FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

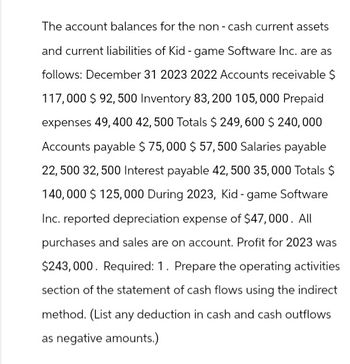

Transcribed Image Text:The account balances for the non-cash current assets

and current liabilities of Kid - game Software Inc. are as

follows: December 31 2023 2022 Accounts receivable $

117,000 $92,500 Inventory 83,200 105,000 Prepaid

expenses 49,400 42,500 Totals $ 249,600 $240,000

Accounts payable $ 75,000 $57,500 Salaries payable

22,500 32,500 Interest payable 42, 500 35,000 Totals $

140,000 $125,000 During 2023, Kid - game Software

Inc. reported depreciation expense of $47,000. All

purchases and sales are on account. Profit for 2023 was

$243,000. Required: 1. Prepare the operating activities

section of the statement of cash flows using the indirect

method. (List any deduction in cash and cash outflows

as negative amounts.)

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps with 1 images

Knowledge Booster

Similar questions

- The following December 31, 2024, fiscal year-end account balance information is available for the Stonebridge Corporation: Cash and cash equivalents Accounts receivable (net) $ 6,300 33,000 73,000 Inventory Property, plant, and equipment (net) 185,000 Accounts payable 52,000 Salaries payable Paid-in capital 24,000 165,000 The only asset not listed is short-term investments. The only liabilities not listed are $43,000 notes payable due in two years and related accrued interest payable of $1,000 due in four months. The current ratio at year-end is 1.5:1. Required: Determine the following at December 31, 2024: 1. Total current assets 2. Short-term investments 3. Retained earningsarrow_forwardJust Dew It Corporation reports the following balance sheet information for 2020 and 2021. JUST DEW IT CORPORATION 2020 and 2021 Balance Sheets Assets 2020 2021 Liabilities and Owners' Equity 2020 2021 Current assets Current liabilities Cash $ 10, 620 $ 13, 275 Accounts payable $ 52, 560 $ 60, 750 Accounts receivable 21,420 29, 925 Notes payable 19, 260 24,075 Inventory 67, 860 82, 575 Total $ 99,900 $ 125, 775 Total $ 71,820 $ 84, 825 Long-term debt $ 36,000 $ 27,000 Owners' equity Common stock and paid - in surplus $ 45,000 $ 45,000 Retained earnings 207, 180 293, 175 Net plant and equipment $ 260, 100 $ 324, 225 Total $ 252, 180 $ 338, 175 Total assets $ 360,000 $ 450,000 Total liabilities and owners' equity $ 360,000 $ 450,000 For each account on this company's balance sheet, show the change in the account during 2021 and note whether this change was a source or use of cash. (If there is no action select "None" from the dropdown options. Leave no cells blank - be certain to enter…arrow_forwardThe current sections of Famous’s statements of financial position at December 31, 2019 and 2020, are presented here. Famous’s net income for 2020 was €147,000. Depreciation expense was €21,000. 2020 2019 Current assets Prepaid expenses €25,000 €27,000 Inventory 158,000 172,000 Accounts receivable 79,000 110,000 Cash 105,000 99,000 Total current assets €367,000 €408,000 Current liabilities Accrued expenses payable € 15,000 € 9,000 Accounts payable 85,000 95,000 Total current liabilities €100,000 €104,000 Instructions Prepare the net cash provided by operating activities section of the company’s statement of cash flows for the year ended December 31, 2020, using the indirect method.arrow_forward

