Managerial Accounting: The Cornerstone of Business Decision-Making

7th Edition

ISBN: 9781337115773

Author: Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

Please answer me this

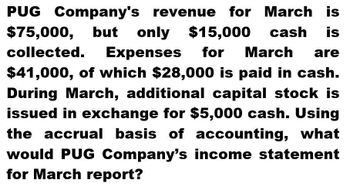

Transcribed Image Text:PUG Company's revenue for March is

$75,000, but

but only $15,000 cash is

collected. Expenses for March are

$41,000, of which $28,000 is paid in cash.

During March, additional capital stock is

issued in exchange for $5,000 cash. Using

the accrual basis of accounting, what

would PUG Company's income statement

for March report?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- Juroe Company provided the following income statement for last year: Juroes balance sheet as of December 31 last year showed total liabilities of 10,250,000, total equity of 6,150,000, and total assets of 16,400,000. Refer to the information for Juroe Company on the previous page. Also, assume that Juroes total assets at the beginning of last year equaled 17,350,000 and that the tax rate applicable to Juroe is 40%. Required: Note: Round answers to two decimal places. 1. Calculate the average total assets. 2. Calculate the return on assets.arrow_forwardGoldfinger Corporation had account balances at the end of the currentyear as follows: sales revenue, $29,000; cost of goods sold, $12,000;operating expenses, $6,200; and income tax expense, $4,320. Assumeshareholders owned 4,000 shares of Gold finger's common stock duringthe year. Prepare Goldfinger's income statement for the current year.arrow_forwardHancock Company reported the following account balancesat December 31, 2027:Sales revenue $97,000Dividends. $11,000Supplies 13,000Accounts payable 41,000Patent $59,000Building Common stock.. $27,000Insurance expense .... $31,000Notes payable .. $39,000Income tax expense $42,000Cash . . $19,000Repair expense ?Copyright $20,000Equipment $14,000Utilities payable. $22,000Inventory $64,000Retained earnings. .. $87,000 (at Jan. 1, 2027)Interest revenue $55,000Cost of goods sold ..... .. $37,000Accumulated depreciation .... $23,000 $34,000Accounts receivable ? Trademark. ... $51,000Calculate the total intangible assets reported in HancockCompany's December 31, 2027 balance sheet. The following additional information is available:1) The note payable listed above was a 4- year bank loan taken out on September 1, 2024.2) The total P - P - E at Dec. 31, 2027 was equal to 75% of the total current liabilities at Dec. 31, 2027. ՄԴ Sarrow_forward

- Selected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $51,900; total assets, $249,400; common stock, $81,000; and retained earnings, $36,386.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Operating expenses Interest expense Income before taxes Income tax expense Net income CABOT CORPORATION Income Statement For Current Year Ended December 31 Sales $ 448,600 297,950 Cost of goods sold Gross profit (1) Req 1 and 2 Req 3 Req 4 Req 5 (2) $ 18,000 8,400 150,650 98,700 4,200 47,750 19,236 $ 28,514 Complete this question by entering your answers in the tabs below. Compute the current ratio and acid-test ratio. Numerator: 30,400 34,150 2,750 150,300 $ 244,000 Total liabilities and equity Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales…arrow_forwards The 2021 income statement of Adrian Express reports sales of $22,110,000, cost of goods sold of $12,950,000, and net income of $2,260,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity Gross profit ratio Return on assets ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Profit margin Asset turnover Return on equity Profitability Ratios Industry averages for the following profitability ratios are as follows: Gross profit ratio Mes % $ 45% 25% 15% 15.5 times. 35% 2021 2020 980,000 1,950,000 2,490,000 5,180,000 4,480,000 $10,600,000 $8,640,000 $1,000,000 1,310,000 1,850,000 Required: 1. Calculate the five profitability ratios listed above for Adrian Express. (Round your answers to 1 decimal place.) $ 2,228,000 $1,928,000…arrow_forwardThe income statement for Sunland, Inc. is as follows:arrow_forward

