FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

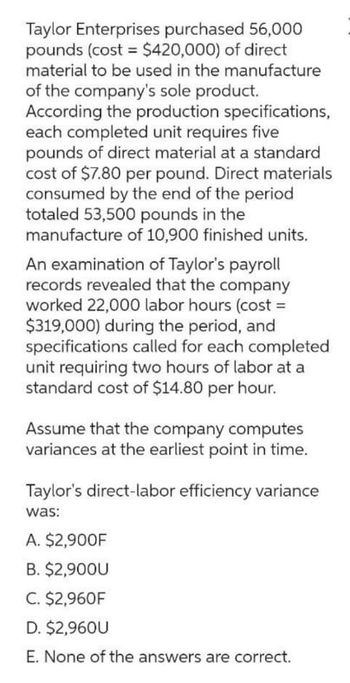

Transcribed Image Text:Taylor Enterprises purchased 56,000

pounds (cost= $420,000) of direct

material to be used in the manufacture

of the company's sole product.

According the production specifications,

each completed unit requires five

pounds of direct material at a standard

cost of $7.80 per pound. Direct materials

consumed by the end of the period

totaled 53,500 pounds in the

manufacture of 10,900 finished units.

An examination of Taylor's payroll

records revealed that the company

worked 22,000 labor hours (cost=

$319,000) during the period, and

specifications called for each completed

unit requiring two hours of labor at a

standard cost of $14.80 per hour.

Assume that the company computes

variances at the earliest point in time.

Taylor's direct-labor efficiency variance

was:

A. $2,900F

B. $2,900U

C. $2,960F

D. $2,960U

E. None of the answers are correct.

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps with 1 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Graham Petroleum produces oil. On May 1, it had no work-in-process inventory. It started production of 205 million barrels of oil in May and shipped 175 million barrels in the pipeline. The costs of the resources used by Graham in May consist of the following: Materials $ 1,981 million Conversion costs (labor and overhead) $ 3,230 million Required: The production supervisor estimates that the ending work in process is 60 percent complete on May 31. Compute the cost of oil shipped in the pipeline and the amount in work-in-process ending inventory as of May 31. (Do not round intermediate calculations. Enter your answers in millions. For example, enter "1" instead of "1,000,000".)arrow_forwardThe cost of direct materials transferred into the Rolling Department of Kraus Company is $3,000,000. The conversion cost for the period in the Rolling Department is $462,600. The total equivalent units for direct materials and conversion are 4,000 tons and 3,855 tons, respectively. Determine the direct materials and conversion costs per equivalent unit.arrow_forwardKramer Corp. began the current period with 4,030 units in process that were 100% complete as to materials and 60% complete as to conversion. Costs of $7,500 in direct materials and $4,720 in conversion costs were incurred in manufacturing those units in the previous period. Kramer ended the current period with 20,100 units completed and 5,010 units still in process. Work in process was 100% complete as to materials and 70% complete as to conversion costs. Kramer incurred $68,000 in direct materials costs, $7,190 in direct labor costs, and $40,100 in manufacturing overhead costs during the period.arrow_forward

- Northern Company processes 100 gallons of raw materials into 75 gallons of product GS-50 and 25 gallons of GS-80. GS-50 is further processed into 50 gallons of product GS-505 at a cost of $7,250, and GS-80 is processed into 50 gallons of product GS-805 at a cost of $5,750. The production process starts at point 1. A total of $20,000 in joint manufacturing costs are incurred in reaching point 2. Point 2 is the split-off point of the process that manufactures GS-50 and GS-80. At this point, GS-50 can be sold for $725 a gallon, and GS-80 can be sold for $145 a gallon. The process is completed at point 3-products GS-505 and GS-805 have a sales price of $585 a gallon and $225 a gallon, respectively. Required: Allocate the joint product costs and then compute the cost per unit using each of the following methods: (1) physical measure, (2) sales value at split-off, and (3) net realizable value. (Do not round intermediate calculations. Round your final answers to nearest whole dollar amount.)…arrow_forwardThe cost of direct materials transferred into the Filling Department of Eve Cosmetics Company is $401,280. The conversion cost for the period in the Filling Department is $252,320. The total equivalent units for direct materials and conversion are 60,800 ounces and 66,400 ounces, respectively. Determine the direct materials and conversion costs per equivalent unit. If required, round to the nearest cent. Direct materials cost per equivalent unit: Conversion costs per equivalent unit:arrow_forwardAlpesharrow_forward

- The cost of direct materials transferred into the Bottling Department of the Mountain Springs Water Company is $1,000,500. The conversion cost for the period in the Bottling Department is $648,000. The total equivalent units for direct materials and conversion are 34,500 liters and 7,200 liters, respectively. Determine the direct materials and conversion cost equivalent unit. Cost per equivalent unit of materials Cost per equivalent unit of conversionarrow_forwardWexpro, Incorporated, produces several products from processing 1 ton of clypton, a rare mineral. Material and processing costs total $60,000 per ton, one-fourth of which is allocated to product X15. Seven thousand units of product X15 are produced from each ton of clypton. The units can either be sold at the split-off point for $9 each, or processed further at a total cost of $9,500 and then sold for $12 each. Required: 1. What is the financial advantage (disadvantage) of further processing product X15? 2. Should product X15 be processed further or sold at the split-off point? 1. 2. Answer is complete but not entirely correct. Financial advantage Product X15 should be 48,000 Processed furtherarrow_forwardam.1234.arrow_forward

- The cost of direct materials transferred into the Filling Department of Eve Cosmetics Company is $122,880. The conversion cost for the period in the Filling Department is $398,240. The total equivalent units for direct materials and conversion are 51,200 ounces and 52,400 ounces, respectively. Determine the direct materials and conversion costs per equivalent unit. If required, round to the nearest cent.arrow_forwardAxel Ltd. began operations on October 1 of the current year. Its production requires that direct materials be added at the beginning of the process, and conversion costs are incurred uniformly. Direct materials costs for October were $380,000, and conversion costs were $1,750,000. There were 80,000 units started during the month. The ending inventory was 25,000 units, which were 60% complete. What was the cost per equivalent unit for conversion? Round to the nearest cent. OA. $70.00 OB. $25.00 OC. $21.88 O D. $16.67 OE. $116.67arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education