- The following information has been extracted from the financial statements and notes of Spring Ltd. 2020 2019 Cash and Cash Equivalents 60,600 59,700 Account Receivable(net) 130,800 128,900 Account Payable 54,700 52,900 Revenue 780,000 750,000 Cost of Goods Sold 450,500 445,500 Profit 65,500 58,500 Inventory 234,700 215,300 Total assets 580,000 590,000 Current Liabilities 250,900 265,700 Total liabilities 300,000 330,000 Short-term investments 67,400 75,900 Based on the above information calculate the following ratios: 1) Return on assets for 2020. 2) Profit Margin ratio for 2020. 3) Debt to assets ratio for 2020. 4) Acid-test ratio for 2020. 5) Inventory Turnover ratio for 2020.arrow_forwardMadigan Pets Supply Inc. has the following account balances at December 31, 2022 and 2023: December 31, 2023 December 31, 2022 Cash $1,200,000 $1,050,000 Notes Receivable $300,000 $100,000 Plant Asset (net) 300,000 100,000 Long Term Security Investments $150,000 250,000 Bonds Payable $550,000 $350,000 Common Stock 300,000 120,000 Additional Paid-in Capital 50,000 20,000 Retained Earnings 200,000 150,000 Dividends Declared and Paid 24,000 18,000 Depreciation Expense (annual) 50,000 50,000 Long-term Intangible Assets(net) $8,000 $12,000 Amortization Expense (annual) $6,000 $8,000 Additional information:2023 plant asset acquisitions were paid in cash.No plant assets were sold during 2023.$30,000 of the notes receivable were collected during 2023.No common stock was retired during 2023.$50,000 in bonds were retired in 2023. All bonds were issued at par value. Using the indirect…arrow_forwardRamakrishnan, Incorporated, reported 2024 net income of $20 million and depreciation of $3,400,000. The top part of Ramakrishnan, Incorporated’s 2024 and 2023 balance sheets is reproduced below (in millions of dollars): 2024 2023 2024 2023 Current assets: Current liabilities: Cash and marketable securities $ 25 $ 26 Accrued wages and taxes $ 43 $ 35 Accounts receivable 98 92 Accounts payable 69 60 Inventory 170 144 Notes payable 60 55 Total $ 293 $ 262 Total $ 172 $ 150 Calculate the 2024 net cash flow from operating activities for Ramakrishnan, Incorporated. Note: Enter your answer in dollars not in millions. donearrow_forward

- Windsor Inc., a greeting card company, had the following statements prepared as of December 31, 2020. WINDSOR INC.COMPARATIVE BALANCE SHEETAS OF DECEMBER 31, 2020 AND 2019 12/31/20 12/31/19 Cash $6,100 $7,100 Accounts receivable 62,400 51,000 Short-term debt investments (available-for-sale) 34,700 18,100 Inventory 40,400 60,300 Prepaid rent 4,900 4,000 Equipment 154,100 130,600 Accumulated depreciation—equipment (34,900 ) (24,800 ) Copyrights 46,400 49,800 Total assets $314,100 $296,100 Accounts payable $46,500 $40,200 Income taxes payable 4,000 6,000 Salaries and wages payable 8,100 4,100 Short-term loans payable 7,900 10,100 Long-term loans payable 59,600 68,400 Common stock, $10 par 100,000 100,000 Contributed…arrow_forwardJanice Wong has extracted the following information from her income statement and balance sheet for 2021 and 2020: 2021 2020 Profit After Tax $687,511 $665,763 Cash at Bank $109,805 $102,213 Mortgage payable this year $21,488 $31,995 Inventory $39,432 $42,929 Accounts payable $128,057 $121,309 Accounts receivable (trade debtors) $444,563 $393,798 Mortgage payable in 5 years time $516,150 $633,164 Owner's Equity $1,479,443 $1,096,378 Based on the information provided, calculate the Return on Equity for 2021.arrow_forwardRamakrishnan, Incorporated, reported 2024 net income of $40 million and depreciation of $2,900,000. The top part of Ramakrishnan, Incorporated's 2024 and 2023 balance sheets is reproduced below (in millions of dollars): 2024 2023 2024 2023 Current assets: Current liabilities: Cash and marketable securities Accounts receivable $ 45 $ 16 85 Inventory 161 82 124 Accrued wages and taxes Accounts payable Notes payable $ 28 $ 25 89 85 85 80 Total $ 291 $ 222 Total $ 202 $ 190 Calculate the 2024 net cash flow from operating activities for Ramakrishnan, Incorporated. Note: Enter your answer in dollars not in millions. Net cash flowarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education