Essentials Of Investments

11th Edition

ISBN: 9781260013924

Author: Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

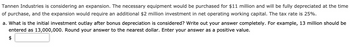

Transcribed Image Text:Tannen Industries is considering an expansion. The necessary equipment would be purchased for $11 million and will be fully depreciated at the time

of purchase, and the expansion would require an additional $2 million investment in net operating working capital. The tax rate is 25%.

a. What is the initial investment outlay after bonus depreciation is considered? Write out your answer completely. For example, 13 million should be

entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value.

$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- You are evaluating a project that will cost $543,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.9% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company?arrow_forwardYou are evaluating a project that will cost $502,000, but is expected to produce cash flows of $127,000 per year for 10 years, with the first cash flow in one year. Your cost of capital is 10.7% and your company's preferred payback period is three years or less. a. What is the payback period of this project? b. Should you take the project if you want to increase the value of the company? a. What is the payback period of this project? The payback period is years. (Round to two decimal places.) b. Should you take the project if you want to increase the value of the company? (Select from the drop-down menus.) If you want to increase the value of the company you take the project since the NPV is will not willarrow_forwardTannen Industries is considering an expansion. The necessary equipment would be purchased for $16 million and will be fully depreciated at the time of purchase, and the expansion would require an additional $3 million investment in net operating working capital. The tax rate is 25%. a. What is the initial investment outlay after bonus depreciation is considered? Write out your answer completely. For example, 13 million should be entered as 13,000,000. Round your answer to the nearest dollar. Enter your answer as a positive value. b. The company spent and expensed $20,000 on research related to the project last year. Would this change your answer? Explain. I. No, last year's expenditure is considered a sunk cost and does not represent an incremental cash flow. Hence, it should not be included in the analysis. II. Yes, the cost of research is an incremental cash flow and should be included in the analysis. III. Yes, but only the tax effect of the research expenses should be included in…arrow_forward

- You are considering opening a new plant. The plant will cost $102.5 million upfront and will take one year to build. After that, it is expected to produce profits of $28.4 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 6.7%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule? Here is the cash flow timeline for this problem: Years 0 Cash Flow ($ million) - 102.5 1 2 28.4 3 28.4 4 28.4 Forever 28.4arrow_forwardCompute the net present value of this investment.arrow_forwardYokam Company is considering two alternative projects. Project 1 requires an initial investment of $470,000 and has a present value of all its cash flows of $2,350,000. Project 2 requires an initial investment of $5,000,000 and has a present value of all its cash flows of $6,000,000. (a) Compute the profitability index for each project. (b) Based on the profitability index, which project should the company select? Complete this question by entering your answers in the tabs below. Required A Required B Compute the profitability index for each project. Profitability Index Numerator: Denominator: Profitability Index = Profitability index Project 1 Project 2arrow_forward

- DDR Enterprises is analyzing an expansion project. The project's installed cost is $80,000. It is eligible for 100% bonus depreciation. The project has a $12,000 salvage value at the end of its five year expected life. The project will requie an additional $8,000 investment in net working capital. The tax rate is 25%. What is the project's initial investment? If you could show the steps in calcualtion too that would be great!arrow_forwardSons Inc. management is considering purchasing a new machine at a cost of $4,390,000. They expect this equipment to produce cash flows of $845,890, $819,250, $917,830, $1,103,400, $1,093,260, and $1,306,800 over the next six years. If the appropriate discount rate is 15 percent, what is the NPV of this investment? (Enter negative amounts using negative sign e.g. -45.25. Do not round discount factors. Round other intermediate calculations and final answer to 0 decimal places, e.g. 1,525.) The NPV is $arrow_forwardYou are considering opening a new plant. The plant will cost $96.2 million upfront and will take one year to build. After that, it is expected to produce profits of $30.2 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 8.2%. Should you make the investment? Calculate the IRR. Does the IRR rule agree with the NPV rule? Here is the cash flow timeline for this problem: Years Cash Flow ($ million) 0 -96.2 1 2 + 30.2 3 30.2 4 30.2 Forever 30.2arrow_forward

- You are considering opening a new plant. The plant will cost $95.1 million up front and will take one year to build. After that it is expected to produce profits of $31.8 million at the end of every year of production. The cash flows are expected to last forever. Calculate the NPV of this investment opportunity if your cost of capital is 7.6%. Should you make the investment? Calculate the IRR and use it to determine the maximum deviation allowable in the cost of capital estimate to leave the decision unchanged. The NPV of the project will be $ million. (Round to one decimal place.)arrow_forwardPlease see image for question to solve.arrow_forwardCompany X is considering an investment project that requires an initial outlay of $500,000 and is expected to generate annual cash flows of $150,000 for five years. The company's cost of capital is 10%. • Calculate the NPV of the proposed investment project. Determine whether it is financially viable for Company X.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Essentials Of Investments

Finance

ISBN:9781260013924

Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.

Publisher:Mcgraw-hill Education,

Foundations Of Finance

Finance

ISBN:9780134897264

Author:KEOWN, Arthur J., Martin, John D., PETTY, J. William

Publisher:Pearson,

Fundamentals of Financial Management (MindTap Cou...

Finance

ISBN:9781337395250

Author:Eugene F. Brigham, Joel F. Houston

Publisher:Cengage Learning

Corporate Finance (The Mcgraw-hill/Irwin Series i...

Finance

ISBN:9780077861759

Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan Professor

Publisher:McGraw-Hill Education