FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

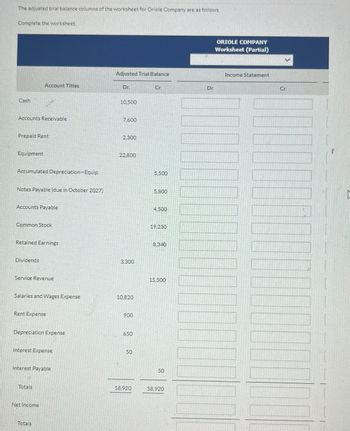

Transcribed Image Text:The adjusted trial balance columns of the worksheet for Oriole Company are as follows.

Complete the worksheet.

Cash

Accounts Receivable

Equipment

Prepaid Rent

Account Titles

Accumulated Depreciation-Equip.

11

Notes Payable (due in October 2027)

Accounts Payable

Common Stock

Dividends

Retained Earnings

Service Revenue

Salaries and Wages Expense

Rent Expense

Depreciation Expense

Interest Expense

Totals

Interest Payable

Net Income

Totals

Adjusted Trial Balance

10,500

7,600

2,300

22,800

3,300

10,820

900

650

50

58,920

Cr.

5,500

5,800

4.500

19.230

15,500

50

58,920

Dr.

ORIOLE COMPANY

Worksheet (Partial)

Income Statement

960.

Cr.

DL

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Part 2 asks to record the adjustment for uncollectable accountsarrow_forwardListed below, in alphabetical order, are the account balances (after adjustments) from the general ledger of KS Services Limited for the year ended December 31, 2018. All accounts have normal balances. Accounts payable Accounts receivable Accumulated depreciation-equipment Bank loan payable $ 4,660 9,600 5,200 1,000 1,100 Cash Common shares 5,000 Depreciation expense Dividends declared Equipment Income tax expense Interest expense Other expenses Rent expense Retained earnings Salaries expense Salaries payable Service revenue 2,600 1,000 20,800 3,500 50 1,675 16,800 3,700 30,700 710 67,200 Supplies Supplies expense Unearned revenue 180 475 1,010 (a) Prepare an adjusted trial balance. (c) Calculate net income for the year. (d) Calculate total assets, liabilities, and shareholders' equity at December 31. (e) Present your answer in part (d) in the form of the basic accounting equation.arrow_forwardThe account balances for Premera Blue Cross are listed below. All balances are as of December 31, 2023, except where noted otherwise. $16,500 Rent Expense $18,000 247,500 28,800 Equipment 7,800 Furniture 66,000 3,600 Notes Payable (due 12/31/25) 105,000 6,000 Accumulated Depreciation 31,350 329,250 Cash 78,000 60,000 150,000 42,450 1,200 31,350 12,600 Accounts Payable Accounts Receivable Wages Payable Prepaid Expenses Dividends Sales Revenue Notes Payable (due 4/30/24) Cost of Goods Sold Loss on Sale of Equipment Inventory Advertising Expense Insurance Expense Select one: Determine Total Current Liabilities as of December 31, 2023: a. $27,300 b. $39,900 3,000 Common Stock c. $144,900 d. $132,300 e. $247,350 158,400 Goodwill 10,500 Retained Earnings (1/1/23) 28,500 Marketable Equity Securities 9,000 Depreciation Expense 6,000 Unearned Revenuearrow_forward

- The following income statement pertains to Bins Limited as of 12/31/2019: Revenue Operating Expenses: Wages Expense Depreciation Expense Other Expenses: Interest Expense Net Income 590,000 Account (120,000) (50,000) (15,000) 405,000 Based on this income statement, what closing entries should Bins Limited record as of 12/31/2019 Debit Creditarrow_forwardRequired:1. Prepare the following statements of the company from the data given above: Income Statement for the year ending at December 31, 2020 Retained Earnings Statement for the year ending at December 31, 2020 Balance Sheet as at December 31, 2020arrow_forwardUse the following Adjusted Trial Balance. Adjusted Trial Balance Debit Credit Cash $16,500 Accounts Receivable 18,200 Supplies 2,000 Prepaid Insurance 2,300 Equipment 14,000 Accounts Payable $14,200 Unearned Fee Revenue 4,300 Common Stock 31,000 Service Fee Revenue 21,500 Salaries Expense 12,000 Rent Expense 6,000 $71,000 $71,000 Prepare a classified Balance Sheet. Balance Sheet December 31, 2019 Assets Current Assets: Total Current Assets Property, Plant, and Equipment: Total Assets Liabilities Current Liabilities: Total Current Liabilities Stockholders' Equity $ Total Stockholders' Equity Total Liabilities and Stockholders' Equityarrow_forward

- Prepare the Statement of Comprehensive Income of Royal Traders for the year ended 28 February 2021. INFORMATION The trial balance, adjustments and additional information given below were extracted from the accounting recore of Royal Traders on 28 February 2021, the end of the financial year. ROYAL TRADERS PRE-ADJUSTMENT TRIAL BALANCE AS AT 28 FEBRUARY 2021 Debit (R) Credit (R) Balance sheet accounts section Capital 301 000 Drawings 134 720 Vehicles at cost 360 000 Equipment at cost 240 000 Accumulated depreciation on vehicles 186 000 Accumulated depreciation on equipment 62 000 Trading inventory 140 000 Debtors control 62 000 Provision for bad debts 8 000 Bank 42 800 Cash float 1 000 Creditors control 82 800 Mortgage loan: Leo Bank (18% p.a.) 160 000 Nominal accounts section Sales 1 000 000 Cost of sales 480 000 Sales returns 8 000 Salaries and wages 178 000 Bad debts 2 000 Stationery 4 000arrow_forwardThe following is a list of alphabetically arranged accounts and balances, in highly simplified form, of VILLEGAS Company for the month of July 2018. Accounts Payable P 8,000Accounts Receivable 14,000Accumulated Depreciation 2,000Cash 8,000Equipment 16,000Prepaid Insurance 4,000VILLEGAS, Capital 24,000VILLEGAS, Drawings 12,000Rent Income 46,000Supplies 8,000Unearned Rent 6,000Utility Expense 4,000Wages Expense 20,000 Required:1. Prepare a 10-column work sheet.2. Data for adjustment:a. Expired…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education