Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

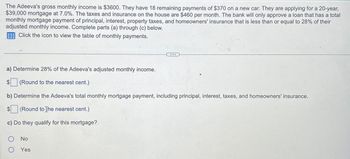

Transcribed Image Text:The Adeeva's gross monthly income is $3600. They have 18 remaining payments of $370 on a new car. They are applying for a 20-year,

$39,000 mortgage at 7.0%. The taxes and insurance on the house are $460 per month. The bank will only approve a loan that has a total

monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of their

adjusted monthly income. Complete parts (a) through (c) below.

Click the icon to view the table of monthly payments.

...

a) Determine 28% of the Adeeva's adjusted monthly income.

(Round to the nearest cent.)

b) Determine the Adeeva's total monthly mortgage payment, including principal, interest, taxes, and homeowners' insurance.

$ (Round to the nearest cent.)

c) Do they qualify for this mortgage?.

O No

O Yes

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Sam and Randy each take out a loan for $9,927. Sam's loan has an annual rate of 16.4% with semi-annual compounding (twice per year). Randy's loan has the same annual rate, but it uses continuous compounding. How many months does Randy need to wait in order to have the same debt that Sam will have after 82 months?arrow_forwardThe monthly mortgage payment on Flynn‘s home is 690,084. Additionally they pay 1,598.57 in annual Real estate taxes and $627 per year in homeowners insurance what is the total amount of their entire monthly paymentarrow_forwardKari is purchasing a home for $260,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $20,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $110; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (arrow_forward

- Kathy wants to buy a condominium selling for $95,000. The taxes on the property are$1500 per year, and homeowners' insurance is $336 per year. Kathy's gross monthly income is$4000. She has 15 monthly payments of $135 remaining on her van. The bank is requiring 20% down and is charging a 9.5% interest rate with no points. Her bank will approve a loan that has a total monthly mortgage payment of principal, interest, property taxes, and homeowners' insurance that is less than or equal to 28% of her adjusted monthly income. (a) Determine the required down payment. (b) Determine 28% of her adjusted monthly income. (c) Determine the monthly payment of principal and interest for a 25-year loan. (d) Determine her total monthly payment, including homeowners' insurance and taxes. (e) Does Kathy qualify for the loan? (f) Determine how much of the first payment on the mortgage is applied to the principal. (g) Determine the total amount she pays for the condominium with a 25-year conventional loan.…arrow_forwardTo go on a school trip, Felipe borrows $700. He makes no payments until the end of 4 years, when he pays off the entire loan. The lender charges simple interest at an annual rate of 6%. a) how much total interest will Felipe have to pay? b) what will the total repayment amount be (including interest)?arrow_forwardThe Fritzes are buying a house that sells for $107,000.The bank is requiring a minimum down payment of 20%.To obtain a 40-year mortgage at 9.5% interest, they must pay 4 points at the time of closing. a) Determine the required down payment. b) Determine the amount of the mortgage on the property with the 20% down payment. c) Find the cost of 4 points on the mortgage. a) The required down payment is $ enter your response here.arrow_forward

- Todd Foley is applying for a $290,000 mortgage. He can get a $2,030 monthly payment for principal and interest and no points, or a $1,827 monthly payment with 4 points? How many months will it take Todd to cover the cost of the discount points if he takes the lower monthly payment?arrow_forwardThe Nicols are buying a house selling for $435,000. They pay a down payment of $35,000 from the sale of their current house. To obtain a 15-year mortgage at a 7% interest rate, the Nicols must pay 1.5 points at the time of closing. a) What is the amount of the mortgage? b) What is the cost of the 1.5 points? a) The amount of the mortgage is S b) The cost of the 1.5 points on the mortgage is $arrow_forwardKari is purchasing a home for $220,000. The down payment is 25% and the balance will be financed with a 15 year mortgage at 8% and 3 discount points. Kari made a deposit of $30,000 (applied to the down payment) when the sales contract was signed. Kari also has these expenses: credit report, $70; appraisal fee, $120; title insurance premium, 1% of amount financed; title search, $200; and attorney's fees, $500. Find the closing costs (in $).arrow_forward

- The Nicols are buying a house selling for $235,000. They pay a down payment of $35,000 from the sale of their current house. To obtain a 15-year mortgage at a 5% interest rate, the Nicols must pay 3.5 points at the time of closing. a) What is the amount of the mortgage? b) What is the cost of the 3.5 points?arrow_forwardJames has a mortgage of $96,500 at 4% for 15 years. The property taxes are $3,900 per year, and the hazard insurance premium is $764.50 per year. Find the monthly PITI payment (in $). (Round your answer to the nearest cent. Use this table as needed.)arrow_forwardScott & Rebecca can afford to pay $4,000.00 each month for a mortgage. Their credit union is offering home loans at 4.375%. If they take out a 30-year mortgage how much can they afford to borrow?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education