FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

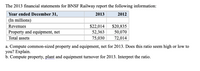

Transcribed Image Text:The 2013 financial statements for BNSF Railway report the following information:

Year ended December 31,

2013

2012

(In millions)

$20,835

50,070

Revenues

$22,014

52,363

Property and equipment, net

Total assets

75,030

72,014

a. Compute common-sized property and equipment, net for 2013. Does this ratio seem high or low to

you? Explain.

b. Compute property, plant and equipment turnover for 2013. Interpret the ratio.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Comparative data from the statement of financial position of Munchies Ltd. are shown below. Current assets Property, plant, and equipment Goodwill Total assets Current assets Property, plant, and equipment Total assets 2021 $1,519,000 2021 3,114.000 $4.730,000 % %6 97,000 2020 $1,164.000 2,827,000 107,000 $4,098,000 Using horizontal analysis, calculate the percentage of the base-year amount, using 2019 as the base year. (Round answers to 1 decimal place, e.g. 52.7%) 2020 2019 % $1,227,000 2.871,000 -0- $4,098,000 2019arrow_forward*Question included in picture.arrow_forwardCurrent Attempt in Progress In its income statement for the year ended December 31, 2027, Ivanhoe Inc. reported the following condensed data. Operating expenses $623,500 Interest revenue $28,380 Cost of goods sold 1,080,160 Loss on disposal of plant assets 14,620 Interest expense 60,200 Net sales 1,892,000 Income tax expense 40,420 Prepare an income statement. (List other revenues before other expenses.) IVANHOE INC. Income Statement > > +Aarrow_forward

- Calculate the Rate of Return on Assets (ROA) for 2011. Disaggregate ROA into the profit margin for ROA and total assets turnover components. Calculate the Rate of Return on Common Stockholders’ Equity (ROCE) for 2011. Disaggregate ROCE into the profit margin for ROCE, total assets turnover and capital structure leverage components.arrow_forwardForecast an Income Statement Following is the income statement for Medtronic PLC. Consolidated Statement of Income ($ millions) For Fiscal Year Ended April 26, 2019 Net sales $27,807 Costs and expenses Cost of products sold 8,331 Research and development expense 2,330 Selling, general, and administrative expense 9,480 Amortization of intangible assets 1,605 Restructuring charges, net 198 Certain litigation charges, net 166 Other operating expense, net 258 Operating profit 5,439 Other nonoperating income, net (373) Interest expense 1,314 Income before income taxes 4,498 Income tax provision 547 Net income 3,951 Net income loss attributable to noncontrolling interests (19) Net income attributable to Medtronic $3,932 Use the following assumptions to prepare a forecast of the company’s income statement for FY2020. Note: Complete the entire question in Excel using the following template: Excel Template. Format each answer to two decimal…arrow_forwardPlease helparrow_forward

- Subject;arrow_forwardA company had net sales of $230,000 for 2010 and $288,000 for 2011. The company’s average total assets for 2010 were $150,000 and $180,000 for 2011. Calculate the total asset turnover for each year and comment on this company's efficiency of using its assets. 2010: 2011: Comment on the company’s efficiency in the use of its assets.arrow_forwardPlease help me with show all calculation thankuarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education