Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

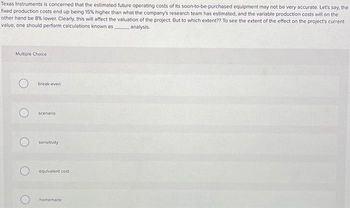

Transcribed Image Text:Texas Instruments is concerned that the estimated future operating costs of its soon-to-be-purchased equipment may not be very accurate. Let's say, the

fixed production costs end up being 15% higher than what the company's research team has estimated, and the variable production costs will on the

other hand be 8% lower. Clearly, this will affect the valuation of the project. But to which extent?? To see the extent of the effect on the project's current

value, one should perform calculations known as analysis.

Multiple Choice

break-even

scenario

O sensitivity

O equivalent cost

homemade

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- A proposed project has a funding requirement of $1M, an NPV of $5M at r = 7% per year, an IRR of 14% per year, and very little risk. Yet it is rejected by the senior management team. What other factor could be wrong with the project proposal? A. Discount Factor too high B. Funding C. Salvage Value D. Time to Payback E. Cumulative Cash Flow not sufficientarrow_forward3. Schultz Company is considering purchasing a machine that would cost $478,800 and have a useful life of 5 years. The machine would reduce cash operating costs by $114,000 per year. The machine would have a salvage value of $6,200. Schultz Company prefers a payback period of 3.5 years or less.Required: a. Compute the payback period for the machine. What does this mean? b. Compute the return on average investment (ROI)arrow_forward1. what amount should be used as the initial cash flow for this project and why?? 2. What is the after-tax salvage value for the spectrometer? 3. What is the MPV of the project? Should the firm accept or reject this project?arrow_forward

- 3. Inflation in project analysis Aa Aa It is often easy to overlook the impact of inflation on the net present value of the project. Not incorporating the impact of inflation in determining the value of the cash flows of the project can result in erroneous estimations. Consider the following scenario: Extensive Enterprise Inc. is considering opening a new division to make iGadgets that it expects to sell at a price of $12,450 each in the first year of the project. The company expects the cost of producing each iGadget to be $6,450 in the first year; however, it expects the selling price and cost per iGadget to increase by 1% each year. Based on this information, complete the following table: Selling price in year 4: Cost per unit in year 4: If a company does not take inflation into account when analyzing a project, the expected net present value (NPV) of the project will typically be than the true NPV of the project.arrow_forwardTLT Ltd is considering the purchase of a new machine for use in its production process. Management has developed three alternative proposals to help evaluate the machine purchase. Only one of these proposals can be implemented. Proposals A and B both have the same cost to set up, but the output from proposal A (as measured by future net cash flows) commences at a high rate and then declines over time, while Proposal B starts at a low rate and then increases over time. Proposal C involves buying two of the machines considered under proposal B. That is, proposal C is simply Proposal B scaled by a factor of two. Proposal C results in net cash flows which are similar in magnitude to proposal A's net cash flows in the first two years. The estimated net cash flows, internal rates of return and net present values at 9% and 11% for each proposal are given in the following table. Proposal A -$290,000 $100,000 $90,000 Proposal B -$290,000 $40,000 $50,000 Proposal C -$580,000 $80,000 $100,000 End…arrow_forwardNote:- Do not provide handwritten solution. Maintain accuracy and quality in your answer. Take care of plagiarism. Answer completely. You will get up vote for sure.arrow_forward

- Basic NPV methods tell us that the value of a project today is NPV0. Time value of money issues also lead us to believe that if we choose not to do the project that it will be worth NPV1 one period from now, such that NPV0 > NPV1. Why then do we see some firms choosing to defer taking on a project?arrow_forwardThe investor-developer would not be comfortable with a 7.8 percent return on cost because the margin for error is too risky. If construction costs are higher or rents are lower than anticipated, the project may not be feasible. The asking price of the project is $12,700,000 and the construction cost per unit is $82,200. The current rent to justify the land acqusition is $2.2 per square foot. The weighted average is 900 square feet per unit. Average vacancy and Operating expenses are 5% and 35% of Gross Revenue respectively. Use the following data to rework the calculations in Concept Box 16.2 in order to assess the feasibility of the project: Required: a. Based on the fact that the project appears to have 9,360 square feet of surface area in excess of zoning requirements, the developer could make an argument to the planning department for an additional 10 units, 250 units in total, or 25 units per acre. What is the percentage return on total cost under the revised proposal? Is the…arrow_forwardGarden-Grow Products is considering a new investment whose data are shown below. The equipment would be depreciated on a straight-line basis over the project's 3-year life, would have a zero salvage value, and would require some additional working capital that would be recovered at the end of the project's life. Revenues and other operating costs are expected to be constant over the project's life. What is the project's NPV? (Hint: Cash flows are constant in Years 1 to 3.) Project cost of capital (r) Net investment in fixed assets (basis) Required new working capital Straight-line deprec. rate Sales revenues, each year Operating costs (excl. deprec.), each year Tax rate a. $31,573 b. $30,069 c. $36,550 d. $34,809 e. $33,152 10.0% $75,000 $15,000 33.333% $75,000 $25,000 25.0%arrow_forward

- 39. Deyland Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost. WACC = 9%. Year 0 a. $24.71 b. $27.46 c. $30.51 d. $33.90 e. $37.29 1 2 3 4 CF, -$1,100 $375 $375 $375 $375 CF₂ $2,200 $725 $725 $725 $725arrow_forwardNast Inc. is considering Projects S and L, whose cash flows are shown below. These projects are mutually exclusive, equally risky, and not repeatable. If the decision is made by choosing the project with the higher MIRR rather than the one with the higher NPV, how much value will be forgone? Note that under some conditions choosing projects on the basis of the MIRR will cause $0.00 value to be lost. WACC: 9.25% CFS CFL 1 2 3 4 -$1,200 $405 $405 $405 $405 -$2,400 $780 $780 $780 $780 0 a. $0.00 b. $210.59 c. $120.02 d. $8.26 e. $7.56arrow_forwardOptiLux is considering Investing in an automated manufacturing system. The system requires an initial Investment of $6.0 million, has a 20-year life, and will have zero salvage value. If the system is Implemented, the company will save $740,000 per year in direct labor costs. The company requires a 10% return from Its Investments. (PV of $1, FV of $1, PVA of $1, and FVA of $1) (Use appropriate factor(s) from the tables provided.) a. Compute the proposed Investment's net present value. b. Using the answer from part a, is the investment's Internal rate of return higher or lower than 10%? Hint: It is not necessary to compute IRR to answer this question. Complete this question by entering your answers in the tabs below. Required A Required B Compute the proposed investment's net present value. Net present valuearrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education