FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

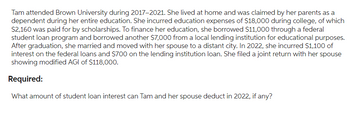

Transcribed Image Text:Tam attended Brown University during 2017-2021. She lived at home and was claimed by her parents as a

dependent during her entire education. She incurred education expenses of $18,000 during college, of which

$2,160 was paid for by scholarships. To finance her education, she borrowed $11,000 through a federal

student loan program and borrowed another $7,000 from a local lending institution for educational purposes.

After graduation, she married and moved with her spouse to a distant city. In 2022, she incurred $1,100 of

interest on the federal loans and $700 on the lending institution loan. She filed a joint return with her spouse

showing modified AGI of $118,000.

Required:

What amount of student loan interest can Tam and her spouse deduct in 2022, if any?

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Similar questions

- Godo In 2017, Karen purchased a house for $150,000 to use as her personal residence. She paid $30,000 and borrowed $120,000 from the local savings and loan company. In 2020, she paid $20,000 to add a room to the house. In 2022 she paid $2,400 to have the house painted and $1,200 for built-in bookshelves. As of January 1 of the current year, she has reduced the $120,000 mortgage to $108,300. What is her basis for the house?arrow_forwardBruce and Amanda are married during the tax year. Bruce is a botanist at Green Corporation. Bruce earns a salary of $56,000 per year. Green Corporation has an accountable reimbursement plan. During the year, Bruce has $5,000 of employee expenses. Green Corporation reimburses Bruce for only $4,000 of expenses.Bruce decides to put $5,500 into a Traditional IRA. Amanda owns a financial consulting firm as a sole proprietor (it qualifies as a full trade or business). Amanda generates $80,000 of revenues during the year. She has the following business payments associated with her firm:● Utilities: $2,000● Office Rent: $14,000● Self-Employment Tax: $5,000● Salary for her secretary: $20,000● Fines/Penalties: $8,000● Payroll Taxes (Employer Portion): $1,000● Business Meals: $2,000● Bribe to police officer to forgive parking violation $1,500Due to the income and expenses above, Amanda has $39,500 of Qualified Business Income. Also, during the year a tornado damaged the roof of their personal…arrow_forwardAlexa owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses inconnection with her condo:Insurance $ 2,000Mortgage interest 6,500Property taxes 2,000Repairs & maintenance 1,400Utilities 2,500Depreciation 14,500 During the year, Alexa rented out the condo for 100 days. She did not use the condo at all for personalpurposes during the year. Alexa's AGI from all sources other than the rental property is $200,000. Unlessotherwise specified, Alexa has no sources of passive income.Assume Alexa receives $30,000 in gross rental receipts. a. What effect do the expenses associated with the property have on her AGI?b. What effect do the expenses associated with the property have on her itemized deductions?arrow_forward

- Richie is an unmarried law student at State University Law School, a qualified educational institution. This year Richie borrowed $24,000 from County Bank and paid interest of $1,440. Richie used the loan proceeds to pay his law school tuition. Calculate the amounts Richie can deduct for higher education expenses and interest on higher education loans under the following circumstances: Richie’s AGI before deducting interest on higher education loans is $50,000.arrow_forwardJackson, a head of household taxpayer, has a 20-year-old daughter, Emma, who attends the University of Minnesota full-time. During 2020, Jackson incurred the following expenses related to Emma's education: 1. Tuition and fees - $13,750 2. Textbooks - $785 3. Rent for campus apartment - $4,200 4. Campus dining plan - $2,150 5. Laptop - $3,600 6. Clothes, toiletries, transportation - $1,890 Jackson paid for Emma's living expenses out of pocket each month, but he took out a loan to cover her tuition and fees, the campus dining plan, and her laptop. During 2020, he paid a total of $895 of interest on that loan. Assuming that Jackson is not subject to an AGI limitation, how much of Emma's college expenses can Jackson deduct in 2020?arrow_forwardJeff is a single taxpayer who sold his home when he was transferred from NY to Denver by hisemployer. He purchased the home on January 10, 2013. He was sent by his company for temporaryassignment to Detroit on February 1, 2016, that lasted for longer and was gone for 16 months in2016 and 2017, during which time he rented out his home. He moved back into the home on June 3,2017. He sold the home on March 15, 2020. Jeff can claim an exclusion of gain on the sale up to:Select one:a. $500,000b. $300,000c. $250,000d. $0arrow_forward

- Adrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,250 in child care expenses so that she would be able to work. Of this amount, $620 was paid to Adrienne's mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $1,500 from her jewelry business. In addition, she received child support payments of $20,500 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forwardRichard is age 39 and was widowed in 2017. He has a daughter, Isabella, age 5.• Richard provided the entire cost of maintaining the household and over half of the support for Isabella. In order to work, he pays childcare expenses to Busy Bee Daycare.• Richard declined to receive advance child tax credit payments in 2021.• Richard’s earned income in 2019 was $19,000.• Richard and Isabella are U.S. citizens and lived in the United States all year in 2021.• Richard received the third Economic Impact Payment (EIP3) in the amount of $2,800 in 2021. 30. Richard is not eligible to claim the Qualifying Widower filing status. true or false 31. What is Richard’s adjusted gross income on his Form 1040? A. $41,500 B. $41,580 C. $41,600 D. $41,620 32. Richard is eligible to claim the child…arrow_forwardAshley Panda lives at 1310 Meadow Lane, Wayne, OH 43466, and her Social Security number is 123-45-6777. Ashley is single and has a 20-year-old son, Bill. His Social Security number is 111-11-1112. Bill lives with Ashley, and she fully supports him. Bill spent 2019 traveling in Europe and was not a college student. He had gross income of $4,655 in 2019. Bill paid $4,000 of lodging expenses that Ashley reimbursed after they were fully documented. Ashley paid the $4,000 to Bill using a check from her sole proprietorship. That amount is not included in the items listed below. Ashley had substantial health problems during 2019, and many of her expenses were not reimbursed by her health insurance. Ashley owns Panda Enterprises, LLC (98-7654321), a data processing service that she reports as a sole proprietorship. Her business is located at 456 Hill Street, Wayne, OH 43466. The business activity code is 514210. Her 2019 Form 1040, Schedule C for Panda Enterprises shows revenues of $315,000,…arrow_forward

- Jane Smith, age 40, is single and has no dependents. She is employed as a legal secretary by Legal Services, Inc. She owns and operates Typing Services located near the campus of Florida Atlantic University at 1986 Campus Drive, Boca Raton, FL 33434. Jane is a material participant in the business. She is a cash basis taxpayer. Jane lives at 2020 Oakcrest Road, Boca Raton, FL 33431. Jane’s Social Security num-ber is 123-45-6781. Jane indicates that she wants to designate $3 to the Presidential Election Campaign Fund. Jane has never owned or used any virtual currency. During 2019, Jane had the following income and expense items: a. $100,000 salary from Legal Services, Inc. b. $20,000 gross receipts from her typing services business. c. $700 interest income from Third National Bank. d. $1,000 Christmas bonus from Legal Services, Inc. e. $60,000 life insurance proceeds on the death of her sister. f. $5,000 check given to her by her wealthy aunt. g. $100 won in a bingo game. h. Expenses…arrow_forwardAdrienne is a single mother with a six-year-old daughter who lived with her during the entire year. Adrienne paid $2,350 in child care expenses so that she would be able to work. Of this amount, $660 was paid to Adrienne’s mother, whom Adrienne cannot claim as a dependent. Adrienne had net earnings of $1,700 from her jewelry business. In addition, she received child support payments of $20,700 from her ex-husband. Use Child and Dependent Care Credit AGI schedule. Required: What amount, if any, of child and dependent care credit can Adrienne claim?arrow_forwardPenelope is 38 and pays college expenses for herself and her dependent son, Mike, age 18. Penelope is attending the University of Wyoming to earn a doctorate degree. Mike is attending Sheridan College full-time, working on an AS in Business. What education credits, if any, would Penelope be eligible for?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education