Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Question

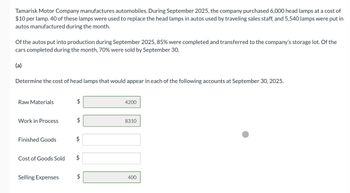

Transcribed Image Text:Tamarisk Motor Company manufactures automobiles. During September 2025, the company purchased 6,000 head lamps at a cost of

$10 per lamp. 40 of these lamps were used to replace the head lamps in autos used by traveling sales staff, and 5,540 lamps were put in

autos manufactured during the month.

Of the autos put into production during September 2025, 85% were completed and transferred to the company's storage lot. Of the

cars completed during the month, 70% were sold by September 30.

(a)

Determine the cost of head lamps that would appear in each of the following accounts at September 30, 2025.

Raw Materials

Work in Process

Finished Goods

A

4200

$

8310

Cost of Goods Sold

+A

A

Selling Expenses

$

400

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

Step by stepSolved in 2 steps

Knowledge Booster

Similar questions

- McCrane Motor Company manufactures automobiles. During September 2020, the company purchased 9,000 head lamps at a cost of $10 per lamp. 70 of these lamps were used to replace the head lamps in autos used by traveling sales staff, and 8,300 lamps were put in autos manufactured during the month.Of the autos put into production during September 2020, 80% were completed and transferred to the company’s storage lot. Of the cars completed during the month, 70% were sold by September 30.(a)Determine the cost of head lamps that would appear in each of the following accounts at September 30, 2020: Raw Materials, Work in Process, Finished Goods, Cost of Goods Sold, and Selling Expenses.arrow_forwardABC Company manufactures boats. During September, 2020, the company purchased 100 cellular phones at a cost of P100 each. Isaac withdrew 70 phones from the warehouse during the month. Twenty of these phones were installed in salespersons’ cars and the remaining 50 phones were put in boats manufactured during the month. Of the boats put into production during September, 2020, 80% were completed and transferred to the company's storage lot. Fifty percent of the boats completed during the month were sold by September 30. COMPUTE FOR THE: 1. cost of goods sold 2.COMPUTE THE SELLING EXPENSES 3. COMPUTE HOW MUCH IS THE FINISHED GOODS INVENTORY OF CELLULAR PHONES 4. COMPUTE HOW MUCH IS THE WORK IN PROCESS INVENTORY OF CELLULAR PHONES 5. COMPUTE HOW MUCH IS THE RAW MATERIALS INVENTORY OF CELLULAR PHONESarrow_forwardIbri Company, a manufacturer of stereo systems, started its production in January 2018. For the preceding 3 years had been a retailer of stereo systems. After a thorough survey of stereo system markets, Ibri Company decided to turn its retail store into a stereo equipment factory. Raw materials cost for a stereo system will total $77 per unit. Workers on the production lines are on average paid $11 per hour. A stereo system usually takes 4 hours to complete. In addition, the rent on the equipment used to assemble stereo systems amounts to $5,200 per month. Indirect materials cost $5 per system. A supervisor was hired to oversee production; her monthly salary is $3,000. Factory janitorial costs are $1,000 monthly. Advertising costs for the stereo system will be $5,000 per month. The factory building depreciation expense is $8,400 per year. Property taxes on the factory building will be $12,000 per year. Instructions Prepare an answer sheet with the following column headings. Cost…arrow_forward

- Rubble, Inc. produced 1,000 backpacks, the company's product in 2020. The standard cost was 3 yards of cloth at a standard cost of $1.00 per yard. The accounting records show that 2,900 yards of cloth were used, and the company paid $1.05 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.75 per direct labor hours. Employees worked a total of 1,800 hours and were paid $9.25 per hour.1. Calculate the direct materials cost variance and the direct materials efficiency variance.arrow_forwardA consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse and converted it into a manufacturing plant for $8,000,000. It completed installation of assembly equipment worth $1,700,000 on December 31st. The plant began operation on January 1st. The company had a gross income of $8,600,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $2,170,000. The depreciation expenses for capital expenditures amounted to $465,000. The corporate tax rate is 21%. (a) Compute the taxable income of this company. The taxable income of this company is $ (Round to the nearest dollar.)arrow_forwardA consumer electronics company was formed to develop cell phones that run on or are recharged by fuel cells. The company purchased a warehouse and converted it into a manufacturing plant for $8,000,000. It completed installation of assembly equipment worth $1,700,000 on December 31st. The plant began operation on January 1st. The company had a gross income of $8,600,000 for the calendar year. Manufacturing costs and all operating expenses, excluding the capital expenditures, were $2,170,000. The depreciation expenses for capital expenditures amounted to $465,000. The corporate tax rate is 21%. (a) Compute the taxable income of this company. The taxable income of this company is $ 5965000. (Round to the nearest dollar.) (b) How much will the company pay in federal income taxes for the year? The federal income taxes for the year will be $ (Round to the nearest dollar.)arrow_forward

