FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

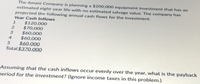

Transcribed Image Text:The Amani Company is planning a $200,000 equipment investment that has an

estimated eight-year life with no estimated salvage value. The company has

projected the following annual cash flows for the investment.

Year Cash Inflows

$120,000

$70,000

$60,000

$60,000

$60,000

Total $370,000

1

4.

Assuming that the cash inflows occur evenly over the year, what is the payback

period for the investment? (Ignore income taxes in this problem.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- A Company is considering an investment proposal, involving an initial cash outlay of TZS 450,000. The proposal has an expected life of 7 years and zero salvage value. At a required rate of return of 12 percent, the proposal has a profitability index of 1.182. Required: Calculate annual cash inflows.arrow_forwardA construction management company is examining its cash flow requirements for the next few years. The company expects to replace software and in-field computing equipment at various times. Specifically, the company expects to spend $5,000 1 year from now, $11,000 3 years from now, and $17,000 each year in years 6 through 10. What is the future worth in year 10 of the planned expenditures, at an interest rate of 13.00% per year? (Round the final answer to three decimal places.) The future worth is determined to be $arrow_forwardRihanna Company is considering purchasing new equipment for $440,000. It is expected that the equipment will produce net annual cash flows of $55,000 over its 10-year useful life. Annual depreciation will be $44,000. Compute the cash payback period. (Round answer to 1 decimal place, e.g. 10.5.) Cash payback period yearsarrow_forward

- You are evaluating an investment project, which has a cost of $161,000 today and is expected to provide after-tax annual cash flows of $20,000 for seven years. In order to compute the MIRR, you are modifying the cash flows. Assuming the cost of capital is 9.1 percent, what is the terminal cash flow of the modified cash flows? Question 12 options: $173,074 $176,474 $178,474 $180,974 $182,874 $184,574arrow_forward2. Marigold Corp. is considering the purchase of a piece of equipment and has complied the information…arrow_forwardIvanhoe Industries management is planning to replace some existing machinery in its plant. The cost of the new equipment and the resulting cash flows are shown in the accompanying table. The firm uses an 18 percent discount rate for projects like this. Should management go ahead with the project? Year Cash Flow 0 -$3,046,900 1 803,710 2 889,200 3 1,247,600 4 1,285,160 5 1,576,500 What is the NPV of this project? - NPV $?arrow_forward

- NOVA Company is considering a long-term investment project called STUDY. STUDY will require an investment of $125,190. It will have a useful life of 4 years and no salvage value. Annual cash inflows would increase by $79,000, and annual cash outflows would increase by $40,000. Compute the cash payback period. O 3.21 years O 1.23 years O 1.58 years O 4 yearsarrow_forwardElmdale Enterprises is deciding whether to expand its production facilities. Although long-term cash flows are difficult to estimate, management has projected the following cash flows for the first two years (in millions of dollars): a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) b. What are the free cash flows for this project for years 1 and 2? a. What are the incremental earnings for this project for years 1 and 2? (Note: Assume any incremental cost of goods sold is included as part of operating expenses.) Calculate the incremental earnings of this project below: (Round to one decimal place.) Incremental Earnings Forecast (millions) Sales Operating Expenses Depreciation EBIT Income tax at 21% Unlevered Net Income Year 1 Year 2 $ $ SA $ 69 $ GA 67 69 $ $ $ 6969 $ $ SAarrow_forwardJack Sprat Inc. wants to know if they invest 11,548 in new exercise equipment, plus $2.000 for installation. how long before they will receive their initial invest back from future cash flows? What is the payback period for the initial costs? Projected Cash flows Year 1: 5,000 Year 2: 7,000 Year 3: 4,000 Year 4: 1,000 Post your answer as number of years with 2 decimal places, for example 5.55arrow_forward

- Beyer Company is considering buying an asset for $350,000. It is expected to produce the following net cash flows. Compute the payback period for this investment. (Cumulative net cash outflows must be entered with a minus sign. Round your Payback Period answer to 2 decimal places.)arrow_forwardA project requires an initial investment in equipment and machinery of $10 million. The equipment is expected to have a 5-year lifetime with no salvage value and will be depreciated on a straight-line basis. The project is expected to generate revenues of $5.1 million each year for the 5 years and have operating expenses (not including depreciation) amounting to 1/3 of revenues. The tax rate is 40%. What is the net cash flow in year 1? Group of answer choices 3.40M 2.84M 0.84M 2.04Marrow_forwardR-Kraine Inc. is considering acquiring an existing project (with financial backing from the government). The project is expected to have another 8 (full) years of economic life. The project's year-end cash flows are as follows: Years 1-4: $2m each year Years 5-8: $500,000, $2m, $500,000 and $2m (respectively) Suppose the relevant discount rate for the project could be estimated from the following cash flows of an 8-year (fixed) coupon bond issued by R-Kraine a couple of months ago: Current market price (per unit): $584,608.5676 Face value (per unit): $800,000 Yearly coupon payments: $72,000 Calculate the YTM of the bond. [Hint: State clearly the relevant numerical formula and then crunch out the answer using Excel program or financial calculator. The answer can also be solved with a scientific calculator using a manual trial-and-error approach as the YTM was set to be an integer.] a)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education