Principles of Accounting Volume 2

19th Edition

ISBN: 9781947172609

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Question

I want the correct answer with accounting

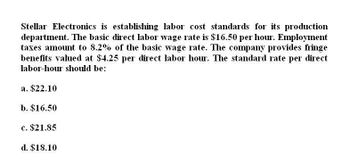

Transcribed Image Text:Stellar Electronics is establishing labor cost standards for its production

department. The basic direct labor wage rate is $16.50 per hour. Employment

taxes amount to 8.2% of the basic wage rate. The company provides fringe

benefits valued at $4.25 per direct labor hour. The standard rate per direct

labor-hour should be:

a. $22.10

b. $16.50

c. $21.85

d. $18.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- The following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forwardsubject: general accountingarrow_forwardDaughdrill Corporation is developing direct labor standards. The basic direct labor wage rate is $10.95 per hour. Employment taxes are 9% of the basic wage rate. Fringe benefits are $4.00 per direct labor hour. The standard rate per direct labor-hour should be: a. $5.96 b. $4.99 c. $10.95 d. $15.94arrow_forward

- Solve thisarrow_forwardAaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $770,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 17,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) A. $29.41 per labor hour B. $1.54 per labor hour C. $154.00 per machine hour D. $100.00 per machine hourarrow_forwardAaron, Inc. estimates direct labor costs and manufacturing overhead costs for the coming year to be $760,000 and $500,000, respectively. Aaron allocates overhead costs based on machine hours. The estimated total labor hours and machine hours for the coming year are 16,000 hours and 5,000 hours, respectively. What is the predetermined overhead allocation rate? (Round your answer to the nearest cent.) OA. $1.52 per labor hour OB. $100.00 per machine hour OC. $152.00 per machine hour O D. $31.25 per labor hourarrow_forward

- Compute the standard direct labor rate per hourarrow_forwardCavy Company estimates that total factory overhead costs will be $1,039,500 for the year. Direct labor hours are estimated to be 110,000.arrow_forwardLabor data for making one gallon of the finished product in Nien Company are as follows: 1. Price-hourly wage rate $13.80, payroll taxes $0.80, and fringe benefits $1.50. 2. Quantity-actual production time 1.1 hours, rest periods and clean up 0.30 hours, and set up and downtime 0.40 hours. Compute the following. a. Standard direct labor rate per hour. b. Standard direct labor hours per gallon. Standard labor cost per gallon.arrow_forward

- Michael & Company expects overhead costs of $25,000 per month and direct production costs of $22 per unit. The estimated production activity for the current accounting period is as follows: Units produced The predetermined overhead rate based on units produced is: Note: Round your answer to the nearest penny Multiple Choice $0.50 per unit. $2.00 per unit. $28.00 per unit. 1st Quarter 2nd Quarter 3rd Quarter 4th Quarter 12,500 8,900 19,850 8,750 $6.00 per unit.arrow_forwardWhat is its standard manufacturing overhead rate per unit?arrow_forwardA company is setting its direct materials and direct labor standards for its leading product. Direct material costs from the supplier are $8.00 per square foot, net of purchase discount. Freight−in amounts to $0.10 per square foot. Basic wages of the assembly line personnel are $12.00 per hour. Payroll taxes are approximately 24% of wages. How much is the direct labor cost standard per hour? (Round your answer to the nearest cent.) A. $14.88 B. $2.88 C. $12.00 D. $22.88arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College