- The controller for Nina Group reviewed the following large transactions this month for the company: ● Purchase of a forklift to use in the warehouse: $32,000 (8-year life, depreciated on a straight-line basis, recorded monthly). ● Purchase of materials for use in the production of wheelbarrows (the company’s primary product): $114,000 (all was used in production this month, and all units produced were sold). ● Recognized payroll costs for this month’s production, office, and administrative employees: $45,000 (one-third for each category). ● Investment in mutual funds (with excess cash): $65,000. What dollar amount from these transactions would be recorded as an expense this month? What dollar amount would still be listed as an asset at the end of the month?arrow_forwardHarold Manufacturing produces denim clothing. This year, it produced 5,280 denim jackets at a manufacturing cost of $41.00 each. These jackets were damaged in the warehouse during storage. Management investigated the matter and identified three alternatives for these jackets. 1. Jackets can be sold to a secondhand clothing shop for $7.00 each. 2. Jackets can be disassembled at a cost of $32,800 and sold to a recycler for $11.00 each. 3. Jackets can be reworked and turned into good jackets. However, with the damage, management estimates it will be able to assemble the good parts of the 5,280 jackets into only 3,050 jackets. The remaining pieces of fabric will be discarded. The cost of reworking the jackets will be $101,400, but the jackets can then be sold for their regular price of $41.00 each. Required: 1. Calculate the incremental income. Incremental revenue Incremental costs Incremental income Alternative 1 Sell to a second- hand shop Alternative 2 Disassemble and sell to a recycler…arrow_forwardThe Devon Motor Company produces automobiles. On April 1, the company had no beginning inventories, and it purchased 8,000 batteries at a cost of $80 per battery. It withdrew 7,600 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in cars used by the company's traveling sales staff. The remaining 7,500 batteries withdrawn from the storeroom were placed in cars being produced by the company. Of the cars in production during April, 90 percent were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30 percent were unsold at April 30. Required: 1. and 2. Determine the cost of batteries appearing in each of the following accounts on April 30 and select whether each of the accounts would appear on the balance sheet or on the income statement. Name of the Account Raw Materials Work in Process Finished Goods Cost of Goods Sold Selling Expense Cost Appears on:arrow_forward

- Bell Company, a manufacturer of audio systems, started its production in October 2017. For the preceding 3 years, Bell had been a retailer of audio systems. After a thorough survey of audio system markets, Bell decided to turn its retail store into an audio equipment factory.Raw materials cost for an audio system will total $75 per unit. Workers on the production lines are on average paid $15 per hour. An audio system usually takes 7 hours to complete. In addition, the rent on the equipment used to assemble audio systems amounts to $5,120 per month. Indirect materials cost $6 per system. A supervisor was hired to oversee production; her monthly salary is $3,840.Factory janitorial costs are $1,410 monthly. Advertising costs for the audio system will be $8,750 per month. The factory building depreciation expense is $7,200 per year. Property taxes on the factory building will be $9,000 per year. Assuming that Bell manufactures, on average, 1,520 audio systems per month, enter…arrow_forwardThe Devon Motor Company produces automobiles. On April 1, the company had no beginning inventories, and it purchased 8,000 batteries at a cost of $80 per battery. It withdrew 7,600 batteries from the storeroom during the month. Of these, 100 were used to replace batteries in cars being used by the company’s traveling sales staff. The remaining 7,500 batteries withdrawn from the storeroom were placed in cars being produced by the company. Of the cars in production during April, 90 percent were completed and transferred from work in process to finished goods. Of the cars completed during the month, 30 percent were unsold at April 30. Required: 1. Determine the cost of batteries that would appear in each of the following accounts on April 30. Name of the Account Cost 1a. Raw Materials $32,000 1b. Work in Process $60,000 1c. Finished Goods 1d. Cost of Goods Sold 1e. Selling Expense $8,000arrow_forwardRubble, Inc. produced 1,100 backpacks, the company's product in 2020. The standard cost was 4 yards of cloth at a standard cost of $0.90 per yard. The accounting records show that 2,700 yards of cloth were used, and the company paid $1.15 per yard. Standard time to make the backpacks was 2 direct labor hours per unit at a standard rate of $9.80 per direct labor hours. Employees worked a total of 1,500 hours and were paid $9.15 per hour.Calculate the direct labor cost variance.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning