FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

thumb_up100%

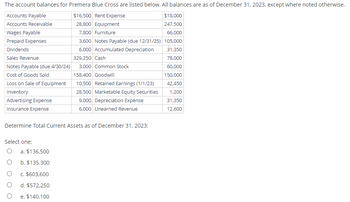

Transcribed Image Text:The account balances for Premera Blue Cross are listed below. All balances are as of December 31, 2023, except where noted otherwise.

$16,500 Rent Expense

28,800 Equipment

7,800 Furniture

3,600 Notes Payable (due 12/31/25)

6,000 Accumulated Depreciation

Accounts Payable

Accounts Receivable

Wages Payable

Prepaid Expenses

Dividends

Sales Revenue

Notes Payable (due 4/30/24)

Cost of Goods Sold

Loss on Sale of Equipment

Inventory

Advertising Expense

Insurance Expense

Select one:

O

329,250 Cash

a. $136,500

b. $135,300

c. $603,600

d. $572,250

e. $140,100

3,000 Common Stock

158,400 Goodwill

10,500 Retained Earnings (1/1/23)

28,500 Marketable Equity Securities

Determine Total Current Assets as of December 31, 2023:

9,000 Depreciation Expense

6,000 Unearned Revenue

$18,000

247,500

66,000

105,000

31,350

78,000

60,000

150,000

42,450

1,200

31,350

12,600

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Determine Total Current Liabilities as of December 31, 2023:

Select one:

a. $27,300

b. $39,900

c. $144,900

d. $132,300

e. $247,350

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

Determine Total Current Liabilities as of December 31, 2023:

Select one:

a. $27,300

b. $39,900

c. $144,900

d. $132,300

e. $247,350

Solution

by Bartleby Expert

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- At December 31, 2021, Skysong, Inc. reported this information on its balance sheet. Accounts receivable Less: Allowance for doubtful accounts During 2022, the company had the following transactions related to receivables. 1. 2. 3. 4. 5. (a) (b) (c) (d) Sales on account Sales returns and allowances $620,000 42,000 Collections of accounts receivable Write-offs of accounts receivable deemed uncollectible Recovery of accounts previously written off as uncollectible Accounts receivable turnover Compute the accounts receivable turnover and average collection period, assuming the expected uncollectibles information provided in (c). (Round answers to 1 decimal place, e.g. 25.2. Use 365 days for calculation.) Average collection period $2,810,000 63,000 2,510,000 44,000 15,000 times daysarrow_forwardAt January 1, 2024, Tarjee Inc. reported the following information on its statement of financial position: Accounts receivable $530,000 40,000 Allowance for expected credit losses ,40,000 During 2024, the company had the following summary transactions for receivables: Sales on account, $1,930,000; cost of goods sold, $1,061,500; return rate, 5% Selling price of goods returned, $76,000; cost of goods returned to inventory, $41,800 Collections of accounts receivable, $1,700,000 Write-offs of accounts receivable deemed uncollectible, $53,000 Collection of accounts previously written off as uncollectible, $12,000 After considering all of the above transactions, total estimated uncollectible accounts, $32,000 Prepare the journal entries to record each of the above summary transactions. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account…arrow_forwardGive me correct answer with explanation.vkarrow_forward

