FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

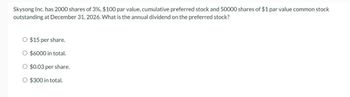

Transcribed Image Text:Skysong Inc. has 2000 shares of 3%, $100 par value, cumulative preferred stock and 50000 shares of $1 par value common stock

outstanding at December 31, 2026. What is the annual dividend on the preferred stock?

O $15 per share.

O $6000 in total.

O $0.03 per share.

O $300 in total.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Please answer do not image formatarrow_forwardSplish Brothers Inc. has 10,800 shares of 8%, $100 par value, cumulative preferred stock outstanding at December 31, 2022. No dividends were declared in 2020 or 2021.If Splish Brothers wants to pay $395,000 of dividends in 2022, what amount of dividends will common stockholders receive? Dividends allocated to common stock $enter Dividends allocated to common stock in dollarsarrow_forwardCBA Incorporated has 400,000 shares outstanding with a $5 par value. The shares were issued for $12. The stock is currently selling for $34. CBA has $5,000,000 in retained earnings and has declared a stock dividend that will increase the number of outstanding shares by 6%. How many shares will be outstanding after the stock dividend? Multiple Choice 376,000 424.000 400,000 9,328,000arrow_forward

- Sandpiper Company has 20,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: 20Y1 $60,000 20Y2 24,000 20Y3 90,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock(dividends per share) Common Stock(dividends per share) 20Y1 fill in the blank fill in the blank 20Y2 fill in the blank fill in the blank 20Y3 fill in the blank fill in the blankarrow_forwardMiriah Inc. has 6,000 shares of 5%, $100 par value, cumulative preferred stock and 50,000 shares of $1 par value common stock outstanding at December 31, 2012. What is the annual dividend on the preferred stock?Select one:a. $0.50 per shareb. $30,000 in totalc. $300 in totald. $50 per sharearrow_forwardWildhorse Appliance Company has 5100 shares of 6%, $50 par value, cumulative preferred stock and 102000 shares of $1 par value common stock outstanding at December 31, 2025, and December 31, 2024. The board of directors declared and paid a $13300 dividend in 2024. In 2025, a total of $60,000 in dividends are declared and paid. What are the dividends received by the preferred stockholders in 2025? O $15300. O $43900. O $30600. O $17300.arrow_forward

- On June 30, 2020, when ABC shares were selling for $ 65 each, the equity accounts had the following balances: Common shares (par value $ 50: 50,000 issued) $ 2,500,000 Capital contributed in excess of par value 600,000 Retained earnings 4,200,000 A 100% share dividend is declared and distributed, the balance of the Common Shares account after recording the dividend will be: a. $2,500,000 b. $7,300,000 c. $3,100,000 d. $5,000,000arrow_forwardDogarrow_forwardWindborn Company has 20,000 shares of cumulative preferred 2% stock, $100 par and 50,000 shares of $20 par common stock. The following amounts were distributed as dividends: 20Y1 $80,000 20Y2 20,000 20Y3 120,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'.arrow_forward

- Please help mearrow_forwardTexas Inc. has 8,000 shares of 6%, $125 par value cumulative preferred stock and 97,000 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? Oa. $60.00 per share Ob. $0.01 per share Oc. $5,820 in total Od. $60,000 in totalarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education