FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Concept explainers

Question

Transcribed Image Text:In 2022, Laureen is currently single. She paid $2,580 of qualified tuition and related expenses for each of her twin daughters, Sheri and Meri, to attend State University as freshmen (a total of $5,160). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,840 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,340 for herself to attend seminars at a community college to help her improve her job skills.

What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios?

Note: Leave no answer blank. Enter zero if applicable.

**Required:**

a. Laureen's AGI is $45,000.

b. Laureen's AGI is $95,000.

c. Laureen's AGI is $45,000, and Laureen paid $12,280 (not $1,840) for Ryan to attend graduate school (i.e., his fifth year, not his junior year).

---

**Complete this question by entering your answers in the tabs below.**

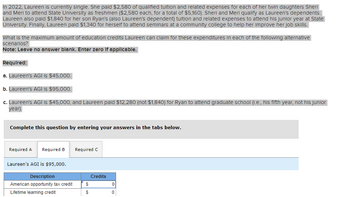

**Required B**

Laureen's AGI is $95,000.

| Description | Credits |

|---------------------------------|---------|

| American opportunity tax credit | $0 |

| Lifetime learning credit | $0 |

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Hanshabenarrow_forwardReba divorced her husband several years back. In the current year (2020), she received $87,000 in salary, $25,000 in child support from her ex-husband, and $4,500 in interest income. Her three children, Cheyenne, Jake, and Kyra, lived with her this year but only Jake and Kyra qualify as her dependents and count as qualifying persons for determining filing status. In addition, she has $6,000 in total itemized deductions available for the year. Assume she is not subject to AMT, is not self-employed, does not qualify for any additional tax credits, and has not made any prepayments of tax for the year. What filing status should Reba use for her 2020 tax return? Regardless of your answer in a., assume that Reba used Single as her filing status in 2020. Use the information above, the appropriate Federal Tax Schedule and other values from Appendix D, and the individual tax formula to calculate Reba’s 2020 tax due at the end of the year. Regardless of your answer in a., assume that Reba…arrow_forward! Required information [The following information applies to the questions displayed below.] In 2023, Laureen is currently single. She paid $2,720 of qualified tuition and related expenses for each of her twin daughters Sheri and Meri to attend State University as freshmen ($2,720 each, for a total of $5,440). Sheri and Meri qualify as Laureen's dependents. Laureen also paid $1,910 for her son Ryan's (also Laureen's dependent) tuition and related expenses to attend his junior year at State University. Finally, Laureen paid $1,410 for herself to attend seminars at a community college to help her improve her job skills. What is the maximum amount of education credits Laureen can claim for these expenditures in each of the following alternative scenarios? Note: Leave no answer blank. Enter zero if applicable. a. Laureen's AGI is $45,000. Description American opportunity tax credit Lifetime learning credit Creditsarrow_forward

- Jim and Mary Jean are married and have two dependent children under the age of 13. Both parents are gainfully employed and earn salaries in 2021 as follows: $130,000 (Jim) and $5,200 (Mary Jean). To care for their children while they work, Jim and Mary Jean pay Eleanor (Jim’s mother) $5,600. Eleanor does not qualify as a dependent of Jim and Mary Jean. Jim and Mary Jean file a joint Federal income tax return. Compute their credit for child and dependent care expenses.arrow_forwardJeremiah and Jonnie Chalk are married and have three dependent children, ages 3, 6, and 9. Assume the taxable year is 2022. Required: Compute their child credit if AGI on their joint return is $99,300. Compute their child credit if AGI on their joint return is $473,700. Compute their child credit if AGI on their joint return is $189,000 and assume that they also have one non-child dependent who meets the requirements for the child credit.arrow_forward2arrow_forward

- Jordan owns and operates Jordan's Exotic Journeys (JEJ), a sole proprietorship. JEJ sponsors a profit- sharing plan. Jordan had net income of $150,000 and paid self-employment taxes of $20,000 (assumed) during the year. Jordan has decided to make a 15% contribution for her employees for the year. Assuming Jordan is over the age of 50, what amount will she contribute for herself to the plan for 2019? a. $16,957. b. $18,261. c. $28,000. d. $56,000.arrow_forwardHarry and Carrie Franklin are married and choose to file Married Filing Jointly on their 2020 tax return. Harry and Carrie have one son Billy and a newborn baby Cristina born in 2020. Carrie was a kindergarten teacher at a private school through May and decided not to return after the birth of her child. Carrie worked a total of 800 hours in 2020 (January - May). She spent $375 on unreimbursed classroom expenses while she was employed. In order to work, the Franklins paid child care expenses of $1,500 through May for Billy. They also paid $750 in child care expenses for Cristina while Carrie volunteered in Billy’s class in November. How much are Harry and Carrie able to deduct for educator expenses in any?arrow_forwardHerb and Carol are married and file a joint tax return claiming their three children, ages 4, 5, and 18, as dependents. Their AGI for 2018 is $405,600 and their pre-credit tax liability is about $84,000. What is Herb and Carol's child tax credit for 2018?arrow_forward

- Tamar owns a condominium near Cocoa Beach in Florida. In 2022, she incurs the following expenses in connection with her condo Insurance Advertising expense Mortgage interest Property taxes Repairs & maintenance : Utilities Depreciation $1,100 550 3,850 945 700 1,000 9,500 During the year, Tamar rented out the condo for 75 days, receiving $10,000 of gross income. She personally used the condo for 35 days during her vacation. Tamar's itemized deduction for nonrental taxes is less than $10,000 by more than the property taxes allocated to the rental use of the property. Problem 14-58 Parts a, b, c, d & e (Algo) Assume Tamar uses the IRS method of allocating expenses to rental use of the property. Required: a. What is the total amount of for AGI (rental) deductions Tamar may deduct in the current year related to the condo? b. What is the total amount of itemized deductions Tamar may deduct in the current year related to the condo? c. If Tamar's basis in the condo at the beginning of the…arrow_forwardSusan and Stan Collins live in Iowa, are married and have two children ages 6 and 10. In 2020, Susan's income is $43,120 and Stan's is $12,000 and both are self-employed. They also have $500 in interest income from tax exempt bonds. The Collins enrolled in health insurance for all of 2020 through their state exchange and elected to have the credit paid in advance. The 2020 Form 1095-A that the Collins received from the exchange lists the following information: Annual premiums $9,800 Annual premium for the designated silver plan in the state $10,800 Total advance payment of the premium tax credit $9,200 The Federal Poverty Line for a family of four is $25,750. Table for Repayment of the Credit Amount Single Taxpayers OtherThan Single Less than 200% $325 $650 At least 200% but less than 300% 800 1,600 At least 300% but less than 400% 1,350 2,700 At least 400% No limit No limit Click here to access the 2020 Applicable Figure Table to use for this…arrow_forwardClay and Marian are married and will file a joint return. Marian is a U.S. citizen with a valid Social Security number. Clay is a resident alien with an Individual Taxpayer Identification Number (ITIN). Marian worked in 2022 and earned wages of $32,000. Clay worked part-time and earned wages of $18,000. The Washingtons have two children: Erin, age 12 and Jenny, age 18. The Washingtons provided the total support for their two children, who lived with them in the U.S. all year. Erin and Jenny are U.S. citizens and have valid Social Security numbers. 7. Jenny qualifies the Washingtons for the Credit for Other Dependents. t farrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education