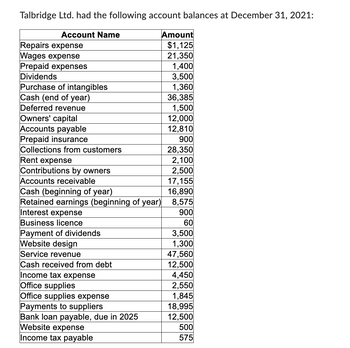

What is ending

What is the correct title for this company's

a. Balance Sheet, Talbridge Ltd., Year ended December 31, 2021

b. Talbridge Ltd., Balance Sheet, December 31, 2021

c. Talbridge Ltd., Balance Sheet, Year ended December 31, 2021

d. December 31, 2021, Balance Sheet, Talbridge Ltd.

e. Talbridge Ltd., December 31, 2021, Balance Sheet

Enter the letter that corresponds to your choice. (A B C D E)

What is total current assets on this company's balance sheet?

What is the correct order for the current assets section of this company's balance sheet?

a. Cash (end of year),

b. Cash (beginning of year), Accounts receivable, Prepaid insurance, Supplies

c. Cash (end of year), Accounts receivable, Prepaid insurance, Supplies

d. Cash (beginning of year), Accounts receivable, Prepaid expenses, Prepaid insurance, Supplies

e. Cash (end of year), Accounts receivable, Prepaid expenses, Prepaid insurance, Supplies

Enter the letter that corresponds to your choice. (A B C D E)

What is the correct order for the intangible section of the balance sheet?

a. Business licence, Supplies, Website design

b. Business licence, Prepaid expenses, Website design

c. Website design, Business licence

d. Website design, Prepaid insurance, Prepaid expenses

e. Website design, Business licence, Prepaid insurance, Prepaid expenses

Enter the letter that corresponds to your choice. (A B C D E)

Step by stepSolved in 1 steps

- B#5arrow_forwardCompanies often voluntarily provide a pro forma earnings number when they announce annual or quarterly earnings. Required: 1. What is meant by the term pro forma earnings in this context? 2. How do pro forma earnings relate to the concept of earnings quality?arrow_forwardWhich one of the following equations represents retained earnings activity at the end of the year? a. Beginning Balance + Net Income + Dividends b. Beginning Balance + Cash Inflows - Dividends c. Beginning Balance + Dividends - Net Income d. Beginning Balance - Dividends + Net Incomearrow_forward

- The balance sheets for Dual Monitors Corporation and additional information are provided below. DUAL MONITORS CORPORATION Balance Sheets December 31, 2024 and 2023 Assets Current assets: Cash Accounts receivable Inventory Investments Long-term assets: Land Equipment Less: Accumulated depreciation Total assets Liabilities and Stockholders' Equity Current liabilities: Accounts payable Interest payable Income tax payable Long-term liabilities: Notes payable Stockholders' equity: Common stock Retained earnings Total liabilities and stockholders' equity Additional Information for 2024: 1. Net Income is $150,600. 2. Sales on account are $1,215,500. (All sales are credit sales.) 3. Cost of goods sold is $973,400. Complete this question by entering your answers in the tabs below. a. Gross profit ratio b. Return on assets c. Profit margin d. Asset turnover e. Return on equity 2024 19.9 % 13.9 % %6 $208,600 60,000 86,000 3,100 times %6 390,000 390,000 700,000 580,000 (338,000) (178,000)…arrow_forwardSeven metrics The following data were taken from the financial statements of Woodwork Enterprises Inc. for the current fiscal year. Assuming that there are no intangible assets. Property, plant, and equipment (net) Liabilities: Current liabilities Mortgage note payable, 10%, ten-year note issued two years ago Total liabilities Stockholders' equity: Preferred $2 stock, $100 par (no change during year) Common stock, $10 par (no change during year) Retained earnings: Balance, beginning of year Net income Preferred dividends Common dividends Balance, end of year Total stockholders' equity Sales Check My Work $1,440,000 566,000 $27,000 179,000 $225,000 1,125,000 $2,006,000 206,000 $1,800,000 $1,350,000 $1,350,000 1,350,000 1,800,000 $4,500,000 $13,614,650 Previousarrow_forwardIdentifying and Computing Net Operating Assets (NOA) and Net Nonoperating Obligations (NNO)Following are the balance sheets and statement of earnings for Home Depot Inc. for fiscal year ended February 3, 2019, which the company labels fiscal year 2018. THE HOME DEPOT INC. Consolidated Balance Sheets February 3, January 28, $ millions, except par value 2019 2018 Assets Current assets Cash and cash equivalents $1,778 $3,595 Receivables, net 1,936 1,952 Merchandise inventories 13,925 12,748 Other current assets 890 638 Total current assets 18,529 18,933 Net property and equipment 22,375 22,075 Goodwill 2,252 2,275 Other assets 847 1,246 Total assets $44,003 $44,529 THE HOME DEPOT INC. Consolidated Balance Sheets February 3, January 28, $ millions, except par value 2019 2018 Liabilities and Stockholders’ Equity Current liabilities Short-term debt $1,339 $1,559 Accounts payable 7,755 7,244 Accrued salaries and…arrow_forward

- S1. Accountarrow_forwardSubject:Accountingarrow_forwardI need help with these please. A. Record transfer of net loss to retained earnings. B. Record transfer of net income to retained earnings. C. Record repurchase of shares for retirement. D. Record declaration of cash dividend. E. Record payment of cash dividend.arrow_forward

- Wiley Coyote started Acme, Inc on June 1, 2020. Acme's Chart of Accounts is below. Chart of Accounts Cash Accounts Receivable Supplies Prepaid Rent Office Equipment Accounts Payable Notes Payable Unearned Fees Common Stock Retained Earnings Dividends Fees Earned Salary Expense Rent Expense Supplies Expense Interest Expense Utility Expense During the month of June, Acme Inc. entered into the following transactions: 1 Transferred cash from a personal bank account in exchange for stock, $100,000 3 Recorded services provided on account, $9,100 5 Received cash from clients as an advance payment for services to be provided in July, $12,500 7 Purchased Office Equipment for $5,000, paying $500 cash and signing a Note for the remainder. 9 Receive cash for services provided: $5,000 10 Paid part-time receptionist for two weeks' salary $1,750 12 Purchased office supplies from Staples on account, $1,200 14 Billed clients for fees earned; $2,500 16 Paid $1,000 for 3 months rent for the months of…arrow_forwardAt September 30, 2022, the end of the first year of operations at Lukancic Incorporated, the firm's accountant neglected to accrue payroll taxes of $2, 189 that were applicable to payrolls for the year then ended. Exercise 7 - 9 (Algo) Part c c. Assume that when the payroll taxes were paid in October 2022, the payroll tax expense account was charged. Assume that at September 30, 2023, the accountant again neglected to accrue the payroll tax liability, which was $2,660 at that date. Determine the income statement and balance sheet effects of not accruing payroll taxes at September 30 2023arrow_forward# 4) Using the following Company X information, prepare a Retained Earnings Statemen Retained earnings balance January 1, 2019, $121,500 Net income for year 2019, $145,800 Dividends declared and paid for year 2019, $53,000arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education