ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

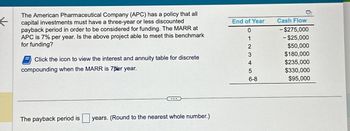

Transcribed Image Text:The American Pharmaceutical Company (APC) has a policy that all

capital investments must have a three-year or less discounted

payback period in order to be considered for funding. The MARR at

APC is 7% per year. Is the above project able to meet this benchmark

for funding?

Click the icon to view the interest and annuity table for discrete

compounding when the MARR is 70er year.

The payback period is years. (Round to the nearest whole number.)

End of Year

1

2

3

4

5

6-8

Cash Flow

- $275,000

- $25,000

$50,000

$180,000

$235,000

$330,000

$95,000

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Need correct answer.absuletly upvote !!arrow_forwardFelix Jones, a recent engineering graduate, expects a starting salary of $35,000 per year. His future employer has averaged 5% per year in salary increases for the last several years. What is the PW and equivalent annuity for Felix’s salary over the next 5 years? Felix uses an interest rate of 6%. Please show the full solutions , given values and formula used. Make sure that the answer is PW = $162,009.arrow_forwardanswer as soon as possiblearrow_forward

- Jane has $240,000 to invest and is considering the following two investment opportunities.Investment A requires an initial investment of $240,000 and promises to return $57,040 every year for 5 years.Investment B requires an initial investment of $216,000 and is expected to return $51,200 every year for 5years. If Jane’s MARR is 5% per year compounded annually, which investment should she choose, if any?arrow_forwardA Philippine Society of Civil Engineers is planning to put up its own building, and two proposals (5-year project) are being considered. The money is worth 20% compounded monthly. PROPOSAL A. The construction of the building to cost P246,933.00 at the end of 4 years and P162,751.00 for the next year. PROPOSAL B. The construction of the building now, to cost P55,016.00, P184,773.00 at the end of 4 years and an extension to be added a year after, to cost P92,348.00. Determine the following: 1. Equivalent present cost of Proposal A. 2. Equivalent present cost of Proposal B.arrow_forwardYou have received the proposal to invest $1,000,000 in exchange for receiving income of $75,000 at the end of the first month that would decrease 0.3% each month starting from the 2nd month. Expenses are estimated at $25,000 at each end of the month, starting from the 1st month. Assume that the proposal will last 5 years and that the minimum acceptable rate of return (m) is 1.5% per month. What does the Present Value criterion recommend? Show your work. If flow patterns are found (uniform, arithmetic, exponential), use factors.arrow_forward

- Caduceus Company is considering the purchase of a new piece of factory equipment that will cost $565,000 and will generate $135,000 per year for 5 years. Calculate the IRR for this piece of equipment. For further instructions on internal rate of return In Excel, see Appendix C.arrow_forwardProblem #2 Solve for the following: 1) Present worth equivalence 2) Annual worth equivalence spread from years 1 to 10 3) Future worth equivalence at the end of year 8 4) Future worth equivalence at the end of year 10 i= 10% 10 A = $3000 P=?arrow_forwardAn industrial firefighting truck costs $100,000. Savings in insurance premiums and uninsured losses from the acquisition and operation of this equipment is estimated at $60,000/yr. Salvage value of the apparatus after 5 yrs. is expected to be $20,000. A full-time driver during operating hours will accrue an added cost of $10,000/yr. What would the rate of return be on this investment? @ 40% present worth @ 50% present wortharrow_forward

- An engineer planning for her retirement will deposit 10% of her salary each year into a stock found. The initial balance in her stock found (year 0) is $20,000. If her salary this year is $120,000 (end of year 1) and she expects her salary to increase by 5% each year, what will be the future worth of the found after 25 years if it earns 15% per year? $4,202,290.77 $5,480,462.35 O $5,315,867.58 O $4,138,818.64 O $3,543,911.72arrow_forwardThe city of Oak Ridge is considering the construction of a three kilometer (km) greenway walking trail. It will cost $1,000 per km to build the trail and $320 per km per year to maintain it over its 23-year life. If the city's MARR is 10% per year, what is the equivalent uniform annual cost of this project? Assume the trail has no residual value at the end of 23 years.arrow_forwardANSWER: ERR (i %) = 23.71%arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education