Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Question

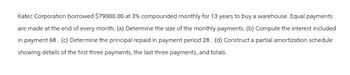

Transcribed Image Text:Katec Corporation borrowed $79000.00 at 3% compounded monthly for 13 years to buy a warehouse. Equal payments

are made at the end of every month. (a) Determine the size of the monthly payments. (b) Compute the interest included

in payment 68. (c) Determine the principal repaid in payment period 28. (d) Construct a partial amortization schedule

showing details of the first three payments, the last three payments, and totals.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 4 steps with 6 images

Knowledge Booster

Similar questions

- $2,950 was deposited at the end of every six months for 8 years into a fund earning 4.5% compounded semi-annually. After this period, the accumulated money was left in the account for another 7 years at the same interest rate. a) Calculate the accumulated amount at the end of the 15-year term. $ b) Calculate the total amount of interest earned during the 15-year period.arrow_forwardCulver Inc. bought an Internet domain name by issuing a $276,000, 6-year, non-interest-bearing note to Ti-Mine Corp. with an effective yield of 10%. The note is repayable in 6 annual payments of $46,000 made at the end of each year. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Prepare the journal entry to record the purchase of the intangible asset. (Round factor values to 5 decimal places, eg. 1.25124 and final answer to O decimal places, eg. 5,275. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter O for the amounts.) Account Titles and Explanation Debit Credit Notes Payablearrow_forwardChuck’s Publishing, Inc. borrows $30,000 from Citicorp to finance the purchase of a new office cooling system. The loan has an interest rate of 12% and Chuck’s will be required to make annual payments for the next 3 years. Fill in the following loan amortization schedule for this transaction.arrow_forward

- A property was purchased for $3976.00 down and payments of $1249.00 at the end of every six months for 6 years. Interest is 8% per annum compounded monthly. What was the purchase price of the property? How much is the cost of financing? The purchase price of the property was $ $☐ (Round the final answer to the nearest cent as needed. Round all intermediate values to six decimal places as needed.)arrow_forwardKavra Corporation purchased a building by signing a $150,000 long-term mortgage with monthly payments of $2,000. The mortgage carries an interest rate of 12 percent. 1. Prepare a monthly payment schedule showing the monthly payment, the interest for the month, the reduction in debt, and the unpaid balance for the first three months. (Round to the nearest dollar.)2. Prepare the journal entries to record the purchase and the first two monthly payments.arrow_forward$4,250 was deposited at the end of every six months for 5 years into a fund earning 2.2% compounded semi-annually. After this period, the accumulated money was left in the account for another 4 years at the same interest rate. a) Calculate the accumulated amount at the end of the 9-year term. $ b) Calculate the total amount of interest earned during the 9-year period.arrow_forward

- Sheridan Company receives a three-year, $9,200, zero-interest-bearing note, and the related present value with a market interest rate of 8% is $7,303.24. The total discount of $1,896.76 under the straight-line method is amortized over the three-year period in equal amounts each year. Therefore, the annual amortization is $1,896.76 ÷ 3 or $632.25. Date of issue End of Year 1 End of Year 2 End of Year 3 Cash Received Click here to view factor tables $0 0 $0 Schedule of Note Discount Amortization Effective Interest Method 0% Note Discounted at 8% Interest Income Discount Amortized $584.26 631.00 681.50 $1,896.76 $584.26. 631.00. 681.50 $1,896.76 Carrying Amount of Note $7,303.24 7,887.50 8,518.50 9,200 Prepare the entry to record the annual interest for years 1 and 2 under the straight-line method and the effective interest method. (Credit account titles are automatically indented when the amount is entered. Do not Indent manually. If no entry is required, select "No Entry" for the…arrow_forwardMurphy Company purchased a new machine for $120,000 on December 31, 2020. They obtained a loan at the bank to finance the purchase. The terms of the loan were: 5 years, 5% interest, annual payments of principal and interest on December 31 of each year. a. Using the table provided, calculate the annual payment on the loan. b. Record the purchase of the new machine on December 31, 2020. c. Record the loan payment on December 31, 2021. d. Record the loan payment on December 31, 2022. d. Calculate the loan balance for December 31, 2022 after the payment. a. Using the table below, calculate the annual payment on the loan. Loan Amount…arrow_forwardEdward purchased a new piece of equipment to be used in its new facility. The $445,000 piece of equipment was purchased with a $66,750 down payment and with cash received through the issuance of a $378,250, 9%, 5-year mortgage payable issued on January 1, 2022. The terms provide for annual installment payments of $97,245 on December 31. 1. Prepare an installment payments schedule for the first five payments of the notes payable 2. Prepare the journal entry related to the notes payable for December 31, 2022. 3. Show the balance sheet presentation for this obligation for December 31, 2022. (Hint: Be sure to distinguish between the current and long-term portions of the note.)arrow_forward

- A firm acquires a warehouse costing $60,000 on January 31. The firm makes a down payment of $7,000 and assumes a 20 year, 6% mortgage for the balance. Interest is payable on January 31 each year. If interest payment on mortgage is recognized on february 28th of the same year, what will be the interest payable.arrow_forwardOn January 1 of this year, Skamania Company completed the following transactions (assume a 8% annual interest rate): (FV of $1, PV of $1, FVA of $1, and PVA of $1) Note: Use the appropriate factor(s) from the tables provided. a. Bought a delivery truck and agreed to pay $60,200 at the end of three years. b. Rented an office building and was given the option of paying $10,200 at the end of each of the next three years or paying $28,200 immediately. c. Established a savings account by depositing a single amount that will increase to $90,400 at the end of seven years. d. Decided to deposit a single sum in the bank that will provide 8 equal annual year-end payments of $40,200 to a retired employee (payments starting December 31 of this year). Required: a. What is the cost of the truck that should be recorded at the time of purchase? b. Which option for the office building results in the lowest present value? c. What single amount must be deposited in this account on January 1 of this year?…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education