FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Not one person has gotten this correct so far - please just give the CORRECT answers to this ASAP! I will give thumbs up for correct numbers.

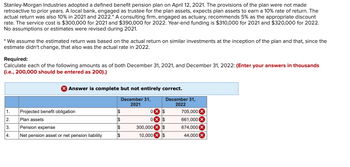

Transcribed Image Text:Stanley-Morgan Industries adopted a defined benefit pension plan on April 12, 2021. The provisions of the plan were not made

retroactive to prior years. A local bank, engaged as trustee for the plan assets, expects plan assets to earn a 10% rate of return. The

actual return was also 10% in 2021 and 2022.* A consulting firm, engaged as actuary, recommends 5% as the appropriate discount

rate. The service cost is $300,000 for 2021 and $390,000 for 2022. Year-end funding is $310,000 for 2021 and $320,000 for 2022.

No assumptions or estimates were revised during 2021.

* We assume the estimated return was based on the actual return on similar investments at the inception of the plan and that, since the

estimate didn't change, that also was the actual rate in 2022.

Required:

Calculate each of the following amounts as of both December 31, 2021, and December 31, 2022: (Enter your answers in thousands

(i.e., 200,000 should be entered as 200).)

X Answer is complete but not entirely correct.

December 31,

2021

1. Projected benefit obligation

2.

3.

4.

Plan assets

Pension expense

Net pension asset or net pension liability

$

$

$

$

0X $

0X $

300,000 $

10,000 X $

December 31,

2022

705,000 X

661,000 X

674,000 X

44,000 X

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 2 steps with 4 images

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- My bank requires me to establish a four digit pin My bank requires me to establish a four digit pin number for my debit card. a. How many possible pin numbers can I choose from? b. What is the probability that someone can correctly guess my pin number? My bank requires me to establish a four digit pinarrow_forwardhelp please answer in text form with proper workings and explanation for each and every part and steps with concept and introduction no AI no copy paste remember answer must be in proper format with all workingarrow_forwardplease help with the question that is attached as a picture. thanksarrow_forward

- The answer 417,974.94 was correct. Can you please help me solve without technology? Formulas used, etc. Thank you!arrow_forwardWhat does the QuickBooks Online Check Register do?arrow_forwardUsing Excel, create a table that shows the relationship between the interestearned and the amount deposited, as shown. we will first create the dollar amount column and the interest row, as shown . Next we will type into cell B3 the formula = $A3*B$2. We can now use the Fill command to copy the formula in other cells, resulting in the table as shown. Note that the dollar sign before A3 means column A is to remain unchanged in the calculations when the formula is copied into other cells. Also note that the dollar sign before 2 means that row 2 is to remain unchanged in calculations when the Fill command is used.arrow_forward

- Hi, Could you please show me how to solve this with formulas? not excel, I should have clarified. Thanksarrow_forwardThe first part of the assignment is to open Excel and in column A starting in row 1 and down to row 40 generate random values using the RAND() function. Copy and special paste those values onto sheet2. You will turn in the Excel file, but you will use the information below when directed. Say an individual is faced with the decision of whether to buy auto insurance or not (like before laws in many states changed). The states of nature are that no accident occurs (with probability .992) or an accident occurs (with probability .008). Here is the payoff table for the decision maker (where -500 is read minus 500, for example) State of Nature Decision No Accident Accident Purchase insurance -500 -500 Do not purchase Ins. 0 -10000 1. Say the individual is a RISK LOVER. Create a table with plausible values of utility for the risk lover where you pick as the indifference probability for the value -500 the first value that is appropriate from your simulation in Excel (starting in cell A1 on…arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education