FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Transcribed Image Text:eAssighmer

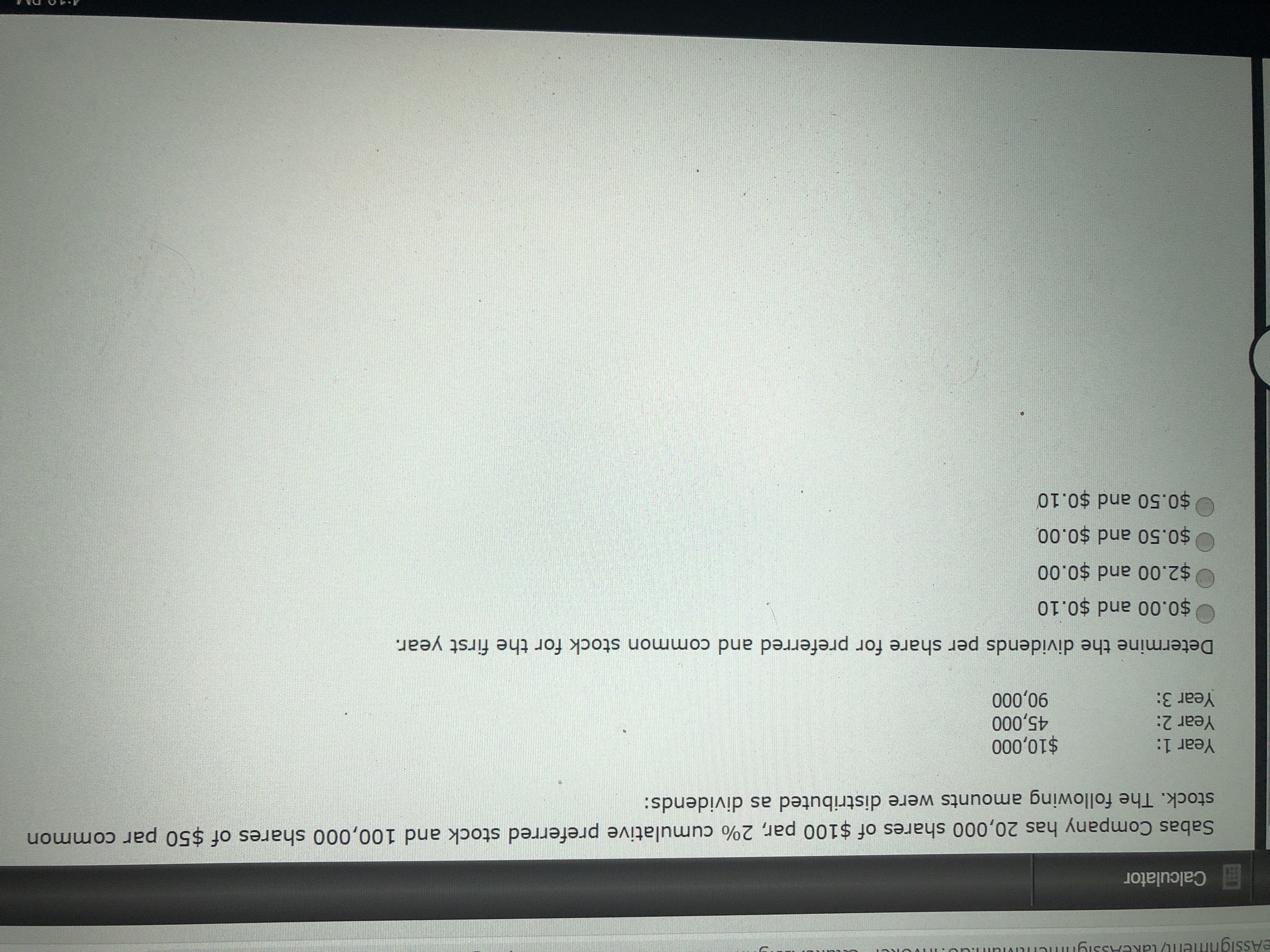

Calculator

Sabas Company has 20,000 shares of $100 par, 2% cumulative preferred stock and 100,000 shares of $50 par common

stock. The following amounts were distributed as dividends:

$10,000

45,000

90,000

Year 1:

Year 2:

Year 3:

Determine the dividends per share for preferred and common stock for the first year.

$0.00 and $0.10

$2.00 and $0.00

$0.50 and $0.00,

$0.50 and $0.10

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 2 images

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

sabas company has issued abd outstanding 37000 shares of 100 par 1% preferred stock and 96000 shares of $50 par common stock

year 1 462,000

year 2 458,000

year 3 586,000

Solution

by Bartleby Expert

Follow-up Questions

Read through expert solutions to related follow-up questions below.

