should never be exercised early O An American call option on a stock should be exercised early when dividends are expected O It can sometimes be optimal to exercise early an American call option on a stock even when no dividends are expected and there is no liquidity or portfolio rebalancing need. O An American call option on a stock should never be exercised early when no dividends are expected << Previous Next ▸arrow_forwardStock R has a beta of 1.5, Stock S has a beta of 0.85, the required return on an average stock is 13%, and the risk-free rate of return is 5%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places.arrow_forwardWhat is the process of consideration of the payback period?arrow_forward

- You are analyzing a stock that has a beta of 1.19. The risk-free rate is 4.4% and you estimate the market risk premium to be 6.6%. If you expect the stock to have a return of 9.8% over the next year, should you buy it? Why or why not? The expected return according to the CAPM is%. (Round to two decimal places.) Should you buy the stock? (Select the best choice below.) O A. Yes, because the expected return based on the beta is equal to or less than the return on the stock. O B. No, because the expected return based on the beta is greater than the return on the stock.arrow_forwardneed helparrow_forwardStock R has a beta of 2.5, Stock S has a beta of 0.65, the required return on an average stock is 14%, and the risk-free rate of return is 6%. By how much does the required return on the riskier stock exceed the required return on the less risky stock? Round your answer to two decimal places. %arrow_forward

- A stock has an expected return of 15.2 percent, the risk-free rate is 3.4 percent, and the market risk premium is 9.3 percent. What must the beta of this stock be? (Do not round intermediate calculations. Round your answer to 2 decimal places.)arrow_forwardSuppose you inherit $100,000 at age 25 and immediately invested in a growth fund who’s annual rate of return average is 13%. Five years later, you transfer all proceeds from the scrubs fun into a long-term IRA that pays an average annual rate of 8%. Immediately you start making additional contributions of $7000 per year to the same IRA. Assuming continuous interest, steady interest rates, and a perfect record of making annualcontributions, how much is this IRA worth when you reach the age of 65? The formula that will need to be used is A = P e^r*t + D/r (e^r*t - 1). Hint: use the continuous interest formula to find the accumulated amount for the first five years, which is then the annual investment, P, into the IRA. arrow_forwardIf the interest rate on T Bills is 2% and the market risk premium is 6%, what is the CAPM-implied expected return on a stock with a beta of 1.25? Enter your answer as a percentage rounded to 2 decimal places.arrow_forward

- What would the effect of the failure in the ratio measurement?arrow_forwardSuppose the risk-free return is 4.5% and the market portfolio has an expected return of 10.3% and a standard deviation of 16%. Johnson & Johnson Corporation stock has a beta of 0.77. What is its expected return? The expected return is %. (Round to two decimal places.)arrow_forwardInvestors expect the market rate of return this year to be 17.00%. The expected rate of return on a stock with a beta of 0.9 is currently 15.30%. If the market return this year turns out to be 15.00%, how would you revise your expectation of the rate of return on the stock? (Do not round intermediate calculations. Round your answer to 1 decimal place.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education