Principles of Accounting Volume 1

19th Edition

ISBN: 9781947172685

Author: OpenStax

Publisher: OpenStax College

expand_more

expand_more

format_list_bulleted

Concept explainers

Topic Video

Question

S1.

Account

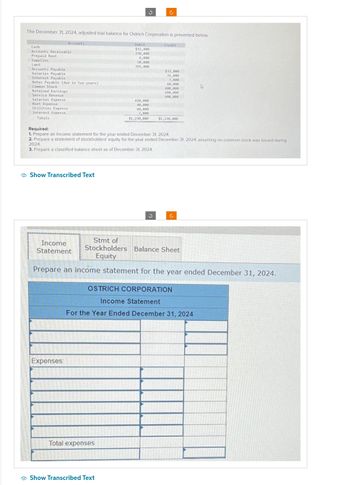

Transcribed Image Text:The December 31, 2024, adjusted trial balance for Ostrich Corporation is presented below.

Cash

Accounts Receivable.

Prepaid Rent

Supplies

Land

Accounts Payable

Salaries Payable

Accounts

Interest Payable

Notes Payable (due in two years)

Common Stock

Retained Earnings

Service Revenue

Salaries Expense

Rent Expense

Utilities Expense

Interest Expense

Totals

Show Transcribed Text

Income

Statement

Expenses:

J

Debit

$32,000

250,000

Total expenses

6,000

50,000

365,000

Show Transcribed Text

420,000

40,000

Ĉ

60,000

7,000

$1,230,000

Required:

1. Prepare an income statement for the year ended December 31, 2024.

2. Prepare a statement of stockholders' equity for the year ended December 31, 2024, assuming no common stock was issued during

2024.

3. Prepare a classified balance sheet as of December 31, 2024.

Credit

$32,000

31,000

7,000

60,000

400,000

100,000

600,000

$1,230,000

Stmt of

Stockholders Balance Sheet

Equity

Prepare an income statement for the year ended December 31, 2024.

OSTRICH CORPORATION

Income Statement

For the Year Ended December 31, 2024

Ĉ

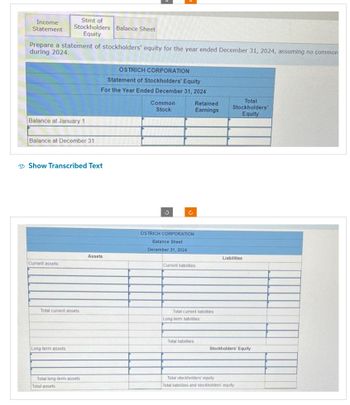

Transcribed Image Text:Income

Statement

Prepare a statement of stockholders' equity for the year ended December 31, 2024, assuming no common

during 2024.

Balance at January 1

Stmt of

Stockholders Balance Sheet

Equity

Balance at December 31

Current assets

Show Transcribed Text

Total current assets

Long-term assets

Total long-term assets

Total assets

OSTRICH CORPORATION

Statement of Stockholders' Equity

For the Year Ended December 31, 2024

Assets

Common

Stock

OSTRICH CORPORATION

Balance Sheet

December 31, 2024

Retained

Earnings

Current liabilities

Total current liabilities

Long-term liabilities

Total liabilities

Total

Stockholders'

Equity

Liabilities

Stockholders' Equity

Total stockholders' equity

Total liabilities and stockholders' equity

Expert Solution

This question has been solved!

Explore an expertly crafted, step-by-step solution for a thorough understanding of key concepts.

This is a popular solution

Trending nowThis is a popular solution!

Step by stepSolved in 3 steps

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Suppose the amounts presented here are basic financial information (in millions) from the 2020 annual reports of Surf and Tide. Surf Tide Sales revenue $19,176.1 $10,381 Allowance for doubtful accounts, beginning 78.4 119 Allowance for doubtful accounts, ending 110.8 124 Accounts receivable balance (gross), beginning 2,873.7 1,743 Accounts receivable balance (gross), ending 2,994.7 1,553 Instructions a) Calculate the accounts receivable turnover and average collection period for both companies. My answer for (a) Surf Tide Net Accounts Receivable, beginning (Accounts receivable balance (gross), beginning-Allowance for doubtful accounts, beginning) (2,873.7-78.4) =2,795.3 (1,743-119) =1,624 Net Accounts Receivable, ending (Accounts receivable balance (gross), ending-Allowance for doubtful accounts, ending) (2994.7-110.8) =2,883.9 (1,553-124) =1,429 Average Net Accounts Receivable (Net Accounts Receivable, beginning+Net Accounts Receivable,…arrow_forwardElegant Universal uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Universal considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Describe the categories change effect on net income and accounts receivable.arrow_forwardNoren Company uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Noren Company considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forward

