FINANCIAL ACCOUNTING

10th Edition

ISBN: 9781259964947

Author: Libby

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Question

Talladega Tire and Rubber Company has capacity to produce 194,000 tires. Talladega presently produces and sells 134,900 tires for the North American market at a price of $180 per tire. Talladega is evaluating a special order from a European automobile company, Autobahn Motors. Autobahn is offering to buy 19,400 tires for $115.60 per tire. Talladega’s accounting system indicates that the total cost per tire is as follows:

| Direct materials | $57 |

| Direct labor | 20 |

| Factory |

26 |

| Selling and administrative expenses (46% variable) | 26 |

| Total | $129 |

Talladega pays a selling commission equal to 4% of the selling price on North American orders, which is included in the variable portion of the selling and administrative expenses. However, this special order would not have a sales commission. If the order was accepted, the tires would be shipped overseas for an additional shipping cost of $7.01 per tire. In addition, Autobahn has made the order conditional on receiving European safety certification. Talladega estimates that this certification would cost $162,184.

| Required: | |

| a | Prepare a differential analysis dated July 31 on whether to reject (Alternative 1) or accept (Alternative 2) the special order from Autobahn Motors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required. |

| b | Determine whether the company should reject (Alternative 1) or accept (Alternative 2) the special order from Autobahn Motors |

| c | What is the minimum price per unit that would be financially acceptable to Talladega? Round your answer to two decimal places. |

| Labels | |

| Costs | |

| Amount Descriptions | |

| Certification costs | |

| Direct labor | |

| Direct materials | |

| Gain on sale of investments | |

| Income (loss) | |

| Loss on sale of investments | |

| Revenues | |

| Shipping costs | |

| Variable factory overhead | |

| Variable selling and administrative expenses |

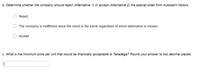

Transcribed Image Text:a. Prepare a differential analysis dated July 31 on whether to reject (Alternative 1) or accept (Alternative 2) the special order from Autobahn Motors. Refer to the lists of Labels and Amount Descriptions for the exact wording of the answer choices for

text entries. For those boxes in which you must enter subtracted or negative numbers use a minus sign. If there is no amount or an amount is zero, enter "0". A colon (:) will automatically appear if required.

Differential Analysis

Reject (Alternative 1) or Accept (Alternative 2) Order

July 31

Differential Effect

Reject Order

Accept Order

on Income

(Alternative 1)

(Alternative 2)

(Alternative 2)

4 (Label)

5

8

10

11

Transcribed Image Text:b. Determine whether the company should reject (Alternative 1) or accept (Alternative 2) the special order from Autobahn Motors.

Reject

The company is indifferent since the result is the same regardless of which alternative is chosen.

О Ассеpt

c. What is the minimum price per unit that would be financially acceptable to Talladega? Round your answer to two decimal places.

2$

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 4 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Vishnuarrow_forwardCan you please give answer?arrow_forwardB. Hygienics Co produces free-standing sanitiser units for domestic and commercial use. They produce a single product in a highly competitive market. They have gathered the following expected information for the year 2021: £Selling price (per unit) Direct materials (per unit)Direct labour (per unit) 155.00 60.25 30.50Other costs are estimated for the year 2021 based on the expected sales of 62,000 units. These costs are given below: Fixed Costs Variable CostsOperating Costs 420,000 1,750,000Marketing Costs 350,000 122,500Storage Costs 570,000 101,000Administration Costs 232,000 - For the year 2021, you are required to calculate: a) the expected profit or loss b) breakeven point in units and sales revenue c) margin of safety in units and % change d) the profit/loss if the selling price is increased by 5% and sales quantity decreases by 50% e) the revised break-even point in units for (d)arrow_forward

- Jade Ltd. manufactures a product, which regularly sells for $67.75. This product has the following costs per unit at the expected production of 47,500 units: Cost Amount Direct labour $20.00 Direct materials 10.50 Manufacturing overhead (36% is variable) 24.00 The company has the capacity to produce 52,250 units. A wholesaler has offered to pay $77 for 12,000 units. If Jade Ltd. accepts this special order, operating income would increase (decrease) by how much?arrow_forwardWashington Company has two divisions, Jefferson and Adams. Jefferson produces an item that Adams could use in its production. Adams currently is purchasing 100,000 units from an outside supplier for $78.40 per unit. Jefferson is currently operating at full capacity of 900,000 units and has variable costs of $46.40 per unit. The full cost to manufacture the unit is $59.20. Jefferson currently sells 900,000 units at a selling price of $86.40 per unit. Required: 1. What will be the effect on Washington Company's operating profit if the transfer is made internally? 2. What will be the change in profits for Jefferson if the transfer price is $67.20 per unit? 3. What will be the change in profits for Adams if the transfer price is $67.20 per unit?arrow_forwardAmarjit Truckers, Ltd. operates a fleet of delivery trucks in North America. The company has determined that, if a truck is driven 120,000 kilometres during a year, the average operating cost is 18.000 cents per kilometre. If a truck is driven only 50,000 kilometres during a year, the average operating cost increases to 21.0 cents per kilometre. Required: 1. Using the high - low method, estimate the variable and fixed cost elements of the annual cost of truck operation. (Do not round intermediate calculations. Round the "Variable cost" to 5 decimal places. Round "Fixed cost" to 2 decimal places.) 2. Express the variable and fixed costs in the form Y = a + bX. (Do not round intermediate calculations. Round the "Variable cost" to 5 decimal places. Round "Fixed cost" to 2 decimal places.) 3. If a truck were driven 80,000 kilometres during a year, what total cost would you expect to be incurred? (Do not round intermediate calculations. Round "Total annual cost" to 2 decimal places.)arrow_forward

arrow_back_ios

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education