Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

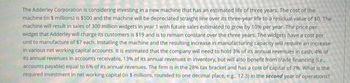

Transcribed Image Text:The Adderley Corporation is considering investing in a new machine that has an estimated life of three years. The cost of the

machine (in 5 millions) is $500 and the machine will be depreciated straight line over its three-year life to a residual value of $0. The

machine will result in sales of 300 million widgets in year 1 with future sales estimated to grow by 10% per year. The price per

widget that Adderley will charge its customers is $19 and is to remain constant over the three years. The widgets have a cost per

unit to manufacture of $7 each. Installing the machine and the resulting increase in manufacturing capacity will require an increase

in various net working capital accounts. It is estimated that the company will need to hold 3% of its annual revenues in cash, 4% of

its annual revenues in accounts receivable, 13% of its annual revenues in inventory, but will also benefit from trade financing (ie,

accounts payable) equal to 6% of its annual revenues. The firm is in the 28% tax bracket and has a cost of capital of 7%. What is the

required investment in net working capital (in $ millions, rounded to one decimal place, e.g. 12.3) in the second year of operations?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A Corporation proposes to construct a new nuclear power plant to meet the increased demand for electricity. The plant will cost $2.2 billion to build. Cash flows provided by the plant will amount to $300 million per year for 15 years. At the end of year 15, the plant will be decommissioned. The cost of decommissioning is estimated to be $900 million. Calculate the project’s NPV if the discount rate is 5%.arrow_forwardTripp Industries is considering buying a new recycling system. The new recycling system would be purchased today for $7,700.00. It would be depreciated straight-line to $1,020.00 over 2 years. In 2 years, the recycling system would be sold and the after-tax cash flow from capital spending in year 2 would be $1,270.00. The recycling system is expected to reduce costs by $2,730.00 in year 1 and by $8,630.00 in year 2. If the tax rate is 52.00% and the cost of capital is 7.73%, what is the net present value of the new recycling system project? $106.43 (plus or minus $10) $191.35 (plus or minus $10) $1,288.60 (plus or minus $10) -$2,245.85 (plus or minus $10) None of the above is within $10 of the correct answerarrow_forwardMichael Scott Paper, Inc. is considering a new machine that requires an initial investment of $ 650,000, including installation costs, and has a useful life of ten years. The expected annual after - tax cash flows for the machine are $90, 000 during the first two years, $115, 000 during years three through six, and $85, 000 during the remaining years of its useful life. What is the net present value ( NPV) when the discount rate is 5% ?arrow_forward

- QRW Corp, needs to replace an old machine with a new, more efficient model. The new machine being considered will result in an increase in camings before interest and taxes of $70,000 per year. The purchase price is $200,000, and it would cost an additional $10,000 to properly install the machine. In addition, to properly operate the machine, inventory must be increased by S10,000. This machine has an expected life of 10 years, with no salvage value. Assume that a straight-line depreciation method being used and that this machine is being depreciated down to zero, the marginal tax rate is 34%, and a required rate of return of 15%. (i) Solve for the value of the initial outlay associated with this project. (ii) Solve for the value of annual after-tax cash flows for this project from 1 through 9arrow_forwardThe Zeron Corporation wants to purchase a new machine for its factory operations at a cost of $350,000. The investment is expected to generate $225,000 in annual cash flows for a period of four years. The required rate of return is 10%. The new machine is expected to have zero value at the end of the four-year period. What is the net present value of the investment closest to? Would the company want to purchase the new machine? Income taxes are not considered. A) $363,025; yes B) $22,500; no C) $350,000; yes D) $375,650; noarrow_forwardAcme Company plans to replace some obsolete equipment with new equipment that costs $232,000 and has a useful life of 16 years and a salvage value of $40,000. Acme expects that the new equipment will reduce operating costs (labor, energy, etc.) by $59,000 per year. Acme can sell the old equipment for $20,000. What is the simple rate of return on the investment in the new equipment? Round to one decimal place. 23.9% 21.6% 20.5% 22.2%arrow_forward

- Caroline’s Chill Chronometers (3C) is considering buying a machine for $600 million. The machine has a useful life of 20 years. Sales are projected to be $120 million per year, with operating expenses of $35 million per year. An initial NWC investment of $10 million would be needed. NWC, however, would decrease by $300,000 per year over the 15 year life of the project due to improved inventory efficiency. The machine can be sold for $175 million at the end of the project. The tax rate is 20% and the required rate of return is 7%. Find the NPV using straight-line depreciation.arrow_forwardMichael Scott Paper, Inc. is considering a new machine that requires an initial investment of $650, 000, including installation costs, and has a useful life of ten years. The expected annual after - tax cash flows for the machine are $90, 000 during the first two years, $115.000 during years three through six, and $85, 000 during the remaining years of its useful life. What is the net present value (NPV) when the discount rate is 5% ?arrow_forwardThe ABC Corporation is considering purchasing a machine to manufacture mobile phones. The purchase of this machine will cause an increase in earnings before depreciation and taxes of $280,000 per year. The machine has a purchase price of $500,000 and it would cost an additional $20,000 to install this machine properly. In addition, the proper operation of this machine needs an increase of working capital of $30,000. The machine has an expected life of 5 years, and it will have a salvage value of $70,000. The company uses straight-line depreciation method; it faces a 25% marginal tax rate and requires a rate of return of 8% for this project. Should ABC Corporation accept the project? Elaborate your rationale and show your calculation steps.arrow_forward

- eEgg is considering the purchase of a new distributed network computer system to help handle its warehouse inventories. The system costs $60,000 to purchase and install and $30,000 to operate each year. The system is estimated to be useful for 4 years. Management expects the new system to reduce the cost of managing inventories by $62,000 per year. The firm’s cost of capital (discount rate) is 10%. Required: 1. What is the net present value (NPV) of the proposed investment under each of the following independent situations? (Use the appropriate present value factors from Appendix C, TABLE 1 and Appendix C, TABLE 2.) 1a. The firm is not yet profitable and therefore pays no income taxes. 1b. The firm is in the 30% income tax bracket and uses straight-line (SLN) depreciation with no salvage value. Assume MACRS rules do not apply. 1c. The firm is in the 30% income tax bracket and uses double-declining-balance (DDB) depreciation with no salvage value. Given a four-year life, the DDB…arrow_forwardthe to be In 2 years, XYZ is considering buying a new, high efficiency interception system. The new system would be purchased today for $46,500.00. It would be depreciated straight-line to $0 over 2 years. system would be sold for an after-tax cash flow of $14,700.00. Without the system, costs are expected to be $100,000.00 in 1 year and $100,000.00 in 2 years. With the system, $79,700.00 in 1 year and $67,000.00 in 2 years. If the tax rate is 48.30% and the cost of capital is 8.30%, what is the net present value of the new interception system project? costs are expected O $13344.34 (plus or minus $50) O $14279.01 (plus or minus $50) O $10213.60 (plus or minus $50) O $11718.49 (plus or minus $50) None of the above is within $50 of the correct answerarrow_forwardVan Nuys Company is considering the purchase of a new machine which will cost $7.370. The machine will provide revenues of $4,000 per year. The cash operating costs will be $2,000 per year. The new machine will have a useful life of six years. The company's cost of capital is 12 percent. Ignore income taxes. Should the company buy the new machine? Yes, because NPV=0 and IRR0 and IRR>Cost of Capital No, because NPV>0 and IRR0 and IRR>Cost of Capital O Yes, because NPV = IRR Question 4arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education