FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

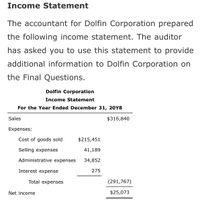

Transcribed Image Text:Income Statement

The accountant for Dolfin Corporation prepared

the following income statement. The auditor

has asked you to use this statement to provide

additional information to Dolfin Corporation on

the Final Questions.

Dolfin Corporation

Income Statement

For the Year Ended December 31, 20Y8

Sales

$316,840

Expenses:

Cost of goods sold

$215,451

Selling expenses

41,189

Administrative expenses

34,852

Interest expense

275

Total expenses

(291,767)

Net income

$25,073

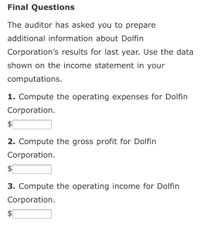

Transcribed Image Text:Final Questions

The auditor has asked you to prepare

additional information about Dolfin

Corporation's results for last year. Use the data

shown on the income statement in your

computations.

1. Compute the operating expenses for Dolfin

Corporation.

$1

2. Compute the gross profit for Dolfin

Corporation.

$1

3. Compute the operating income for Dolfin

Corporation.

$4

%24

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 3 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information is available for Tamarisk Corp. for the year ended December 31, 2022. Other revenues and gains $23,800 Other expenses and losses 4,000 Cost of goods sold 292,000 Sales discounts 4,600 Sales revenue 760,000 Operating expenses 221,000 Sales returns and allowances 10,800 Prepare a multiple-step income statement for Tamarisk Corp. The company has a tax rate of 25%.arrow_forwardYou are the senior accountant for a shoe wholesaler that uses the periodic inventory method. You have determined the following information from your company’s records, which you assume is correct: Inventory of $296,064 was on hand at the start of the year. Purchases for the year totalled $2,028,000. Of this, $1,694,400 was purchased on account; that is, accounts payable was credited for this amount at the time of the purchase. A year-end inventory count revealed inventory of $389,760 Required: b) Assume now that your company uses the perpetualmethod of inventory control, and that your records show that $1,857,990 of inventory (at cost) was sold during the year. What is the adjustment needed to correct the records, given the inventory count in item 3 above?arrow_forwardPrepare an income statement for Hansen Realty for the year ended December 31, 2023. Beginning inventory was $1,244. Ending inventory was $1,596. Note: Input all amounts as positive values. Sales $ 34,500 Sales returns and allowances 1,088 Sales discount 1,148 Purchases 10,312 Purchase discounts 536 Depreciation expense 111 Salary expense 5,000 Insurance expense 2,400 Utilities expense 206 Plumbing expense 246 Rent expense 176arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education