Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

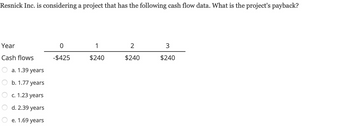

Transcribed Image Text:### Project Payback Period Calculation

**Resnick Inc.** is evaluating a new project and has the following cash flow data. The objective is to determine the project's payback period.

#### Cash Flow Data:

| Year | Cash Flow |

|------|-----------|

| 0 | -$425 |

| 1 | $240 |

| 2 | $240 |

| 3 | $240 |

#### Payback Period Options:

- a. 1.39 years

- b. 1.77 years

- c. 1.23 years

- d. 2.39 years

- e. 1.69 years

### Calculation of Payback Period

1. **Initial Investment (Year 0)**: The project starts with an initial cash outflow of $425.

2. **Cash Inflows**:

- Year 1: $240

- Year 2: $240

- Year 3: $240

To determine the payback period, we calculate how long it takes for the cumulative cash inflows to equal the initial investment:

- After Year 1: Total cash inflow = $240

- After Year 2: Total cash inflow = $240 (Year 1) + $240 (Year 2) = $480

By the end of Year 1, $240 of the initial $425 investment is recovered. This leaves $425 - $240 = $185 to be recovered. By Year 2, the $185 remaining from the initial investment is fully recovered, with some surplus.

Since $240 is received in Year 2, the fraction of the year required to recover the remaining $185 is: \( \frac{185}{240} \approx 0.77 \) years.

Thus, the payback period is: 1 year + 0.77 years = **1.77 years**.

### Conclusion

The project's payback period, according to the cash flow data, is **1.77 years**. Therefore, the correct option is **b. 1.77 years**.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Mendez Company has identified an investment project with the following cash flows. Year 1 Cash Flow $870 1,230 234 1,490 1,650 a. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 20 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 30 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) a. Present value at 10% b. Present value at 20% c. Present value at 30%arrow_forwardFuente, Incorporated, has identified an investment project with the following cash flows. Cash Flow $700 925 1,125 1,250 Year 1 2 3 4 a.lf the discount rate is 11 percent, what is the future value of these cash flows in year 4? Future value at 11% b.What is the future value at a discount rate of 18 percent? Future value at 18%arrow_forwardConsider the following two projects: Project Year 0 Year 1 Year 2 Year 3 Year 4 Discount Cash Flow Cash Flow Cash Flow Cash Flow Cash Flow Rate A B -100 -73 40 30 50 50 N/A 0.11 30 30 30 0.11 The payback period for project A is closest to A. 2.4 years B. 2.2 years ○ C. 2 years OD. 2.6 yearsarrow_forward

- Stern Associates is considering a project that has the following cash flow data. What is the project's payback? Year 0 1 2 3 4 5 Cash flows -$950 $380 $390 $400 $410 $420 a. 3.45 years b. 1.55 years c. 2.45 years d. 2.55 years e. 1.23 yearsarrow_forwardResnick Inc. is considering a project that has the following cash flow data. What is the project's payback? Year Cash flows O a. 1.44 years O b. 2.08 years O c. 2.92 years O d. 1.54 years e. 2.54 years O 0 -$500 $240 2 $240 3 $240arrow_forwardMendez Company has identified an investment project with the following cash flows. Year Cash Flow 1 $770 2 1,030 3 1,290 4 1,400 a. If the discount rate is 10 percent, what is the present value of these cash flows? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) b. What is the present value at 17 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.) c. What is the present value at 25 percent? (Do not round intermediate calculations and round your answer to 2 decimal places, e.g., 32.16.)arrow_forward

- I need full details solution with explination.arrow_forwardMasulis Inc. is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: Year 0 Cash flows -$1,225 a. 3.37 years b. 3.63 years c. 1.12 years d. 2.63 years e. 2.37 years 8.75% 1 $575 2 $535 3 $495 4 $455arrow_forwardGuerilla Radio Broadcasting has a project available with the following cash flows: Year Cash Flow 0 1 71 2 3 4 -$ 16,500 6,800 8,100 3,700 3,300 What is the payback period?arrow_forward

- Fernando Designs is considering a project that has the following cash flow and WACC data. What is the project's discounted payback? WACC: 10.75% Year 0 1 2 3 Cash flows - $800 $510 $510 $510 a. 2.18 years b. 1.10 years c. 2.82 years d. 1.82 years e. 1.18 yearsarrow_forwardConsider the following two mutually exclusive projects: Year Cash Flow (A) Cash Flow (B) 0 -$ 243,567 -$ 15,530 1 27,200 55,000 60,000 413,000 234 5,173 8,261 13,237 8,729 Whichever project you choose, if any, you require a 6 percent return on your investment. a. What is the payback period for Project A? Payback periodarrow_forwardThere is a project with the following cash flows : Year 0 1 2 1345 Cash Flow -$ 23,350 6,300 7,400 8,450 7,350 5,900 What is the payback period?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education