Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

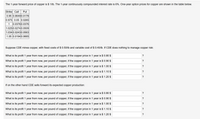

Transcribed Image Text:The 1-year forward price of copper is $ 1/lb. The 1-year continuously compounded interest rate is 6%. One-year option prices for copper are shown in the table below.

Strike Call|

Put

0.95 0.0649 0.0178

0.975 0.05 0.0265

1

0.0376 0.0376

1.025 0.02740.0509

1.034 0.02430.0563

1.05 0.0194 0.0665|

Suppose CDE mines copper, with fixed costs of $ 0.50/lb and variable cost of $ 0.40/lb. If CDE does nothing to manage copper risk:

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.80 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.90 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.00 $

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.10 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.20 $

?

If on the other hand CDE sells forward its expected copper production:

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.80 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 0.90 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.00 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.10 $

?

What is its profit 1 year from now, per pound of copper, if the copper price in 1 year is $ 1.20 $

?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- The 1-year spot rate is 8%p.a. effective. The term structure of 1-year effective forwardratesisasfollows: attimet=1therateis7%,attimet=2therate is 6%, at time t = 3 the rate is 5%. (a) Determine the term structure of spot rates. (b) A fixed income security pays £10 annual coupons and it is redeemed after 4 years for £100. Compute its price at time t = 0.arrow_forwardNonearrow_forwardBased on the table below, the 2-year implied spot rate is closest to: Forward rate 1 year forward rate at time zero (1f0) 1 year forward rate 1 year from now (1f1) 1 year forward rate 2 year from now (1f2) 1 year forward rate 3 year from now (1f3) 1 year forward rate 4 year from now (1f4) Value 0.80% 1.12% 3.94% 3.28% 3.14% All rates are annual rates stated for a periodicity of one (effective annual rates). ○ 1.93% 0.96% ○ 1.31%arrow_forward

- Nonearrow_forwardIf $3000.00 is invested for seven years and seven months at 6% p.a. compounded quarterly, calculate the maturity value. Question 11 options: A) $4712.57 B) $4882.57 C) $4745.43 D) $3776.32 E) $3763.18arrow_forwardWe know that the market should respond positively to good news and that good-news events such as the coming end of a recession can be predicted with at least some accuracy. Why, then, can we not predict that the market will go up as the economy recovers?arrow_forward

- A ten-year floating-rate note (FRN) has coupons referenced to 3-month pound LIBOR, and pays coupon interest quarterly. Assume that the current 3-month LIBOR is 4 percent. If the risk premium above LIBOR that the issuer must pay is 12.5 basis points, the next period's coupon payment on a £1,000 face value FRN will be Group of answer choices £31.25. £82.50. £165.00. £10.31.arrow_forwardA plain vanilla 2-year interest rate swap with annual payments has a notional principal of $1 million. 5 month(s) into the swap, the term structure of interest rates is flat at 4.70%. The first floating-rate payment has already been set to 5.00%. The fixed payments are 5.29%. What is the value of this swap? Please show steps Answer: -8310arrow_forwardA $30,000,000 interest rate swap has a 12-month maturity, and was entered 2 months ago. This means the swap has a remaining life of 10 months. The swap pays interest quarterly, and it stipulates that the fixed rate is 4.5%, while the floating rate is the 3-month LIBOR +1%. Two months ago, when the swap was entered, 3-month LIBOR was 2.9%. The 3-month LIBOR forward rates and continuous time zero-coupon prices are given in a table below. Use the zero coupon prices to discount cash-flows. 3-month LIBOR Forward Rates Term rate 1x4 2.90% 2x5 2.85% 3x6 2.84% 4x7 2.88% 5x8 2.90% 6x9 2.91% 7x10 2.92% 8x11 2.92% 9x12 2.92% Zero-Coupon prices T (month) Price 1 0.9976 2 0.9953 3 0.9929 4 0.9904 5 0.988 6 0.9856 7 0.9831 8 0.9807 9 0.9783 10 0.9761 11 0.9737 12 0.9712 (Important hint: since the swap was entered 2 months ago, and makes quarterly payments, in the remaining 10 months, payments should be expected in 1 month, 4 months, 7 months and 10 months. Discount cash flows accordingly.)…arrow_forward

- 5. Suppose you have a 2.5-year remaining on an interest rate swap with a notional principal of $10,000, 000 between Company A and Company B. Company A pays fixed rate and Company B pays the float rate. Fixed and float payments are exchanged every year and the last payment was exchanged 6 months ago. The fixed rate is 3.5% per annum, and the floating rate is tied to the annual LIBOR. The previous 1-year LIBOR rate, set 6 months ago, is 2.75%, 6 month LIBOR is 3.25%. the 1.5-year LIBOR is 3.25%, and the 2.5-year LIBOR is 3.50%. Calculate the present value of the fixed and floating legs of the swap, and determine the swap's net present value from Company A's perspective. Assume annual compounding for discounting.arrow_forwardSuppose you have a 2.5-year remaining on an interest rate swap with a notionalprincipal of $10, 000, 000 between Company A and Company B. Company A pays fixed rateand Company B pays the float rate. Fixed and float payments are exchanged every year andthe last payment was exchanged 6 months ago. The fixed rate is 3.5% per annum, and thefloating rate is tied to the annual LIBOR. The previous 1-year LIBOR rate, set 6 months ago,is 2.75%, 6 month LIBOR is 3.25%. the 1.5-year LIBOR is 3.25%, and the 2.5-year LIBOR is3.50%.Calculate the present value of the fixed and floating legs of the swap, and determine the swap’snet present value from Company A’s perspective. Assume annual compounding for discounting.arrow_forwardUse the following table of spot rates: Years to Maturity Annual Effective Spot Rate 3.00% 2 3.60% 3. 3.85% 4 4.05% 5. 4.20% For a 2-year-deferred, 3-year interest rate swap with the level notional amount is I million and 1-year spot rate at time 3 is 3%, what is the amount of the net settlement payment at time 4? Is this amount paid by the payer, or by the receiver? O a. 15,950 paid by the receiver Ob. 16,950 pay by the receiver O. 15,950 paid by the payer Od. 16,950 paid by the payer O e. None of the abovearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education