ENGR.ECONOMIC ANALYSIS

14th Edition

ISBN: 9780190931919

Author: NEWNAN

Publisher: Oxford University Press

expand_more

expand_more

format_list_bulleted

Question

thumb_up100%

Transcribed Image Text:Sure! Here is the transcribed text that can be used for an educational website:

---

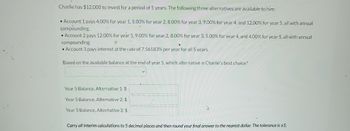

### Investment Options Analysis for Charlie

Charlie has $12,000 to invest for a period of 5 years. The following three alternatives are available to him:

1. **Account 1** pays 4.00% for year 1, 5.00% for year 2, 8.00% for year 3, 9.00% for year 4, and 12.00% for year 5, all with annual compounding.

2. **Account 2** pays 12.00% for year 1, 9.00% for year 2, 8.00% for year 3, 5.00% for year 4, and 4.00% for year 5, all with annual compounding.

3. **Account 3** pays interest at the rate of 7.56183% per year for all 5 years.

**Based on the available balance at the end of year 5, which alternative is Charlie's best choice?**

- **Year 5 Balance, Alternative 1:** $____________

- **Year 5 Balance, Alternative 2:** $____________

- **Year 5 Balance, Alternative 3:** $____________

Carry all interim calculations to 5 decimal places and then round your final answer to the nearest dollar. The tolerance is ±5.

---

This detailed breakdown allows for an educational exploration of the compound interest principles and enables learners to evaluate the best investment option based on future expected balances. The problem requires applying compound interest formulas and comparing the results of three different investment strategy alternatives.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 5 steps with 14 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- During the past eight years, the demand for Titleist Pro V1 golf balls has increased from 400 units per day to 560 units per day at a local pro shop. What was the average annual compound growth rate over this period? Assume continuous compounding and show your work.arrow_forwardSuppose that a father, on the day his son is born, wishes to determine what lump amount would have to be paid into an account bearing interest of 17% per year to provide withdrawals of $4,000 on each of the son's 9th, 10th, 11th, and 12th birthdays. How much money does the father have to deposit on the day his son is born ? Please, represent the cash-flow diagram.arrow_forwardThree years ago, Keith paid $150,000 for his 3 bedroom home. If the property has appreciated at 5% compounded each year, what is the property value today? $172,500 $175,464 $179,300 $173,644arrow_forward

- How long does it take an investment to quadruple at 5% with m = 7 compoundings per year? years.arrow_forwardWhat is the initial amount of money needed to end up with $12125 in five years if it is invested at 18% annually but compounded monthly? What is the effective annual interest rate?arrow_forwardGive typing answer with explanation and conclusionarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON

Principles of Economics (12th Edition)EconomicsISBN:9780134078779Author:Karl E. Case, Ray C. Fair, Sharon E. OsterPublisher:PEARSON Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON

Engineering Economy (17th Edition)EconomicsISBN:9780134870069Author:William G. Sullivan, Elin M. Wicks, C. Patrick KoellingPublisher:PEARSON Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning

Principles of Economics (MindTap Course List)EconomicsISBN:9781305585126Author:N. Gregory MankiwPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Managerial Economics & Business Strategy (Mcgraw-...EconomicsISBN:9781259290619Author:Michael Baye, Jeff PrincePublisher:McGraw-Hill Education

Principles of Economics (12th Edition)

Economics

ISBN:9780134078779

Author:Karl E. Case, Ray C. Fair, Sharon E. Oster

Publisher:PEARSON

Engineering Economy (17th Edition)

Economics

ISBN:9780134870069

Author:William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher:PEARSON

Principles of Economics (MindTap Course List)

Economics

ISBN:9781305585126

Author:N. Gregory Mankiw

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Managerial Economics & Business Strategy (Mcgraw-...

Economics

ISBN:9781259290619

Author:Michael Baye, Jeff Prince

Publisher:McGraw-Hill Education