- Prior to adjustments, Barrett Companys account balances at December 31, 2019, for Accounts Receivable and the related Allowance for Doubtful Accounts were 1,200,000 and 60,000, respectively. An aging of accounts receivable indicated that 106,000 of the December 31, 2019, receivables may be uncollectible. The net realizable value of accounts receivable at December 31, 2019, was: a. 1,034,000 b. 1,094,000 c. 1,140,000 d. 1,154,000arrow_forwardElegant Linens uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Elegant Linens considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between total uncollectible. C. Complete the following 2019 comparative income statements for 2019, showing net income changes as a result of the changes to the balance sheet aging method categories. D. Describe the categories change effect on net income and accounts receivable.arrow_forwardComplex Income Statement The following items were derived from Woodbine Circle Corporations adjusted trial balance on December 31, 2019: Other financial data for the year ended December 31, 2019: Required: Using the multiple-step format, prepare a formal income statement for Woodbine for the year ended December 31, 2019, together with the appropriate supporting schedules. All income taxes should be appropriately shown.arrow_forward

- Balance Sheet Baggett Companys balance sheet accounts and amounts as of December 31, 2019, are shown in random order as follows: Required: 1. Prepare a December 31, 2019, balance sheet for Baggett. 2. Compute the debt to-assets ratio.arrow_forwardGoods for Less uses the balance sheet aging method to account for uncollectible debt on receivables. The following is the past-due category information for outstanding receivable debt for 2019. To manage earnings more favorably, Goods for Less considers changing the past-due categories as follows. A. Complete each table by filling in the blanks. B. Determine the difference between totals uncollectible. C. Describe the categories change effect on net income and accounts receivable.arrow_forwardBalance Sheet from Adjusted Trial Balance The following is the alphabetical adjusted trial balance of Meadows Company on December 31, 2019; Required: 1. Prepare Meadowss December 31, 2019, balance sheet. 2. Next Level Compute the debt-to-assets ratio. What does it indicate about Meadows at the end of 2019?arrow_forward

- The December 31, 2021, unadjusted trial balance for Demon Deacons Corporation is presented below.Accounts Debit CreditCash $10,000Accounts Receivable 15,000Prepaid Rent 7,200Supplies 4,000Deferred Revenue $ 3,000Common Stock 11,000Retained Earnings 6,000Service Revenue 51,200Salaries Expense 35,000 $71,200 $71,200At year-end, the following additional information is available: 1. The balance of Prepaid Rent, $7,200, represents payment on October 31, 2021, for rent from November 1, 2021, to April 30, 2022. 2. The balance of Deferred Revenue, $3,000, represents payment in advance from a customer. By the end of the year, $750 of the services have been provided. 3. An additional $700 in…arrow_forwardData for item nos. 16 and 17 The following accounts and their balances in an unadjusted trial balance of Record of Youth Company as of December 31, 2020: Cash and cash equivalents- P400,000; Trade and other receivable P2,000,000; Subscription receivable- P375,000; Inventory- P500,000; Trade and other payables- P670,000; Income tax payable- P196,500. Additional information are as follows: • Trade and other receivables include long term advances to company officers amounting to P430,000. • The subscription receivable has the following call dates: June 30, 2021, P200,000; December 31, 2021, P100,000; and June 30, 2022, P75,000. • Inventory of P500,000 was determined by physical count. At December 31, 2020, goods costing P125,000 are in transit from a supplier. Terms of purchase of said goods is FOB shipping point. The goods and the related invoice have not been received as of year-end. • Trade and other payables include dividends payable amounting to P170,000, of which P70,000 is payable…arrow_forwardThe adjusted trial balance of Palm Realtors Ltd. at December 31, 2019, appears below:Palm Realtors Ltd.Adjusted Trial BalanceDecember 31, 2019Cash $ 8,950Accounts receivable 53,530Prepaid rent 2,200Equipment 45,690Accumulated amortization $ 18,930Accounts payable 15,900Interest payable 900Salary payable 3,500Income tax payable 4,700Note payable (due 2025) 19,500Common shares 8,000Retained earnings 29,325Dividends 30,000Commissions 227,480Depreciation expense 6,260Salary expense 140,500Rent expense 26,400Interest expense 1,500Income tax expense 13,205Total $328,235 $328,235Required:1. Prepare in good form a single step statement of earnings (income statement) of Palm Realtors Ltd.for the year ended December 31, 2019.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning