FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Subject - account

Please help me.

Thankyou.

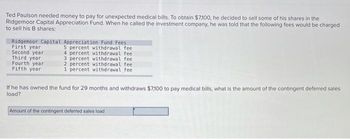

Transcribed Image Text:Ted Paulson needed money to pay for unexpected medical bills. To obtain $7,100, he decided to sell some of his shares in the

Ridgemoor Capital Appreciation Fund. When he called the investment company, he was told that the following fees would be charged

to sell his B shares:

Ridgemoor Capital Appreciation Fund Fees

5 percent withdrawal fee

4 percent withdrawal fee

3 percent withdrawal fee

2 percent withdrawal feel

1 percent withdrawal fee

First year

Second year

Third year

Fourth year

Fifth year

If he has owned the fund for 29 months and withdraws $7,100 to pay medical bills, what is the amount of the contingent deferred sales

load?

Amount of the contingent deferred sales load

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 2 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Jasmine Thompson AutoSave Document4 Word O Search B Share Comment File Insert Draw Design Layout References Mailings Review View Help Home O Find X Cut Calibri (Body) A A Aa A EE v E EE T AaBbCcDd AaBbCcDd AaBbC AABBCCC AaB AaBbCcD AaBbCcDd AaBbCcDd v 12 S Replace Dictate Editor Copy Paste Emphasis BIU ab x, x' A ~ A EEEE E - 1 Normal 1 No Spac. Heading 1 Heading 2 Title Subtitle Subtle Em... A Select V Format Painter Styles Editing Voice Editor Clipboard Font Paragraph 3 4 5. 6. 1 2. In Year 2, Chalon Company records the payment of $450 cash for an expense accrued in Year 1 and records the accrual of $425 for another expense. Additionally, Chalon Company pays $475 for supplies that were purchased in Year 1 on account. The impact of these three entries on Year 2 total expenses and total liabilities is: Total Expenses Liabilities a. increase by $425 decrease by $500 b. increase by $450 decrease by $25 c. increase by $425 increase by $25 d. increase by $900 decrease by $500 e. increase…arrow_forwardI have answered A-I in the pictures I posted below. I need the answers to J-L.arrow_forward/ List the system defaults account in Quick Books and explain the purpose of any FOUR default accounts (hint- there are many such accounts in Quick Books)arrow_forward

- name the account to be debited and the name of the account to be credited for each transaction. *arrow_forwardClicking Generate at the bottom of the A/P Create Payment Batch form creates a payment batch. Group of answer choices. True Falsearrow_forwardWhat does the QuickBooks Online Check Register do?arrow_forward

- Safari File Edit View History Bookmarks Window Help uLink - Student... W 1. 2. uLink - Student... 3. 4. learn-eu-central-1-prod-fleet01-xythos.content.blackboardcdn.com uLink - Student... 21 445 Entity A enters into the following transactions. You are required to show the impact of the transactions below on the accounting equation. e Content 9 Bb https://learn-eu-... Entity A purchased 1 000 bags of cement from K Ltd on credit. K Ltd normally sells a bag for R45. Entity A received a 10% discount for the 1 000 bags. Entity A returned 150 bags of cement, as they were defective. On the same day, the outstanding balance was settled through an online payment. This transaction did not affect the discount offered to Entity A. Select the correct values from the dropdown menus in the table provided in the Blackboard activity. MAR 7 In an attempt to assist the business, the owner of Entity A deposited R100 000 into the entity's bank account. A quarter of the amount is payable to the owner and…arrow_forwardSubject : Accounting what is the lowest subscription level of QuickBooks online that allows custom fields to be added to purchase orders?arrow_forwardAny help is appreciated, here is the question. https://drive.google.com/file/d/0B-AOAJtLKPhfOEJhR0RWRWtmT3BGVVljQUZaRko0Zkh2NDRr/view?usp=sharingarrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education