Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

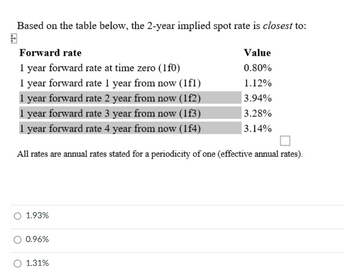

Transcribed Image Text:Based on the table below, the 2-year implied spot rate is closest to:

Forward rate

1 year forward rate at time zero (1f0)

1 year forward rate 1 year from now (1f1)

1 year forward rate 2 year from now (1f2)

1 year forward rate 3 year from now (1f3)

1 year forward rate 4 year from now (1f4)

Value

0.80%

1.12%

3.94%

3.28%

3.14%

All rates are annual rates stated for a periodicity of one (effective annual rates).

○ 1.93%

0.96%

○ 1.31%

SAVE

AI-Generated Solution

info

AI-generated content may present inaccurate or offensive content that does not represent bartleby’s views.

Unlock instant AI solutions

Tap the button

to generate a solution

to generate a solution

Click the button to generate

a solution

a solution

Knowledge Booster

Similar questions

- Assume that at time 0 a sum L is lent for a series of n yearly payments. The rth payment, of amount xr, is due at the end of the rth year. Let the effective annual interest rate for the rth year be ir. Give an identity which expresses L in terms of the xr and ir.arrow_forwardNonearrow_forwardSuppose the term structure of interest rates is shown below: Term Rate (EAR%) 1 year 5.00% 2 years 3 years 5 years 10 years 20 years 4.50% 4.30% 4.30% 4.25% 4.15% The present value of receiving $1000 per year with certainty at the end of the next three years is closest to:arrow_forward

- Calculate the geometric (average) return over the 5-year investment period. Year Price 0 19 1 22 2 20 3 23 4 25 5 27 Round your answer to 4 decimal places. For example, if your answer is 3.205%, then please write down 0.0321.arrow_forwardSuppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (ie.. years 2, 3, and 4, respectively) are as follows: 181 = 4%, E(201) = 5%, E(31) = 5.50 %, E(41) = 5.85% Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Round your answers to 2 decimal places.) Years AGN- Current (Long-term) Ratesarrow_forwardFor each of the following cases, indicate (a) what interest rate columns and (b) what number of periods you would refer to in looking up the future value factor. (1) In Table 1 (future value of 1): Number of Annual Rate Years Invested Compounded Case A 5% 5 Annually Case B 8% 6 Semiannually Case A Case B . (a) % % (2) In Table 2 (future value of an annuity of 1): Annual Rate Number of Years Invested Compounded Case A 6% 9 Annually Case B 8% 5 Semiannually Case A Case B (b) periods periods (a) (b) % periods % periodsarrow_forward

- Suppose that the current 1-year rate (1-year spot rate) and expected 1-year T-bill rates over the following three years (i.e., years 2, 3, and 4, respectively) are as follows:1R1 = 2.62%, E(2r1) = 3.90%, E(3r1) = 4.40%, E(4r1) = 5.90%Using the unbiased expectations theory, calculate the current (long-term) rates for one-, two-, three-, and four-year-maturity Treasury securities. (Do not round intermediate calculations. Round your answers to 2 decimal places.)arrow_forwardfollowing questions: a. What is the mid-rate for each maturity? b. What is the annual forward premium for all maturities? (Click on the icon to import the table into a spreadsheet.) Period spot 1 month 2 months 3 months 6 months 12 months 24 months Period Bid Rate Spot 1.3267 1.3265 1.3263 1.3259 1.3250 1.3228 1.3179 a. What is the mid-rate for each maturity? Calculate the mid-rate for each maturity below: (Round to five decimal places.) Days Forward Ask Rate 0 1.3268 1.3266 1.3264 1.3262 1.3252 1.3233 1.3207 Bid Rate US$/€ 1.3267 Ask Rate US$/€ 1.3268 Mid-rate US$/€arrow_forwardIf the compounding frequency is monthly and the discount factor=0.62026, what is the value of the corresponding annual interest rate? What is the corresponding continuous compounding annual interest rate if the discount factor remains at 0.62026?arrow_forward

- Suppose today’s LIBOR rates for 1, 2, 3, 4, 5, and 6 months are 1.6%, 1.8%, 2.0%, 2.0%, 1.9%, and 1.6% with continuous compounding. What are the forward rates for future 1-month periods?arrow_forward3.8 The following table shows the spot rates of interest over a number of horizons: (b) What is the effective rate of interest earned by this annuity-immediate if it were constant through the whole investment period? [Hint: Use the Excel function Rate to compute the rate of interest.] Period of investment (in years) Spot rate (in %) 1 6.00 2 7.00 3 7.75 4 8.25arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education