- The 2021 income statement of Adrian Express reports sales of $18,957,000, cost of goods sold of $11,971,500, and net income of $1,690,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets. Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities Common stock Retained earnings Total liabilities and stockholders' equity ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days. 2 to 1 50% 2021 $ 690,000 1,580,000 1,980,000 4,890,000 $9, 140,000 365.0 days days to 1 % 2020 $ 850,000 1,090,000 1,490,000 4,330,000 $7,760,000 Required: 1. Calculate the four risk ratios listed above for Adrian Express in…arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were Inventory, $49,900; total assets, $259,400; common stock, $87,000; and retained earnings, $28,750.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Sales CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity $ 12,000 Accounts payable $ 17,500 8,400 Accrued wages payable 4,800 31,200 Income taxes payable 3,300 36,150 3,050 148,300 Long-term note payable, secured by mortgage on plant assets 68,400 Common stock 87,000 Retained earnings 58,100 $ 239,100 Total liabilities and equity $ 239,100 CABOT CORPORATION Income Statement For Current Year Ended December 31 $ 451,600 Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income 298,250 153,350 99,400…arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $51,900; total assets, $249,400; common stock, $81,000; and retained earnings, $36,386.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement. For Current Year Ended December 31 Sales $ 448,600 297,950 150, 650 98,700 4,200 47,750 19,236 $ 28,514 Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income Req 1 and 2 Req 3 Required: Compute the following: (1) current ratio, (2) acid-test ratio, (3) days' sales uncollected, (4) inventory turnover, (5) days' sales in inventory, (6) debt-to-equity ratio, (7) times interest earned, (8) profit margin ratio, (9) total asset turnover, (10) return on total assets, and (11) return on equity. Note:…arrow_forward

- The 2021 income statement of Adrian Express reports sales of $15,642,000, cost of goods sold of $9,351,500, and net income of $1,590,000. Balance sheet information is provided in the following table. Assets Current assets: Cash Accounts receivable Inventory Long-term assets Total assets Liabilities and Stockholders' Equity Current liabilities Long-term liabilities. ADRIAN EXPRESS Balance Sheets December 31, 2021 and 2020 Common stock Retained earnings Total liabilities and stockholders' equity Average collection period Average days in inventory Current ratio Debt to equity ratio Industry averages for the following four risk ratios are as follows: Risk Ratios Average collection period Average days in inventory Current ratio Debt to equity ratio 25 days 60 days 2 to 1 50% days days 2021 Required: 1. Calculate the four risk ratios listed above for Adrian Express in 2021. (Use 365 days in a year. Round your answers to 1 decimal place.) to 1 % 2020 $ 590,000 1,380,000 $750,000 990,000…arrow_forwardThe balance sheet and income statement for J. P. RObard Manufatcuring Company are as follows: Item Cash J.P. Robard Manufacturing Company Balance Sheet as at 31 December 2021 ($ in thousands) 500 Account receivable Inventory Total current assets Net fixed assets Total assets Accounts payable Accrued expenses Short-term notes payable Total curernt liabilities Long-term debt Total common equity Total liabilities and equity 2,000 1,000 3,500 4,500 8,000 1,100 600 300 2,000 2,000 4.000 8,000arrow_forwardSelected current year-end financial statements of Cabot Corporation follow. (All sales were on credit; selected balance sheet amounts at December 31 of the prior year were inventory, $51,900; total assets, $169,400; common stock, $85,000; and retained earnings, $45,550.) Assets Cash Short-term investments Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets CABOT CORPORATION Income Statement CABOT CORPORATION Balance Sheet December 31 of current year Liabilities and Equity $ 22,000 Accounts payable 8,800 Accrued wages payable 33,400 Income taxes payable 34,150 Long-term note payable, secured by mortgage on plant assets 2,850 152,300 Common stock Retained earnings $ 253,500 Total liabilities and equity For Current Year Ended December 31 Sales Cost of goods sold Gross profit Operating expenses Interest expense Income before taxes Income tax expense Net income $ 450,600 298,050 152,550 98,900 4,500 49,150 19,800 $ 29,350 $ 15,500 4,000 3,700…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,