FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

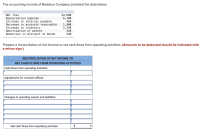

Transcribed Image Text:The accounting records of Baddour Company provided the data below.

$4,680

6,100

460

Net loss

Depreciation expense

Increase in salaries payable

Decrease in accounts receivable

Increase in inventory

Amortization of patent

Reduction in discount on bonds

1,900

2,350

340

240

Prepare a reconciliation of net income to net cash flows from operating activities. (Amounts to be deducted should be indicated with

a minus sign.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Accounts receivable arising from trade transactions amounted to $44,000 and $53,000 at the beginning and end of the year, respectively. Net income reported on the income statement for the year was $105,000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method is: a. $105,000 b. $114,000 c. $96,000 d. $158,000arrow_forwardAccounts receivable arising from sales to customers amounted to $82000 and $77000 at the beginning and end of the year, respectively. Income reported on the income statement for the year was $282000. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows is $282000. O $205000. O $287000. O $276000.arrow_forwardAccounts receivable from sales transactions were $45,634 at the beginning of the year and $60,027 at the end of the year. Net income reported on the income statement for the year was $126,710. Exclusive of the effect of other adjustments, the net cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method would be a. $126,710 b. $112,317 c. $14,393 d. $141,103arrow_forward

- The accounting records of Hampton Company provided the data below ($ in thousands). Net income Depreciation expense Increase in accounts receivable Decrease in inventory Decrease in prepaid insurance Decrease in salaries payable Increase in interest payable $33,300 9,400 5,600 7,100 2,000 4,300 1,400 Required: Prepare a reconciliation of net income to net cash flows from operating activities.arrow_forwardAccounts payable pertain to operating expenses. Prepare the operating activities section of the statement of cash flows using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g. -15,000 or in parenthesis e.g. (15,000).) SHERIDAN COMPANY Partial Statement of Cash Flows Adjustments to reconcile net income to $ $arrow_forwardMacrosoft Company reports net income of $62,000. The accounting records reveal depreciation expense of $77,000 as well as increases in prepaid rent, accounts payable, and income tax payable of $57,000, $10,000, and $16,500, respectively. Prepare the operating activities section of Macrosoft's statement of cash flows using the indirect method. (Amounts to be deducted should be indicated with a minus sign.) Cash flows from operating activities MACROSOFT COMPANY Statement of Cash Flows (partial) Adjustments to reconcile net income to net cash flows from operating activities: Net cash flows from operating activitiesarrow_forward

- On the indirect statement of cash flows, $500,000 relating to notes payable was subtracted from net income to get indirect cash flow from operations. This must mean that:arrow_forward125. accountigarrow_forwardAccounts receivable from sales transactions were $49,313 at the beginning of the year and $62,098 at the end of the year. Net income reported on the income statement for the year was $122,531. Exclusive of the effect of other adjustments, the cash flows from operating activities to be reported on the statement of cash flows prepared by the indirect method would bearrow_forward

- The accounting records of United Company provided the data below. $40,000 12,000 11,000 14,000 4,800 700 Net Income Depreciation expense Increase in salaries payable Increase in accounts receivable Decrease in inventory Amortization of patent Decrease in premium on bonds payable 223 500 Required: Show all work A. Based on the information provided, determine the net cash flows from operating activities for United Company. Provide your response and your work in the space below B. Determine the Quality of Income for United Company. Specify if it is of low quality or high quality and briefly explain. Provide your responses and your work in the space below. Essay Toolbar navigation. BIUS E = = E E = A v 43 of 44 Next > < Prev MacBook Airarrow_forwardThe Cash and Accounts Receivable end-of-year balances for a company are provided below. Current Year Prior Year Cash $45,537 $35,300 Accounts receivable (net) 35,900 71,800 Based on this information, what is the amount and percentage of increase or decrease that would be shown with horizontal analysis? Enter a decrease using a minus sign before the amount and the percentage. Account Dollar Change Percent Change Cash $fill in the blank 1 fill in the blank 2 % Accounts Receivable $fill in the blank 4 fill in the blank 5 % increase,decreasearrow_forward11. In 2020, Windsor Corporation reported a net loss of $69,800. Windsor’s only net income adjustments were depreciation expense $81,700, and increase in accounts receivable $8,900.Compute Windsor’s net cash provided (used) by operating activities. (Show amounts that decrease cash flow with either a - sign e.g. -15,000 or in parenthesis e.g. (15,000).) Net cash by operating activities $arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education