Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

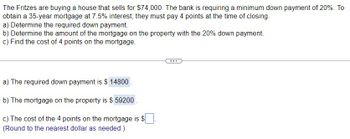

Transcribed Image Text:The Fritzes are buying a house that sells for $74,000. The bank is requiring a minimum down payment of 20%. To

obtain a 35-year mortgage at 7.5% interest, they must pay 4 points at the time of closing.

a) Determine the required down payment.

b) Determine the amount of the mortgage on the property with the 20% down payment.

c) Find the cost of 4 points on the mortgage.

a) The required down payment is $ 14800.

b) The mortgage on the property is $ 59200

c) The cost of the 4 points on the mortgage is $

(Round to the nearest dollar as needed.)

...

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Chuck Wells is planning to buy a Winnebago motor home. The listed price is $175,000. Chuck can get a secured add-on interest loan from his bank at 7.45% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $4,100 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.) $ Can he pay off the loan and keep his payments under $4,100? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. (b) What are Chuck's options to get his payments closer to his goal? (Select all that apply.) try to negotiate a higher interest ratetry to bargain for a lower sale pricetry to negotiate a lower interest ratemake a lower down paymenttry to bargain for a higher sale pricemake a higher down payment (c) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.85% loan if Chuck can pay 20% down. What…arrow_forward4) Brenda is buying a living room set for her home. At Furniture, Inc., she picks out a set for a total cash price of $1,899 The salesperson tells her if she qualifies for an installment loan, she may pay 10% down and finance the balance with payments of $88.35 per month for 24 months?arrow_forwardThe Fritzes are buying a house that sells for $173,000. The bank is requiring a minimum down payment of 10%. To obtain a 30-year mortgage at 11.5% interest, they must pay 2 points at the time of closing a) Determine the required down payment. b) Determine the amount of the mortgage on the property with the 10% down payment. c) Find the cost of 2 points on the mortgage. a) The required down payment is $ b) The mortgage on the property is S c) The cost of the 2 points on the mortgage is $ (Round to the nearest dollar as needed.)arrow_forward

- A homeowner is looking to buy a home in Marvin Gardens. The most he can afford to pay in total is $3,080 per month. Yearly property taxes will be about $12,000 (escrowed monthly) and insurance is $187 per month. There are no other costs. If mortgage rates are 5.48% for a 30-year fixed-rate mortgage, how large can his mortgage be? (Do not round intermediate calculations. Round your answer to the nearest whole number.)arrow_forwardThis problem is a complex financial problem that requires several skills, perhaps some from previous sections. Clark and Lana take a 30-year home mortgage of $128,000 at 7.9%, compounded monthly. They make their regular monthly payments for 5 years, then decide to pay $1200 per month. (a) Find their regular monthly payment. (Round your answer to the nearest cent.) $ (b) Find the unpaid balance when they begin paying the $1200. (Round your answer to the nearest cent.) $ (c) How many payments of $1200 will it take to pay off the loan? Give the answer correct to two decimal places. monthly payments (d) Use your answer to part (c) to find how much interest they save by paying the loan this way. (Round your answer to the nearest cent.)arrow_forwardThe Taylors have purchased a $310,000 house. They made an initial down payment of $40,000 and secured a mortgage with interest charged at the rate of 10%/year on the unpaid balance. Interest computations are made at the end of each month. If the loan is to be amortized over 30 yr, what monthly payment will the Taylor's be required to make? (Round your answers to the nearest cent.) monthly payment $ What is their equity (disregarding appreciation) after 5 yr? After 10 yr? After 20 yr? equity after 5 yr $ equity after 10 yr $ equity after 20 yr $arrow_forward

- The Potters want to buy a small cottage costing $119,000 with annual insurance and taxes of $760 and $2900, respectively. They have saved $11,000 for a down payment, and they can get a 6%, 10-year mortgage from a bank They are qualified for a home loan as long as the total monthly payment does not exceed $1000. Are they qualified? What is the total monthly payment?arrow_forward2 . Please answer the whole answer there is more than one answer that needs to be answeredarrow_forwardChuck Wells is planning to buy a Winnebago motor home. The listed price is $155,000. Chuck can get a secured add-on interest loan from his bank at 7.45% for as long as 60 months if he pays 15% down. Chuck's goal is to keep his payments below $3,600 per month and amortize the loan in 42 months. (a) Find Chuck's monthly payment (in $) with these conditions. (Round your answer to the nearest cent.) $ Can he pay off the loan and keep his payments under $3,600? Yes, under these conditions, Chuck will meet his goal.No, the monthly payment is too high. (b) What are Chuck's options to get his payments closer to his goal? (Select all that apply.) try to negotiate a lower interest ratemake a higher down paymenttry to bargain for a higher sale pricetry to bargain for a lower sale pricemake a lower down paymenttry to negotiate a higher interest rate (c) Chuck spoke with his bank's loan officer, who has agreed to finance the deal with a 6.95% loan if Chuck can pay 20% down. What…arrow_forward

- The Fritzes are buying a house that sells for $107,000.The bank is requiring a minimum down payment of 20%.To obtain a 40-year mortgage at 9.5% interest, they must pay 4 points at the time of closing. a) Determine the required down payment. b) Determine the amount of the mortgage on the property with the 20% down payment. c) Find the cost of 4 points on the mortgage. a) The required down payment is $ enter your response here.arrow_forwardTodd Foley is applying for a $290,000 mortgage. He can get a $2,030 monthly payment for principal and interest and no points, or a $1,827 monthly payment with 4 points? How many months will it take Todd to cover the cost of the discount points if he takes the lower monthly payment?arrow_forwardA couple wants to purchase a new house and feel that they can afford a mortgage payment of $600 a month. They are able to obtain a 30-year 7.4% mortgage (compounded monthly) but must put down 20% of the cost of the house. Assuming that they have enough savings for the down payment, how expensive a house can they afford? The couple can afford a house that costs up to $ ☐ . (Round the final answer to the nearest dollar as needed. Round all intermediate values to six decimal places as needed.)arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education