- The current assets and current liabilities sections of the balance sheet of Sunland Co. appear as follows. Sunland Co.Balance Sheet (Partial)As of December 31, 2017 Cash $ 17,900 Accounts payable $ 29,500 Accounts receivable $ 39,600 Notes payable 15,400 Less: Allowance for doubtful accounts 3,200 36,400 Unearned revenue 3,800 Inventory 61,100 Total current liabilities $ 48,700 Prepaid expenses 7,400 Total current assets $ 122,800 The following errors in the corporation’s accounting have been discovered: 1. Keane collected $ 5,200 on December 20, 2017 as a down payment for services to be performed in January, 2018. The company’s controller recorded the amount as revenue. 2. The inventory amount reported included $ 2,300 of merchandise that had been received on December 31, 2017 but for which no purchase invoices had been received or entered. Of this amount, $ 1,600 had been received on…arrow_forwardOn January 1, 2021, the general ledger of ACME Fireworks includes the following account balances:Accounts Debit CreditCash $ 25,100Accounts Receivable 46,200Allowance for Uncollectible Accounts $ 4,200Inventory 20,000Land 46,000Equipment 15,000Accumulated Depreciation 1,500Accounts Payable 28,500Notes Payable (6%, due April 1, 2022) 50,000Common Stock 35,000Retained Earnings…arrow_forwardSkysong Corporation had the following 2025 Income statement. Revenues $103,000 Expenses Net income In 2025, Skysong had the following activity in selected accounts. Accounts Receivable 21,000 Revenues 103,000 Write-offs Collections 1/1/25 66,000 $37,000 12/31/25 29.100 Allowance for Doubtful Accounts 1/1/25 Write-offs 900 Bad debt expense 12/31/25 (a) 900 94,000 1,300 1,700 2,100 Prepare Skysong's cash flows from operating activities section of the statement of cash flows using the din SKYSONG CORPORATION Statement of Cash Flows-Direct Method (Partial)arrow_forward

- Required: Compute the asset turnover ratio for 2021. (Re Asset turnover ratioarrow_forwardOn January 1, 2021, the general ledger of Big Blast Fireworks includes the following account balances: Debit $ 23, 300 40, e0e Accounts Credit Cash Accounts Receivable Allowance for Uncollectible Accounts $ 4, 5e0 Inventory Land Accounts Payable Notes Payable (6%, due in 3 ycars) 37,e00 72,100 28,98e 37, eee 63, 0ee Common Stock Retained Earnings 39. eee Totals $172,488 $172,488 The $37,000 beginning balance of inventory consists of 370 units, each costing $100. During Janusry 2021, Big Blast Fireworks had the following inventory transections: January 3 Purchase 1,680 units for $168,888 on account ($18s cach). January 8 Purchase 1,78e units for $187,800 on account ($110 cach). January 12 Purchase 1,88e units for $207, Bee on account ($115 cach). January 15 Return 135 of the units purchased on January 12 because of defects. January 19 Sell 5,200 units on account for $780,8ee. The cost of the units sold is deternined using a FIFD perpetual inventory systen. January 22 Receive $753,eee…arrow_forwardBelow are amounts (in millions) from three companies' annual reports. Beginning Accounts Ending Accounts Receivable $2,722 6,494 625 WalCo TarMart CostGet Receivable $1,775 5,966 589 Net Sales $318,427 63,878 64,963 Required: 1. Calculate the receivables turnover ratio and the average collection period for WalCo, TarMart and CostGet. 2. Which company appears most efficient in collecting cash from sales?arrow_forward

- .arrow_forwardGive Answer with Explanationarrow_forwardAt January 1, 2024, Kennel Inc. reported the following information on its statement of financial position: Accounts receivable Allowance for expected credit losses During 2024, the company had the following summary transactions for receivables: 1. 2. 3. 4. 5. 6. Show Transcribed Text Sales on account, $1.670,000; cost of goods sold, $935.200; return rate of 7% Selling price of goods returned, $83.000: cost of goods returned to inventory, $46,480 Collections of accounts receivable, $1,600,000 Write-offs of accounts receivable deemed uncollectible, $47,000 Collection of accounts previously written off as uncollectible, $13,000 After considering all of the above transactions, total estimated uncollectible accounts, $29,000 (1) Bal v (4) $500,000 46,000 Your answer is partially correct. (1) Prepare T accounts for Accounts Receivable and Allowance for Expected Credit Losses, (2) enter the opening balances, (3) post the above summary entries, and (4) determine the ending balances. (Post…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education