Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

thumb_up100%

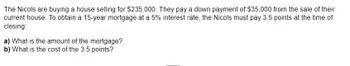

Transcribed Image Text:The Nicols are buying a house selling for $235,000. They pay a down payment of $35,000 from the sale of their

current house. To obtain a 15-year mortgage at a 5% interest rate, the Nicols must pay 3.5 points at the time of

closing.

a) What is the amount of the mortgage?

b) What is the cost of the 3.5 points?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- Ben buys a house. He obtains a $220,000, 30-year mortgage at 5%. Annual property taxes $1,800, property insurance $480 a year, house association fee $220 a month. Based on these items what is the total monthly mortgage payment?arrow_forwardAnna is buying a house selling for $285,000. To obtain the mortgage, Anna is required to make a 10% down pa Anna obtains a 30-year mortgage with an interest rate of 4%. Click the icon to view the table of monthly payments. a) Determine the amount of the required down payment b) Determine the amount of the mortgage. c) Determine the monthly payment for principal and interest. a) Determine the amount of the required down payment. COarrow_forwardThe Fritzes are buying a house that sells for $107,000.The bank is requiring a minimum down payment of 20%.To obtain a 40-year mortgage at 9.5% interest, they must pay 4 points at the time of closing. a) Determine the required down payment. b) Determine the amount of the mortgage on the property with the 20% down payment. c) Find the cost of 4 points on the mortgage. a) The required down payment is $ enter your response here.arrow_forward

- Todd Foley is applying for a $290,000 mortgage. He can get a $2,030 monthly payment for principal and interest and no points, or a $1,827 monthly payment with 4 points? How many months will it take Todd to cover the cost of the discount points if he takes the lower monthly payment?arrow_forwardA homebuyer bought a house for $250,000. The buyer paid 22 percent down. If the borrower took out a 30-year fixed-rate mortgage at a 7 percent annual interest rate, how much interest will the borrower pay over the life of the mortgage?arrow_forwardJohn Lee bought a home in Des Moines, Iowa, for $65,000. He put down 15% and obtained a mortgage for 30 years at 8 1/2%. What is (A) John's monthly payment and (B) the total interest cost of the loan? (Round your answers to the nearest cent.) A. B.arrow_forward

- Justin and Hayley are interested in a fixed-rate mortgage for $450,000. They are undecided whether to choose a 15- or 30-year mortgage. The current mortgage rate is 3.5% for the 15-year mortgage, and 3.85% for the 30-year mortgage (a) What are the monthly principal and interest payments for EACH loan? (b) What is the total amount of interest paid on EACH loan? (c) Overall, how much more interest is paid by choosing the 30-year mortgage?arrow_forwardThe Hills obtain a 30-year, $144,000 conventional mortgage at a 4.5% rate on a house selling for $180,000. Their monthly mortgage payment, including principal and interest, is $729.63. They also pay 2 points at closing. Determine the total amount the Hills will pay for their house over 30 years. The total amount is $ (Round to the nearest cent as needed.)arrow_forwardK The Nicols are buying a house selling for $345,000. They pay a down payment of $45,000 from the sale of their current house. To obtain a 20-year mortgage at a 4.5% interest rate, the Nicols must pay 2.5 points at the time of closing a) What is the amount of the mortgage? b) What is the cost of the 2.5 points? a) The amount of the mortgage is $ b) The cost of the 2.5 points on the mortgage is S C***arrow_forward

- The Fritzes are buying a house that sells for $107,000. The bank is requiring a minimum down payment of 20%. To obtain a 40-year mortgage at 9.5% interest, they must pay 4 points at the time of closing. a) Determine the required down payment. b) Determine the amount of the mortgage on the property with the 20% down payment. c) Find the cost of 4 points on the mortgage. a) The required down payment is Sarrow_forwardSuppose you have just purchased your first home for $550,000. At the time of purchase you could only afford to commit to a down payment of $55,000. In order to make the loan, the lender requires you to obtain private mortgage insurance (PMI) on their behalf. Suppose over time you paid down the principal of the loan to $535,000 and at that point in time you can no longer make any mortgage payments (i.e., you default on the loan). If the lender were to foreclose on your property and sell it for $508,000 (net proceeds), what would the lender's loss of principal be taking into consideration the protection of mortgage insurance? (Let's assume that the PMI in this case covers the top 25% of the loan.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education