Follow-up Question

sabas company has issued abd outstanding 37000 shares of 100 par 1% preferred stock and 96000 shares of $50 par common stock

year 1 462,000

year 2 458,000

year 3 586,000

Solution

by Bartleby Expert

Knowledge Booster

Similar questions

- Dividend Per Share Windborn Company has 25,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: Year 1 $50,000 Year 2 10,000 Year 3 75,000 Determine the dividend per share for preferred and common stock for each year. Round all answers to two decimal places. If an amount box does not require an entry, leave it blank. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) $ $ $ $ Common stock (Dividend per share) $ $arrow_forwardJordan Company has 1,000 shares of $50 par value, 5% cumulative preferred stock and 50,000 shares of $10 par value common stock outstanding. The company paid total cash dividends of $1,000 in its first year of operation, and declared total cash dividends of $5,000 in its second year of operation. The cash dividend paid to common stockholders in the second year will be: Select one: a. $1,000 b. $2,250 c. $2,750 d. $3,500arrow_forwardHow do I do the journal entries for the following? Unrestricted cash contributions of $1,200,000 were received through the local United Way campaign. An additional $140,000 was received in direct cash contributions, of which $20,000 is restricted to the parolees’ program and $50,000 was for the building fund. Documented promises of $60,000 were received, collectible within the next year. These promises are unrestricted and expected to be 85% collectible. Bad debt expense is included with administrative expenses. PLEASE DONT GIVE handwritten ANSWERS THANKUarrow_forward

- Texas Inc. has 9,000 shares of 8%, $125 par value cumulative preferred stock and 87,000 shares of $1 par value common stock outstanding at December 31. What is the annual dividend on the preferred stock? a. $80.00 per share b. $6,960 in total c. $90,000 in total d. $0.01 per sharearrow_forwardStair Step Company has 20,000 shares of $100 par, 2% cumulative preferred stock, and 100,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year 1: $30,000Year 2: 55,000Year 3: 90,000 Determine the dividends per share for preferred and common stock for the second year.arrow_forwardDividends Per Share Sandpiper Company has 15,000 shares of cumulative preferred 2% stock, $50 par and 50,000 shares of $20 F common stock. The following amounts were distributed as dividends: Year 1 $22,500 Year 2 7,500 Year 3 45,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock Common Stock (dividends per share) (dividends per share) Year 1 Year 2 Year 3arrow_forward

- Dividend Per Share Windborn Company has 25,000 shares of cumulative preferred 3% stock, $100 par and 50,000 shares of $25 par common stock. The following amounts were distributed as dividends: Year 1 $187,500 Year 2 60,000 Year 3 225,000 Determine the dividend per share for preferred and common stock for each year. Round all answers to two decimal places. If an amount box does not require an entry, leave it blank. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) 5. Common stock (Dividend per share) %24 %24arrow_forwardSandpiper Company has 10,000 shares of cumulative preferred 3% stock, $50 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: $37,500 6,000 45,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock (dividends per share) 15,000 X 20Y1 20Y2 20Y3 20Y1 20Y2 20Y3 $ 0 X 0 X Common Stock (dividends per share) LA LA 0 X 0 0 Xarrow_forwardDividends Per Share Windborn Company has 20,000 shares of cumulative preferred 1% stock, $100 par and 50,000 shares of $10 par common stock. The following amounts were distributed as dividends: 20Y1 $30,00020Y2 16,00020Y3 60,000Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Preferred Stock(dividends per share) Common Stock (dividends per share)20Y1 $fill in the blank 1$fill in the blank 220Y2 $fill in the blank 3$fill in the blank 420Y3 $fill in the blank 5$fill in the blank 6arrow_forward

- Dividend Per Share Swilley Furniture Company has 50,000 shares of cumulative preferred 2% stock, $75 par, and 100,000 shares of $10 par common stock. The following amounts were distributed as dividends: Year 1 $45,000 Year 2 123,000 Year 3 130,000 Determine the dividend per share for preferred and common stock for each year. If an amount box does not require an entry, leave it blank. Round all answers to two decimal places. Year 1 Year 2 Year 3 Preferred stock (Dividend per share) Common stock (Dividend per share) %24 %24 %24arrow_forwardSandpiper Company has 30,000 shares of cumulative preferred 2% stock, $150 par and 50,000 shares of $15 par common stock. The following amounts were distributed as dividends: Year 1 $225,000 Year 2 45,000 Year 3 270,000 Determine the dividends per share for preferred and common stock for each year. Round all answers to two decimal places. If an answer is zero, enter '0'. Year 1 Year 2 Year 3 Preferred stock (Dividends per share) $ $ $ Common stock (Dividends per share)arrow_forwardSabas Company has issued and outstanding 45,000 shares of $100 par, 5% preferred stock and 110,000 shares of $50 par common stock. The following amounts were distributed as dividends: Year 1 Year 2 Year 3 $471,000 442,000 500,000 Determine the dividend per share for preferred and common stock for each year. If required, round your answers to two decimal places. Dividend per share: Preferred stock Common stock Year 1 Year 2 Year 3arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education